Dynamics of growth and taxes (History Bitcoin)

Hi all. As I also spoke in the previous post (reference https://steemit.com/cryptocurrency/@krutilla/who-remembers-beginning-of-bitcoin ), in it it will be a question of dynamics of growth Bitcoin and of taxes.

Among factors which could promote growth there was the European crisis of a sovereign debt, especially financial crisis of Cyprus in 2012-2013 Which FinCEN improved the legal provision of currency and increased interest in mass media and the Internet.

From 2009 to 2013 almost all market with bitcoins was in US dollars ($).

As market assessment of total of bitcoins approached 1 bln. dollars of the USA, some commentators called price bitcoin a bubble. At the beginning of April, 2013 the price for bitcoin fell from $266 to $50, and then grew to $100. In two weeks, since the end of June, 2013, the price fell steadily up to 70 dollars. The price began to be restored, having reached level on October 1 of 140 dollars. On October 2 the Silk way was taken by FBI. This Ross Ulbricht caused sudden crash to 110 dollars. The price was quickly restored, and in several weeks it returned to 200 dollars. The last run went from $200 on November 3 up to $900 on November 18.

The bitcoin fell by 1000 US dollars on November 28, 2013 on the mountain. GOx.

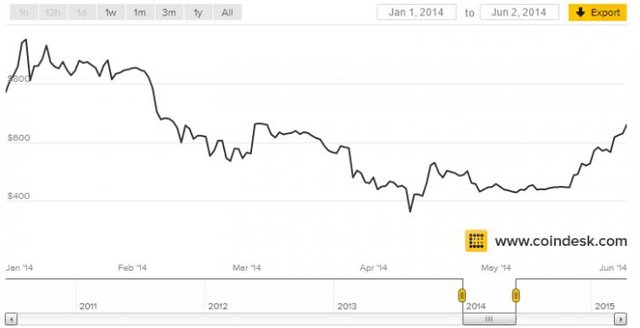

The prices fell approximately up to 400 dollars in April, 2014 before gathered in the middle of the year. At the beginning of 2015 they were reduced no more than by 200 dollars.

Date USD: 1 BTC Notes

Jan 2009 – Mar 2010 generally not Any exchanges or the market, users generally were admirers of cryptography who sent bitcoins for a hobby. In March, 2010 the user of "SmokeTooMuch" offered for an auction 10 000 BTC for 50 US dollars (cumulatively), but the buyer was not found.

Mar 2010 $0.003 Already begun exchange of BitcoinMarket.com became on March 17, 2010 the first.

May 2010 $ less than 0.01 On May 22, 2010 László Hanyets made the first transaction in the real world, having bought two pizzas in Jacksonville, the State of Florida, for 10 000 BTD.

July 2010 $0.08 In five days the price grew by 1000%, having risen from $0,008 to $0,08 for 1 bitcoin.

Feb 2011 – April 2011 $1.00 Bitcoin takes parity with US dollar.

8 July 2011 $31.00 Top of first "bubble" which the first falling of the price follows.

Dec 2011 $2.00 At least in several months.

Dec 2012 $13:00 Slowly grows within a year.

11 April 2013 $266 Top of price rally during which cost grew for 5-10% a day.

May 2013 $130 Generally stable, again slowly rising.

June 2013 $100 In June slowly fell up to 70 dollars, but in July grew to 110 dollars.

Nov 2013 $350 — $1,242 Since October $150-200 in November, having risen up to $1,242 on November 29, 2013.

Dec 2013 $600 — $1,000 The price fell up to 600 dollars, jumped aside up to 1000 dollars, again failed to 500 dollars. It is stabilized to the range of $650 - $800.

Jan 2014 $750 — $1,000 The price grew to 1000 dollars a little, and then remained in the range from 800 to 900 dollars for the rest of month.

Feb 2014 $550 — $750 The price fell after Mt stop. Gox before recovering to the range of $600-700.

Mar 2014 $450 — $700 The price continued to fall because of the untrue report on the ban of bitcoins in China and uncertainty concerning whether the Chinese government will try to forbid banks to work with the digital currency exchanges.

Apr 2014 $340 — $530 The lowest price from the Cyprian financial crisis of 2012-2013 was reached at 3:25 in the morning on April 11.

May 2014 $440 — $630 At first business recession is slowed down, and then on the contrary, increasing more than by 30% in the last days of May.

Mar 2015 $200 — $300 The price fell prior to the beginning of 2015.

Early Nov 2015 $395 — $504 Big splash in cost from 225 to 250 dollars at the beginning of October to the record level of 504 US dollars.

May–June 2016 $450 — $750 Big jump in cost, since 450 dollars and reaching a maximum in 750 dollars.

July–September 2016 $600 — $630 The price was stabilized in the range of low 600 dollars.

October–November 2016 $600 — $780 As the Chinese zhenmin depreciated against US dollar, bitcoin rose to the top 700 dollars.

January 2017 $800 — $1,150

5-12 January 2017 $750 — $920 The price dropped by 30% in a week, having reached a months-long minimum in 750 dollars.

