Hey Mark Cuban, Stick to What You Know!

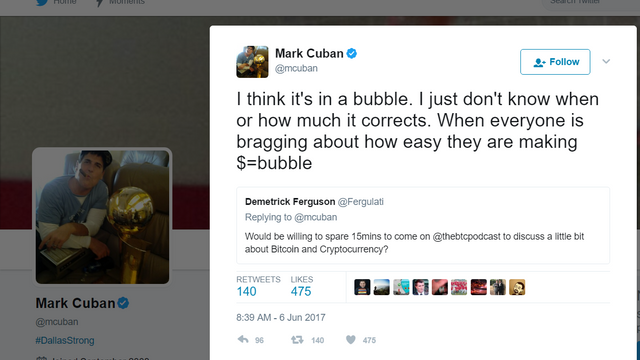

Earlier today Mark Cuban tweeted some thoughts on Bitcoin.

Shortly after, Bitcoin took a massive dump:

Mark was being asked several questions regarding Bitcoin and blockchain technology in general.

This was his tweet about Bitcoin that started the tumble:

I respect Mark very much for being right on a number of different calls in the past.

A specific one I can recall was his wonderful call on Netflix. To this day, it has been a great call.

I also enjoy him very much on Shark Tank. He does a great job on there and for the most part offers decent deals to the participants.

However, regarding Bitcoin, I think he hasn't quite thought it all the way through.

I agree that Bitcoin could pull back at any time. It has pulled back roughly 178 times since 2013. I fully expect that trend to continue.

The real question when calling something a bubble is if you think it will never make new highs again. Otherwise any pullbacks and corrections are just volatility on it's way to higher highs that any long term investor should simply ignore.

If you think Bitcoin is a fad to be replaced by something else then ok, stick to your bubble call.

However, if blockchain technology is here to stay, like you mentioned in a later tweet I might add, then I think the odds of this being the highest price Bitcoin ever sees highly unlikely.

The tweet can be seen here:

If blockchain technology is the future, Bitcoin has a better chance than almost any other coin of realizing a big piece of that future.

Speed and scaling are certainly issues, but they are likely issues that can be solved.

If Mark is advocating to sell now so that you can get back in at a better price, well that is an option, but that is more trading than investing. There is no guarantee that there will be a better price or that you will actually get back in when that better price presents itself.

For those of us that are investing for the world changing technology, selling the rips and buying the dips is not what we are investing for.

It is very dangerous to throw around the bubble word Mr. Cuban. Make sure you quantify your time frame when doing so!

Saying something is due for a correction is very different than saying something is a bubble...

Stay informed my friends!

Sources:

http://www.cnbc.com/2017/06/06/mark-cuban-calls-bitcoin-a-bubble-price-falls.html

Image Sources:

https://papodehomem.com.br/quebrei-minha-empresa/

http://www.cnbc.com/2017/06/06/mark-cuban-calls-bitcoin-a-bubble-price-falls.html

Follow me: @jrcornel

That's why I'm in STEEM :).

I get a kick out of old Mark Cuban... He is probably just mad because disco went out of style and that is the only dance he knew.

OR that his Mark Cuban's wife knows about the child he fathered when he knocked up a not legal aged little Filipino girl from Maryland. Google it.

It is amusing to me that a few of the billionaires who have spoken about blockchain respect it but when it comes to bitcoin they reject it. It is as if they are unwilling to accept the idea that currency as we know it is changing.

Envy and bitterness.

Mark Cuban has invested in Bitcoin, however he is far from a whale. LOL!

https://twitter.com/TRWNBC/status/872327342319861760

Disclaimer: I am just a bot trying to be helpful.

a serious bubble needs a certain amount of market saturation and cryptos simply aren't even close to capacity in this manner. large portions of the world do not know what cryptocurrency is, and other large populations aren't even online or owning cell phones. the potential is still unbelievable. we shouldn't be listening to this guy at all imho. he probably had an assistant explain blockchain to him 5 mins before the interview. please also consider it may be in his own (and other scared millionaires) personal interest to drive crypto prices down right now. everyone can see how sensitive the crypto market is to certain types of "News".

Actually, a bubble can be created when as little as 50% of the public in general owns a particular asset. The real estate bubble is an example but home ownership may have been as high as 60%+ when "the top" was reached in early 2007 home prices. The bubble itself was the "price being paid." If price is driven to unsustainable levels in an asset that is owned by only 1% of the general population it is still a bubble. You will realize it "was" a bubble when the market adjusts out and it becomes "obvious" in most examples of past bubbles. Nobody can argue that a movement in price of 1000% is 2 years is not a bubble however. The "facts" from past history point to the distinct possibility that bitcoin (and since all cryptos will likely follow bitcoin's price path, those also) is a bubble. I base my comments on years of experience following how sentiment drives price...and how mistakes in price are made by the masses, big or small. Follow along if you'd like as I blog continuously about it here.

