They say a picture is worth a thousand words...

For those of you that think Bitcoin is too pricey and can't really go much higher, check this picture out:

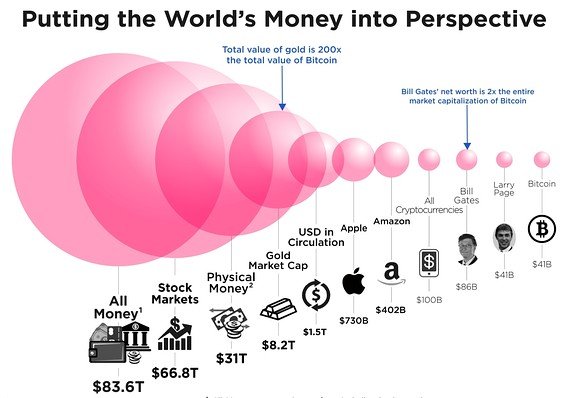

As you can see Bitcoin's current market cap is right around $41 billion.

Lets take a moment and see exactly how much Bitcoin would have to increase to reach the levels of some of these other items:

At $41 billion, Bitcoin would have to multiply it's market cap by roughly 18x to reach the current market cap of Apple, and Apple is a company.

Bitcoin certainly isn't a company, instead it claims it is a new form of currency.

Well, for Bitcoin to reach the current market cap of all the U.S. dollars in circulation, it would have to multiply it's market cap by roughly 37x from current levels.

And that is just U.S. dollars.

Some people like to say that Bitcoin isn't really a currency either.

Instead, they say it is more comparable to Gold as a speculative asset.

Well, for Bitcoin to reach the current market cap of Gold, it would have to multiply it's market cap by roughly 200x from current levels.

Are you seeing a trend yet?

Now lets say Bitcoin were to one day replace all the physical money that is currently in existence globally.

For that to happen Bitcoin would have to increase it's market cap by roughly 770x from current levels.

So...

The next time someone tries to tell you that Bitcoin is maxed out at current levels in terms of price or market cap, show them this picture and bust these facts out for them.

We are not talking about the price of a speculative asset. We are talking about possibly an entire paradigm shift.

I wonder where steem might fit on this scale... ;)

Stay informed my friends!

Sources:

Follow me: @jrcornel

Heads are turning now, when BTC hits 4k and sustains that price for a while, it will be a pivotal moment in my opinion. People will start rushing in at a breakneck pace. Exciting times!

Following you. Please follow back, I have some really cool posts planned.

Thanks!

#payitforward

This really puts things into perspective! Much appreciated post, thank you!

Yeah for sure, I try to show simple infographs to people when I start to talk about Cryptocurrency because what I am hearing now from some that have heard about BTC is "Well, isn't it in a Bubble?" This does a great job of showing that if we are in a bubble, it's quite a small one and we've got a long way to go~

Bitcoin is a gateway currency and this is only a speculative value. For example, compare Apple to Bitcoin? What is Apple offering? Real, physical products among everything else. What is Bitcoin offering? Gateway to the market exchanges and some darknet value. It's used only because people don't have better ways to put fiat into crypto. + the fees are already too high.

Steem has more to offer than Bitcoin. First, it is empowering decentralized social media. Second, it has a huge potential of becoming a major player in the social media world and it might ignite some first decentralized broadcasting media. Third, we could see Steem along with EOS, BTS and other, as a future way of payment because of speed and no fees of transactions. And the last, but most important, we could see Steemit becoming a great online community capable of influencing social trends, starting charities, great quality content and much more.

thats great and all, but bitcoin does so much more than just be a payment system for the dark-net(other alts are taking bitcoins place in the dark world) bitcoin is in a class of its own, just one example is if you need to buy other alts for your software well you have to buy bitcoin and exchange it on one of many exchanges available. and when you need to sell your alt coin, you have to convert it back to btc. so you see as the alt coin market goes through its winners and losers, bitcoin will simply eat up all the alt coins that fail eventually. thus adding more to btc market cap. plus its a storage of wealth on top of these things, so even more being added to btc market cap....plus moble casinos use btc now, there will be beter markets than ebay,,,, etc,,,,, it will keep growing to 1 million per bitcoin in our life time.

