The Future Of Cryptocurrencies. Where Are Speculators And ICOs Taking Us?

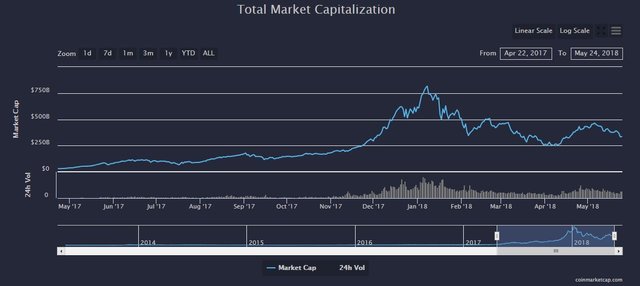

If you are into this game of cryptocurrencies for more than a year, you are probably used to all this pump and dump, panic selling, FUD/FOMO party that has been going on for quite some time now. Those that have joined "the club" recently (and I know more than a few guys out there that invested in BTC at $17,000 despite me telling them not to) are probably out of their skin, biting their nails, 'cause every time the market looks like the bull run is coming it turns out to be just another bull trap which leaves deeper burn-marks on the portfolio.

Basically, this is what has been experienced by the investors every year since the dawn of the blockchain based currencies and this article will try to help all of you to understand the mechanics and the politics behind the "revolution" that cryptocurrencies are often taught to be.

First, I will try to deduce the actual connection between the development team/company and their respectful token.

Why does a great piece of news from the Ethereum Foundation have any impact on the price of ETH cryptocurrency?

"Well, it's the same as on the stock market!"

No, it isn't.

When you buy some company's stock, you become the partial owner of that company and are entitled to a yearly dividend. The only connection between the ETH coin and the foundation is based in the fact that the success of the foundation is a great marketing piece which will be the reason for more investors to buy in, looking for a quick buck.

No more, no less.

Buying a huge number of ETH (or the majority of other coins or tokens on the exchanges) is doing no more than giving you the opportunity to speculate on its future value and, let's face it, speculation is nothing more than trying to buy an asset from some sucker who is panic-selling at its lowest and selling it to another sucker (or even the same one) at its peak.

Who benefits most?

-the exchanges that charge for listing and traders fees

-the development teams/founders who keep hold of the big percentage of the cryptocurrency

Centralized exchanges keep hold of your coins without offering you the security that one would expect of the company dealing with billions of dollars worth a day. They even sometimes don't support cryptocurrency forks so less informed holders don't get the new cryptocurrency they are entitled to if they kept their coins on the exchange. So who gets those coins? Well, those nice guys from the exchange can easily keep them for themselves. Yes, we can not overlook the existence of decentralized exchanges but they are rarely user-friendly and the support is usually nerve-rackingly bad (in my experience, and I have plenty).

Take a look at this interesting article

The development teams can have two kinds of leaders.

-Skilled blockchain developers interested in the possibilities of the technology they deal with, highly motivated to bring us the biggest tech-revolution (or evolution as some like to call it) since the internet (like Vitalik Buterin) are the guys that mostly don't have their priorities set towards pumping the price of the coin. As the focus is mainly set on the tech-improvement, that can sometimes lead to certain development decisions which can negatively influence the price.

-Marketing guys, whose sole purpose is keeping their coin in the hype, carefully selling their product, sometimes trying to bring down direct "competition" (like Roger Ver). Now, these guys are the most dangerous people. If they are good at what they do (marketing), the consequences of them shilling their cryptocurrency can be much severe than usual when we face another bear phase.

Either way, they do not look upon the average investor as somebody whose interests they should protect. If that was the case, they would give us the percentage of the ownership of their company and voting rights.

That brings us to the ICOs.

Now, imagine if I told you to give me some money to start my own company, from which I could earn myself a lot of money, and in exchange, I give you some asset that isn't tied to my company in any other way other than the fact that the company issued it. After the curtain opens, you are left with the "asset" that can be utterly useless in a few months and I am left with your hard earned money, all set to start building my business empire. No insurances and no repercussions. Get the picture?

This all may seem as I am just emphasizing the negative aspects of the cryptocurrencies but the truth is that I strongly believe in the future of the blockchain. Cryptocurrencies are just a feature of the technology which is often being misused. My opinion is that cryptocurrencies failed in regulating themselves, which could easily lead to the unfortunate regulations by the governments that do not understand (or feel threatened by) the technological advancement that blockchain can bring to the economy, business, and everyday life.

Until an average investor can feel secure investing in the cryptocurrencies, we will not see wider adoption and use.

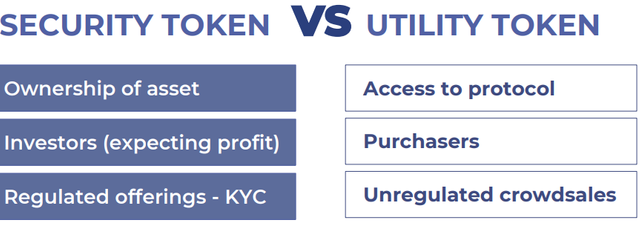

One possible solution is the security tokens which could easily be the game changer because of the fact that they would offer their investors real value in a form of the ownership and revenue percentage. The investors would be motivated to keep hold of their assets more if that would enable them to have a real passive income that is tied to the success of the project they invested in. That would also quickly filter the companies out there and deduce the ones that are doing the job from the gimme-money-and-disappear ones.

"Yes, but that would bring the SEC in the game", you say?

To paraphrase one of my colleagues: "The fact that the police often isn't doing its job the right way doesn't mean it shouldn't exist".

Lastly, I want to know what you think, so feel free to comment, argue or just say hello!

I think that the temptation to buy into cheap start-ups will prove too tempting for institutional money not to invest. The masses will follow them in. It's just a waiting game now.