Do you think 50% of the general public owns a bitcoin? I can't name a single person I know outside of steemit that owns even 1 Bitcoin... not one.

I didn't say 50% of the general population of any country even knows about let alone owns bitcoin. I said a bubble can form with even 1% of the population in bitcoin if everyone who wants in is already in at "whatever price is neccessary to get in" is paid. Based on my "sentiment" indicators that is pretty much where you are at right now. Bitcoin is priced for perfection if measured by sentiment driven pricing models that predicted price movements of other assets in the past. Bitcoin is basically "off the charts" with investor enthusiasm so if you are looking for lower prices...your chances are better than good that your wish/hopes will be met. Here's hoping hope doesn't turn to fear. None of the advocates will help you. Those who paid $100/coin or less likely don't even give a shit about anyone who paid current prices.

sell now

they'll buy and hoard

and leave you drooling when it soars back up

higher than how much is actually costs now

what do you think ?

is it a bubble or a blowing bubble?

fingers crossed - a blowing bubble at least that one flies longer hahah

I did some volume/price studies on Bitcoin over the memorial day weekend. Volume spikes at every single low were buys. And every single volume buy led to a rally. I posted an example of just one such volume buy just to show how easy it is to spot when you are being played. "Actual" bitcoin rose off that low for the biggest % gain for the entire weekend. Here's teh current live bitcoin chart. The "manipulators" tried many times to "rescue" the drop. Every single one failed today. You had better learn how to determine what the players moving teh price are thinking. Or else you will get crushed. The best advice is to just not trade it...even tho it is very easy to trade it and make $$$ doing so. Look at the 12 hour chart and you will "clearly" see manipulation if you have ANY trading experience. if you don't see manipulation...don't give trading advice. Just a suggestion. Here's teh 12 hour "live" bitcoin view.

http://bitcointicker.co

He already has more money than he knows what to do with. I am sure he is not envious of anything.

I guess it takes a "special" kind of personality to amass the empire he has, but Mark Cuban comes across as an arrogant douchebag.

Based on his track record with the SEC, he's also apparently very adept at skating right up to the edge of the ice, and then having his lawyers explain why the edge of his ice is really 3 feet further than everyone else's.

Somehow money makes you an icon and an

Expert? I can't stand him he is a total

Chuck! God do is his comments and an affect on the BTC market.

Bitcoin has some potential problems and since it is an older coin it seems a bit more set in its ways. Some people might just want something newer and more open to innovation as we go forward.

Yep, he seemed to contradict himself by saying that blockchain technology is our future going to be used in everything, then he says oh by the way Bitcoin is in a bubble...

The elite understand that blockchain is the future, but they are afraid of public decentralized blockchains. They want private centralized blockchains, or else they become irrelevant... They will always bad-mouth bitcoin

I said this below too, but the dot-com bubble was the future but at the wrong price. What is stopping that from happening again? Just because it is the future doesn't necessarily mean that the price is right.

I agree with that, and I would have agreed more had he said the altcoin market is in a bubble. I just don't agree that Bitcoin itself is currently in a bubble.

Yeah, that's fine to not agree that Bitcoin is in a bubble, but I think that there is enough ambiguity that we can give Mark Cuban some slack, haha

Haha I guess we can, especially since sometimes when I talk about Bitcoin I am really talking about blockchain technology in general and Bitcoin, all rolled into one. ;)

I think he did it on purpose, so he can buy some more of it lol.

He was most likely saying Bitcoin is in a bubble because it was round the same number for almost a week. Not saying that I agree with him.

Well, I think if it is in a "bubble" it will be a small one. Maybe with a small pullback around $3200 settling around $3000 before heading up again.

Does this have to be a contradiction? If I understand this right, Bitcoin is the first application of blockchain technology in form of decentralized currency but they are not the same thing. Today we know, that underlying tech (blockchain) can be (and already is) much more than "just currency". Therefore to me he is saying something like: "Paper bills are our future (LOL). But Dollar paper bills are in a bubble [compared to other currencies]".

In any case, I am not sure what is a "bubble" definition in crypto market. Given how volatile are even the most stable currencies, they would all qualify for "bubble" assets in real word of up-to-2% fluctuations. So I could be throwing darts into crypto-currencies list and and with each hit I could map a smaller or larger bubble burst within past 3 months. The thing is, that basically all of these "bubble bursts" recover.

Its not that it is rejected. Though it is clear there is mass speculation which tends to inflate prices past its core use. Which lead to the wild swings as news and conditions vary. Such as the recent SegWit agreement which already has detractors. If this deal does not go through at the agreed date, expect it to take a swing down as speculators dump ship to buy at a better price.

Also keep in mind, the pioneers often blaze the path for younger and more fit innovators to bring it to the next level. In our age of rapid change, it is no guarantee BitCoin will have its dominance in a few years. Although if you keep your investments in the game with the rising stars, diversified, this industry is just getting started. Best of sucess and good news.

Could it be because they are tied with fiat form ever since and not will to adapt change. I mean every currencies would have problems and new one will solve them, but it does not mean it will loose value. But Mark Cuban need some in-depth class on Blockchain, just scratching the surface.

Or they don't like it. Because you can not influence blockchain with money, political influence, local wars, or by buying a bank. :)))))) This playground's rules are not corruptible with money....and even if they do not admit it, many billionaires make a lot of money like that on the fiat market. :)))). I will not admit saying this :))) -temporary insanity--- or temporary alcohol abuse :))))

Do you want the REAL info on MARK CUBAN?

FACTS

Agreed. There will be surges and corrections as the uptake of Bitcoin among the masses continues.

At the moment, it hasn't really got into the public consciousness but there is talk of ETFs and wider Bitcoin adoption by businesses so there's a long future ahead with plenty of 'steps'.

Bitcoin is the proven crypto, it's been around the longest and as a consequence the most 'battle hardened'.

If it fails..ALL cryptos fail and I can't see technology like this failing en masse.

Just because he's had a few correct calls, doesn't mean he's right about everything :-)

I'm curious why you think this is true. I could imagine Bitcoin being taken over by something like Ethereum.

I think a failure in Bitcoin will cause loss of faith in Blockchain technology as an 'immutable, decentralized record keeping system'. Pretty much the foundation on which every other crypto is based. Right now, there is an intimate link between the crypto market and what Bitcoin does as any gains made in cryptos is cashed out/stored via Bitcoin. It seems to be the default coin..almost like crypto gold. Ethereum may well take over in market cap but as a store of wealth, I think Bitcoin will reign supreme. Ethereum will run applications on it which are currency agnostic, whose to say that most of the apps run on it won't be Bitcoin based? :-)

If Bitcoin tanks for some reason, I think this loss of faith will be significant but probably recoverable. Now we have a taste of what's possible this technological concept won't be given up on so easily.

Look at the hard fork Ethereum went through, you might have been forgiven for thinking when that happened that would be the end of that but look at them now, now both Ethereum Classic and Ethereum are thriving.

Stick to watching others play basketball and polishing their trophies, Mark. :)

Haha, hey he has more than my Phoenix Suns do!

No. the players won those. :)

Yea but I mean he put all those pieces together. It is pretty difficult to win an NBA championship. Especially in a league where the players have so much power to create super teams etc...

Magnets ;) Basketball is the most rigged of all Pro sports. Cuban is a mascot.

Crypto's are a whole other ball-game , eh, i mean assetclass ;-)

Mark will probably use this opportunity to buy the f***ing dip!

Mark's fallacy is immediately apparent in his own tweet. He literally destroys his own argument in his own words:

"When everyone is bragging about how easy they are making money=bubble"

Here he parrots some conventional cliches about investing, going back to the shoe-shine boy.

"When even shoeshine boys are giving you stock tips, it's time to sell." - Joseph F Kennedy, supposedly presciently predicting the stock market crash of 1929.

Using radical fallacy, he equates those of us active in the crypto-currency world with "everyone" who are apparently all "bragging".

I don't know about the rest of you, but when I look around on the street, I can't imagine that even 1 in 25 or maybe 1 in 50+ people have ever owned a cryptocurrency or, indeed, would even be capable of accomplishing the task if they set out to.

Apparently, Mark thinks experts on obscure technology that practically nobody (perhaps <.1%) of the population fully understands and is comfortable with, constitute the modern-day "shoeshine boys".

Yeah, nice one Mark - why don't you ask your shoeshine boy what a Trezor is, or what he thinks is likely to happen on August 1st, and get back to us?

Mark should indeed stick to what he knows - arguing with the even-more-entitled partners he has on Shark Tank.

PS - Mark is my favorite shark, so sorry to be so hard on ya. =)

I couldn't agree more with just about everything you wrote here. Well said! That point about not everyone owning it yet is exactly why it's not in a bubble yet. Outisde of the people I know on Steemit, I don't know a single person who owns even 1 Bitcoin, not one.

I tried to convince all my close friends on the merits of cryptocurrency in 2012, when I was ready to risk going most-of-the-way in. Most of them concluded my level of enthusiasm indicated insanity, and distanced themselves gradually from my circle. We're talking master's-degrees+ on average, intelligent people. They weren't even capable of considering the argument without assassinating a messenger with an established record of honesty and forward-thinking (to their experience).

We're still going to see crazy whip-saws in price though. Watch Mark Cuban do a victory lap on this tweet if BTC hits $1500 or less, even for a day.

great post......

upvote & restem

Thank you!

your'e welcome @jrcornel

that pic reminds me of