Bitworld you seem to know your stuff, so i got a question for you (I am not very knowledgeble about the crypto curriencies at the moment) . As you mention you have to use bitcoin to exchange for other currencies, this definetely is an awesome quality of Bitcoin that will always ensure high demand for it. My question is: is there anyway to buy any altcoins directly and not through exchanging Bitcoins? Further, if it is not possible today will it be possible soon you think? i am interested because if this status were to change i am sure that Bitcoins place as number one would change pretty fast.

That is correct, but if you go to coinbase you can use ltc, and eth for exchanging to fiat currency. There is also a exchange called coinexchange.io you can deposite lots of alts here and trade for btc, and many other new alts to be thrown into the crypto economy. But as far as bitcoin goes it will still be the safe investment compared to 95% of other coins for a long time, literally 98% of all things crypto, use btc. And will still have to use btc one way or another. Its also a means for storing your wealth. if you look at the global index, total $$$involved in a safe investment such as gold, well we are talking tens of trillions of dollars. so we are just at the starting point for mainstream adoption, we are past the early investors, now its time for the boom. bitcoin will hit at least 47k per coin when we hit 1 trillion in btc markt cap, and i see bitcoins capturing 5-20 trillion in our life time if not more. so btc will definitely hit 1 million per btc in 10-20 years from today.

With Coinbase you can use USD to buy LTC, BTC, and ETH directly yes. Though if we look around the total crypto space we are seeing more and more global exchanges that are opening up direct buying opportunities for fiat pairs. so one could skip bitcoin and go straight into Dash, or Z-Cash, or Ethereum classic if they choose. This is happening increasingly on the Chinese and Korean exchanges. Bitcoin is still the whale that's true, but it's dominance is being chipped away at in a steady way and will continue to do so until it finally scales and adopts segwit. If that whole thing gets solved in a satisfying way, which I'm sure it will, bitcoin will see it's nice stairstep. We will probably get an other surge into alt's at the same time.

@dandesign86 If you are going to invest in bitcoin right now just be SURE to read up about Segwit2x (google it or search here on steemit) and what the implications are and HOW and WHERE you should store your bitcoin (hint, not on an exchange like coinbase or poloniex. Electrum wallet seems to be a very good safe storage place)

Don't forget about Shapeshift for conversions too. http://shapeshift.io/

@jrcornel

which cave are they from?

only those who has never experienced using it in a physical store would say that

Not exactly; Coinbase now allows sales of ETH and LTC.

You're mostly right though!

cryptocurrencies, stocks, companies and even gold are worth what the people think they are worth. Other than people noone in the university needs these things or cares about their value ;))

Wait what ? are you crazy ?

It offers a personnal bank account and a way to exchange, and it's getting more wide than only the darknet. Take steam for example, you can pay game in BTC.

BTC is always critizise, but actually it's the crypto that is the most develop and scalable. You see ETH getting in trouble of scalability right now.

True that some crypto offer another value more than just "money". But don't forget that they all depend on BTC. I just hope that futur fork will lead to good :/

Well explained :)

by the way i see steemit like the way I see Facebook but better platform, so it will take Facebooks spot.

Yes, the social aspect of Steem through Steemit is what gives it mind-blowing value. Steemit is penetrating homes, social circles, information markets and entertainment markets. It has the potential to be everywhere!

My thoughts exactly! I read this same article and had a very different outlook than the author. Even though they are clearly trying to make the argument that Bitcoin's growth is only the result of a bubble based purely on hype (There's an original claim!) it's all in your perspective. You could make two very different assertions looking at this same chart.

A critic who believes cryptocurrency is just a fad or a really elaborate Ponzi scheme would look at this chart and scoff at how little Bitcoin is compared to the amount of attention is has garnered by the media. Looking at the data, you would assume an investment in Apple or Amazon would have paid much bigger dividends by now. But that's comparing Apples to oranges (pun intended :P). Amazon was founded in 1994 and was first publicly traded in 1997 at $16/share. Apple was founded as a company in 1977 and went public in 1980 at $22/share. If you adjust for splits, that puts Amazon at $1.96/share and Apple at $0.39/share. Bitcoin was created in January 2009 and the earliest exchange data I could find on Bitcoin was in Aug 2011 when it was trading at roughly $12/BTC and then due to early volatility in the market it quickly fell to a low of around $2/BTC with an average of $5.10/BTC in the first 30 days.