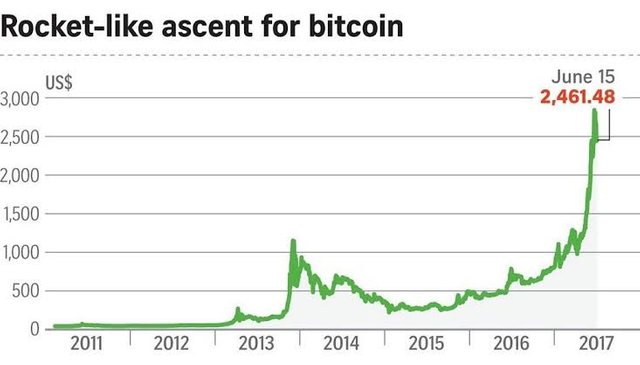

2-3 March 2017 $1,290 + The price exceeded a mark in November, 2013 of $1,242, and then traded above $1290.

April 2017 $1,210 — $1,250

May 2017 $2,000 The price reached a new maximum, having reached 1 402,03 US dollars on May 1, 2017 and more than 1 800 US dollars on May 11, 2017. On May 20, 2017 the price of one bitcoin was for the first time transferred to 2000 US dollars.

May–June 2017 $2,000 — $3,200 + The price reached the record level of 3 000 US dollars on June 12 and since then is about 2500 US dollars. As of August 6, 2017 the price was 3270 dollars.

August 2017 $4,400 On August 5, 2017 the price of one BTD for the first time received 3000 US dollars. On August 12, 2017 the price of one BTD was for the first time agreed for 4000 US dollars. In two days the cost of one BTD for the first time was 4400 US dollars.

September 2017 $5,000 Bitcoin for the first time beat on September 1, 2017 5 000 US dollars, having exceeded 5 013,91 US dollars.

12 September 2017 $2,900 The price sharply fell in China and exchanged repressions (those who monitored inadequate practice).

13 October 2017 $5,600 The price shot itself as the world moves on the past after followed China to repression.

21 October 2017 $6,180 The price reached one more maximum.

6 November 2017 $7,300

12 November 2017 $5,519-6,295 Due to increase in prices for bitcoin cash, having exceeded 2477,65 US dollars for barrel or about 2,2-2,5 times from cost bitcoin cash on one bitcoin. These developments force out Ethereum as cryptocurrency, the second for popularity, in the third in comparison with the general market capitalization of the specified cryptocurrency according to dollar value, at least temporary before Ethereum steals the place on the second place. It is closed only for 6000$ / BTC

17-20 November 2017 $7,600-8,100 Briefly were exceeded by USD 8004.59$ / BTC at 1:14:11 UTC before receding from maxima. At 05:35 UTC on November 20, 2017 it made 7 988,23 US dollars / BTC according to CoinDesk. This splash in Bitcoin can be connected with events in a Zimbabwean coup of 2017. Reaction of the market in one exchange Bitcoin is alarming as 1 BTC exceeded nearly 13 500 US dollars, just timid twice exceeding the cost of the International market.

25 November 2017 $9,000 Bitcoin for the first time surpass a mark of 9 000 dollars.

28 November 2017 $10,000 Bitcoin for the first time exceed 10 000 dollars.

29 November 2017 $11,000 Bitcoin exceed 11 000 dollars for the first time.

5 December 2017 $12,000 Bitcoin for the first time exceed 12 000 dollars.

6 December 2017 $13,000 Bitcoin for the first time exceed 13 000 dollars.

7 December 2017 $17,000 Bitcoin for the first time exceed $17 000 @ 23:03.

8 December 2017 $18,000 Bitcoin for the first time exceed $18 000 @ 00:28.

8 December 2017 14,277 The price of bitcoin fell to ~ 14 000 dollars, but later on the same day it reaches $16,250

15 December 2017 $17,900 The price of bitcoin reached 17 900 US dollars

22 December 2017 $13,800 The price of bitcoin loses one third of the cost in 24 hours, having fallen lower than 14 000 dollars.

5 February 2018 $6,200 The price of bitcoin dropped by 50% in 16 days, having fallen lower than 7 000 dollars.

31 October 2018 $6,300 In 10-year anniversary of bitcoin the price stick to higher than $6000 in the period of historically low volatility.

14 November 2018 $5,590 Falling are lower than $6000.

24 November 2018 $3,778 Falling are lower than $4000 (a source: cointelegraph.com)

29 November 2018 $4,333 The price of bitcoin reached $4300 (a source: https://coin360.io/)

We go further. What concerning taxes?!

In 2012 the Legal lawyer group on a cryptocurrency (CLAG) emphasized importance of that taxpayers defined whether taxes concerning the transaction connected with bitcoin, proceeding from are subject, whether there was an event of "realization": when the taxpayer provided service in exchange for bitcoins, the realization event probably took place, and any profit or a loss will probably pay off with use of fair market values for the provided service".

In August, 2013 the Ministry of Finance of Germany characterized bitcoin as a uniform accounting system.

On December 5, 2013 the People's Bank of China announced in the press release concerning regulation of bitcoins while in China it is authorized to natural persons to trade and exchange freely bitcoins as goods, the Chinese financial banks are forbidden to work with cryptocurrency. The value of bitcoin fell at various exchanges between 11 and 20 percent after the announcement of regulation before again jumping aside up.

*****In the following post I will write about the exchange bans also about large thefts Bitcoin. Also do not forget: "you know history - you can look in the future" . All thanks

Congratulations @krutilla! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOP