What the experts are saying about Tether

Negative news is accentuated by a bear market. This is especially true with the cryptocurrency market as the moves are large and the investor base is inexperienced. As a result, the community tends to latch onto any negative news and disseminate it wildly. The negative news cycle during this bear market was intense. First it was news that China was banning Bitcoin mining and offshore cryptocurrency trading (turns out it was simply discouraging Bitcoin mining). Next was news that South Korea was banning cryptocurrency trading (which ultimately turned out to be false). Then it was news that the CFTC subpoenaed to Bitfinex/Tether. Most recently, it was news that India was also banning cryptocurrency trading (which also ultimately turned out to be false, nevermind the fact that the Indian cryptocurrency market is incredibly small).

We'll be focusing on the Bitfinex/Tether news and whether the huge negative sentiment around it is justified. I've already written a post on why I believe the negative news is overblown and in this post, I want to focus on what some cryptocurrency experts are saying about the situation. You'll find that most of them are dismissive of it.

But first, here's a brief primer on the Bitfinex/Tether situation. The whole debacle started with a Twitter account, Bitfinexed, posting several damning articles on possible misbehaviour by Bitfinex/Tether (two very closely related companies). Bitfinexed accused Tether of being insolvent, i.e. it does not have enough real USDs to back up their issued USDTs. Bitfinexed also accused Tether of continuing to fraudulently print USDTs and, with the help of Bitfinex, is using the USDTs to prop up the market.

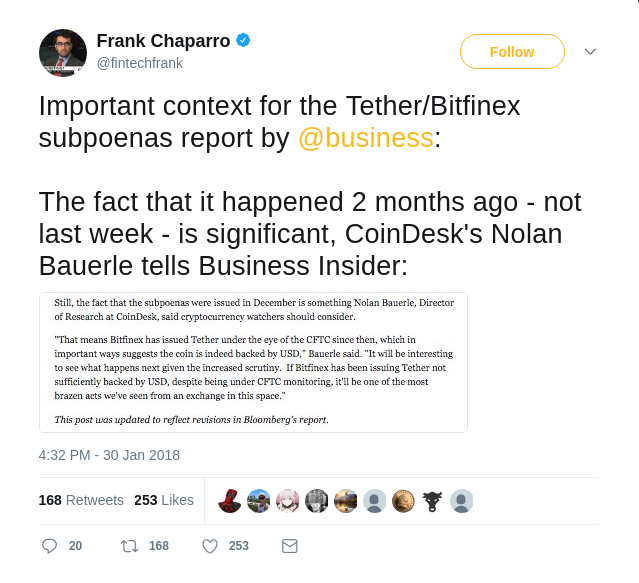

In the midst of a raging bear market, Bloomberg released an article claiming that the US regulatory body, CFTC, very recently subpoenaed to Bitfinex which significantly alleviated fears that Bitfinex/Tether was insolvent (Bloomberg corrected the article to state that Bitfinex was actually subpoenaed almost 2 months ago). The bad news was accentuated by the fact that Bitfinex, which had been ceaselessly critical of Bitfinex/Tether for several months now, had ramped up the criticisms during the bear market.