So, let's say you were incredibly lucky and you were able to invest $2k during the initial offering of Amazon (the largest company to emerge from the .com era) and Apple (currently the most highly valued company on the planet). With your initial investment of $2k in AAPL in 1980 at the split-adjusted price of $0.39/share, you would be able to sell your shares for $746,923.08 USD (5128.205128205128 AAPL at $145.65 USD each).

Your initial $2k investment in AMZN in 1997 at $1.96/share would have netted you an astonishing $1,022,632.66 USD (1020.408163265306 AMZN at $1002.18 USD each) at the time of this writing!

Now, let's say you invested $2k in BTC in 2011 and bought 246.9135802469136 BTC when it was trading at $5.10/BTC on BitStamp. With the current exchange rate of 1 BTC = $2698.23 USD at the time of this writing, your initial investment of $2k would now be worth $666,229.63 USD. Not quite as impressive as what you would be worth had you been able to get in on the ground floor of Apple or Amazon.

However, you have to consider that we are only eight years into BTC being available as a currency. If you consider the amount of time each company has been publicly traded, Amazon has had a 14-year head start over BTC, and Apple is the dinosaur having had a 31-year head start over BTC.

Given all that, I would say Bitcoin has performed hand over fist better than any current tech company on the market.

So, any informed investor could look at this same chart and make the argument that for a digital currency that was only an experiment in digital currency just eight years ago, BTC has performed exceptionally well. Born of a failing economy created and heavily regulated by governments and central banks, what other investment opportunity can you show us that has proven more resilient to stock market fluctuations, weak growth or scandal than cryptocurrency?

I say to the crypto-critics, don't ignore what is consistently proving to be a great investment opportunity and a great chance to be part of a piece of history. As they say, don't put all your eggs in one basket, and don't invest more than you are willing to lose. You shouldn't drain your 401k into cryptocurrency at this point. However, don't pass up on an opportunity like this such that we may not see again in our lifetime.

There is some really great history in here. Thanks for sharing!

Very well put. You would think its that simple just follow the math, but people are very emotional beings and they follow the crowd. Basically its monkey see monkey do, its only a matter of time before its mainstream adoption....

very nice picture....If people think BITCOIN is overvalued have them compare its market cap to a similiar company like PAY-PAL. Both companys are very similiar but PAY-PAL has a market cap that is about double the size of BITCOIN.

$60 Billion compared to $30Billion.

^^UPVOTED^^

great giff

Hahaha, that's a perfect crypto gif.

For the record:

Today's (June 20th, 2017; 40 days before segwit via NYA/UASF) stats to remember:

BTC price: $2680

Average confirmation time: 426 minutes

Average fee: $4.15

Transactions per block: 1774

BTC market cap: $44,474,013,720

Market cap ratio: 39.5%

Lets revisit these stats around October and evaluate if segwit is really a scaling solution. And lets see if we will be able to claim part of 40% market cap ($40 billion) we lost since the progress was blocked.

Sharing to help retain collective memory and avoid similar in-fights in the community.

Sources:

https://blockchain.info/charts/avg-confirmation-time?timespan=30days&daysAverageString=7

https://blockchain.info/charts/n-transactions-per-block?daysAverageString=7

http://coinmarketcap.com/

I look forward to revisiting as well. :)

Interesting information, right now I also collect bitcoins, albeit in small quantities, but I am sure, one day the price will double from what I gather.

I'm expecting a price of 10k this or next year ;) so I think that the plan of doubling your money will work :p But have some patients my friends. I hop Steem will reach the 5 dollar soon.

what do you think of Ethereum?

i wouldn't hold eth, its manipulated, and controlled supply

example flash crash of on gdax a few days ago.

any source i can look into?

for etherum?

yes

https://forum.ethereum.org/discussion/46/total-supply-of-eth

does this help?

I now at least once fact.

Humanity will eventually get red it off physical currencies and this crypto era is unstoppable

waaaait. It makes it two

Absolutely! It's a beautiful thing.

Most likely more than double imho.

hahahahah Exactly what I think will more than double

not double, but qua-triple :)

We have seen nothing yet! We are just in the beginning of the biggest rush since tulip Mania 💪🏼🙌🏼💯

I love me some tulips! :)

Tulips are damn pretty 💐🌼🎍🌸🌺😂😂😂😂

Thank you. That was very insightful.