Capital preservation and the 2%

Two sides

Since I started in the world of cryptocurrencies I've been torn between two very different approaches in trading/investing: going all in or being conservative.

There are two sides possibly everything in life, but in crypto these different approaches stand out. Who hasn't seen that guy on Twitter that made 10x in a few months of trading? Or that person that put all on the line in a 25x leverage trade and got an amazing return over their entire portfolio? I see cases like these on a daily basis. It's easy to be greedy, to believe you can make 2x, 3x in a small amount of time. If so many people did it, why can't you?

It's exciting, it's seducing and tempting to "bet high". That's why people gamble, not only for the profits but for the rush you get when doing it.

What about the people that are on the other side of the scope? With such great risks for sure there are people out there risking high and losing high percentages. But it's easy to think it won't happen to you.

As said by Mike Tyson after the collapse of his fortune and fame: “If you’re not humble, life will visit humbleness upon you.”

Source

On the other hand, if you follow older and more experienced traders, you will find that the their approach is very, very different...

Capital preservation

The more I read and learn about trading, the more I value what experienced traders mean about capital preservation. This quite different from going all in and trying to make huge amounts of money on every trade. It's the idea of taking it slow and keeping what you have; if you end up winning, great!

Source

It sounds like something your father would tell you, doesn't it? "Be careful." Kinda boring. But it's the type of knowledge that only comes with experience. I've been reading about it and listening to people talk about it and I came to believe it is the best way to trade, specially if you think on the long term. I really do. But still, I know that I will only really follow these ideas once I have experience enough to do so. In other words, once I get burned enough by being reckless.

It's said that there are bold traders and there are old traders, but there are no old bold traders. If you don't manage your capital, you will eventually lose more than you should.

People that got into crypto in 2017 might have only learned about this at the beginning of 2018, when we entered a bear market. Before that, they had an entire year of profits and profits. You didn't need that much knowledge at the time to make money since the entire crypto market was in an extremely bull trend. If you just bought bitcoin at the beginning of 2017 and sold at the end, you could have easily made 15x. In a single trade.

Managing your capital is paramount in the long term. You will have losing trades, that's a certainty, no one just wins. So when you lose, lose little. And when you win, win big.

Source

Learn how to assess risk and potential profit and enter trades that offer a high risk to reward ratio. Change your mindset from "Damn, it's mooning, it could go up 100% more, I'll get in!" to "If it doesn't go the way I think it will go, how much will I lose? Am I willing to lose it? Can I afford it?".

Source

The 2%

Some traders say that you should never trade more than 2% of your portfolio in a single trade. That seems very little right? It will take forever to actually win something...

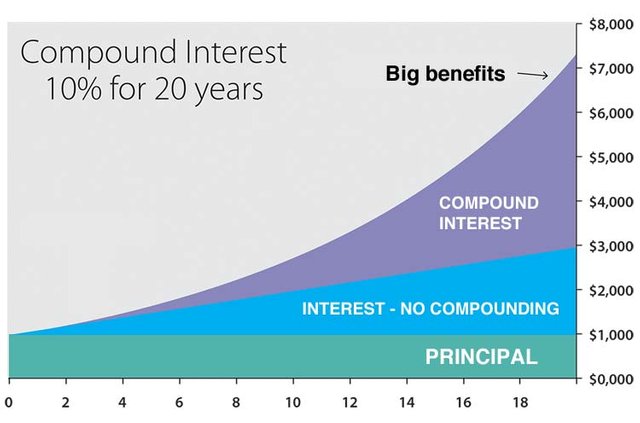

That's why I want to bring another 2% idea: the 2% compounded over time. Have you thought what happens if you make 2% of your portfolio, let's say, every week? If you start with $5k, in a year you will have $14k, which is almost a 3 times what you started with. In two years, that will become almost $40k. And you don't need to change your strategy, just keep doing what you were doing since the beginning.

This is specially useful when you are starting. Most traders take years to become profitable; until then they are just learning. If you are careful while you're learning, you will preserve more of your capital and increase the profits you'll take from your wins when you become profitable.

Compounded interest is the clearest example of how profits can "snowball" if they are done consistently:

Source

That's what happen if you put money early on in an investment and that's what can happen if you're consistent in your trades. And to be consistent you cannot be reckless.

If we stress out this idea a little more and say that you can make 1% of your portfolio every day. In this case, $5k becomes almost $190k in a single year! That's crazy! Of course it isn't easy to be this consistent, but it's a great way to visualize how profitable you can be even while doing small sized trades.

This is the principle that explain the dominance of a few, the 80/20 Pareto principle, not only when talking about money, but with several other things in life. A company that is 1% better than their competitors has a tendency of having way more than the competitors over time. A tree that grows 1% more than the others will dominate over time.

So consider this when you're thinking about trading or investing in crypto. There are many ways to achieve your goals. Going slow and steady is proving to be the way for me.

Takeaways

- Compound everything!

- Be consistent.

- If in doubt in a trade, don't take it.

- Don't ever FOMO.

- Entry point is very important as it helps define the risk to reward ratio.

- Use stop losses, you need to know the maximum you can lose.

- Never go all in and never go all out. Aim to exit early if losing and letting profits ride if winning.

- Trading is hard. What comes easy can go just as easily.

- There will always be people making money faster than you, don't make this fact influence your thinking.

- Be like the tortoise.

Disclaimer: This is not financial advice, this is for informational and educational purposes only. This is only my opinion, make of it what you wish.

Wow. This is a great content. But the sad truth is that people will always be greedy...forgetting there are no shortcuts to success.

Theres a popular quote by buffet which says “Risk comes from not knowing what you are doing.” Well done @jwyles

Absolutely true. But that's what differ those that succeed from those that don't, right? Need to keep learning and listening to more experienced people to contain our impulses.

Thank you for the comment!

Resteemed to over 17300 followers and 100% upvoted. Thank you for using my service!

Send 0.200 Steem or 0.200 Steem Dollars and the URL in the memo to use the bot.

Read here how the bot from Berlin works.

We are happy to be part of the APPICS bounty program.

APPICS is a new social community based on Steem.

The presale was sold in 26 minutes. The ICO is open now for 4 rounds in 4 weeks.

Read here more: https://steemit.com/steemit/@resteem.bot/what-is-appics

@resteem.bot

@resteemator is a new bot casting votes for its followers. Follow @resteemator and vote this comment to increase your chance to be voted in the future!