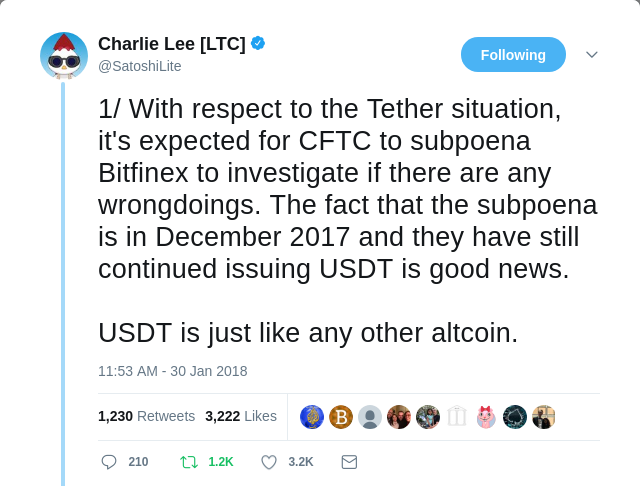

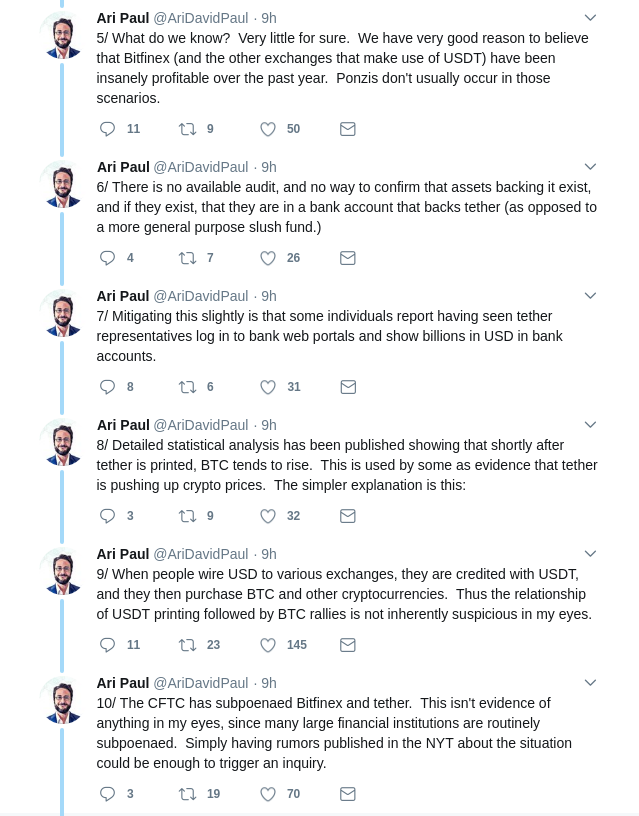

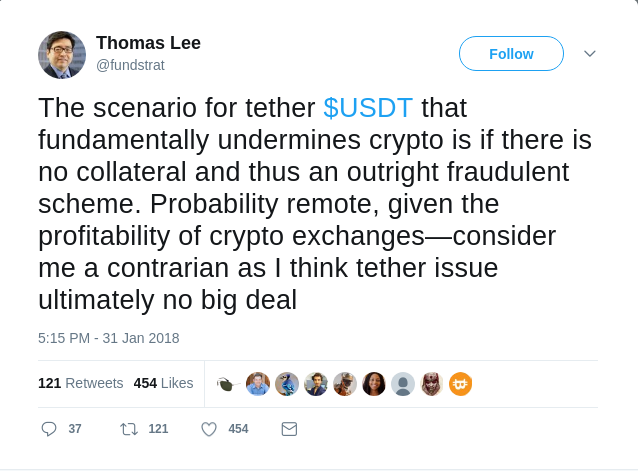

Is the Tether "crisis" overblown? Here's my take on it. TLDR I think it's overblown. But don't just listen to me, here are what some cryptocurrency expert are saying on Twitter:

https://twitter.com/SatoshiLite/status/958427996209074176

https://twitter.com/AriDavidPaul/status/959571893039878144

https://twitter.com/fundstrat/status/958871401397551104

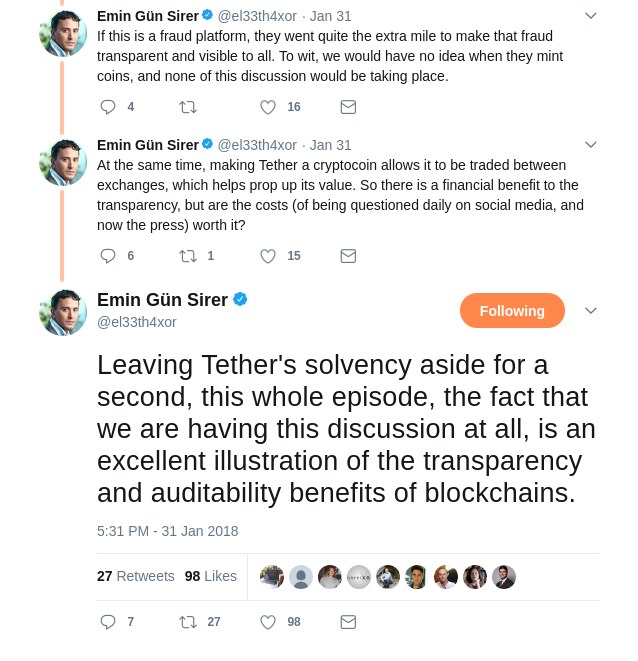

https://twitter.com/el33th4xor/status/958875310480592905

https://twitter.com/fintechfrank/status/958498250989989888

So the experts are not worried about Tether. If they were commiting fraud, Tether certainly went the extra mile to make it super transparent to all, including regulators, yet no problems have been found so far. Why panic?

I'm not sure I see the relevance of the article about NEO (under "more reading") to all this, but that was a great article and I'm very glad I read it.

Upvoted ☝ Have a great day!

Tether is a temporary solution

good post

Thanx for sharing

anytime :)

Thanks @kjnk something I think about is Bitfinex makes so much money on fees in its exchange that it could easily afford to back Tether with USD.