"Buy When There's Blood In The Streets!"

At least that is how the saying goes. But, is it true?

Well, that probably depends on what you are investing in.

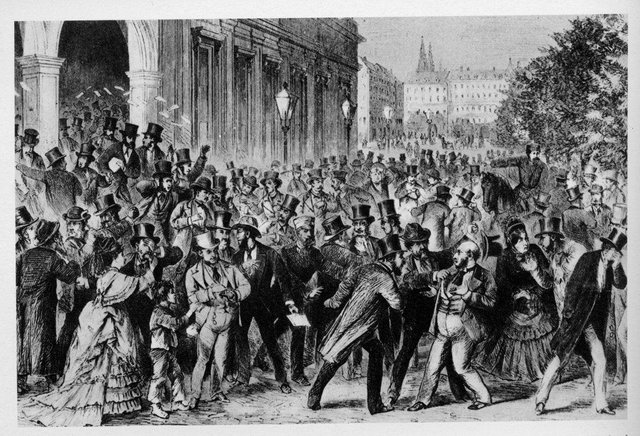

Baron Nathan Rothschild was first credited with saying, "the time to buy is when there's blood in the streets." Although, the whole quote is believed to be something closer to this:

"the time to buy is when there's blood in the streets, even if that blood is your own."

A quote with a slightly darker connotation...

Rothschild should know though, as he made a fortune buying in the panic that followed the Battle of Waterloo against Napoleon. He was quite the banking opportunist, continuing a long line of wealthy bankers.

Let's explore the context of that quote a bit though, shall we.

In 1869 there began a post civil war boom. Railroad speculation was fueling massive price increases. At the time it was the largest employer in the nation and tons of money was flowing into the space. More money was flowing in than could actually be used to provide immediate returns. This eventually (among other things) lead to a run on gold and eventually in 1873 major banks and brokerage houses started failing as the bubble had burst.

The issues across the pond in Europe were much much worse. A global depression had begun. This would provide the backdrop for one of the world's most legendary investors the opportunity to make a fortune for himself. Nathan Rothschild became the stuff of legend for his risky investments during the impending financial crisis, and his quote, "the time to buy is when there's blood in the streets" is one of the most often quoted in the financial space.

For Rothschild, his quote could not be any more true.

There are also countless examples of times when stocks dropped very quickly in times of turmoil only to rise again a few months or years later to many multiples of what they were trading for on the lows.

Savvy investors who picked them up were able to make a killing as the prices rose.

You can read about some of those examples here:

https://www.forbes.com/2009/02/23/contrarian-markets-boeing-personal-finance_investopedia.html

However, there is one very important caveat to keep in mind here.

Only the very best companies survived the busts. People talk about buying IBM or EBAY when the tides went out, but for every one of those, there were 10 dot.com companies that completely went away during the dot-com bubble burst.

So, before just diving in and buying things that are way down, you need to make sure you do your homework and only buy the things that actually have solid fundamentals attached to them.

How does that relate to cryptocurrencies?

In the cryptocurrency space it can be harder to see exactly who the ones are with strong fundamentals. For that reason, some good old fashion diversification is probably the best advice you can receive.

Yes, there is a good chance that the crypto space could offer world changing technology, but when the tide goes out, and it certainly will at some point, the wheat will be separated from the chaff. At that point you want to make sure you are holding a lot more wheat than chaff.

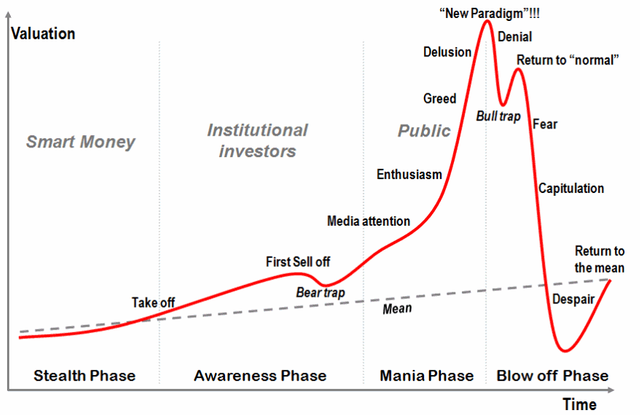

Which part of the price cycle do you think we are currently in?

Know what you own and look forward to the times you can get it for a steep discount.

Stay safe out there my friends!

Sources:

https://seekingalpha.com/article/741351-when-theres-blood-in-the-streets

https://en.wikipedia.org/wiki/Panic_of_1873

https://www.forbes.com/2009/02/23/contrarian-markets-boeing-personal-finance_investopedia.html

Image Sources:

https://seekingalpha.com/article/741351-when-theres-blood-in-the-streets

https://ants-and-grasshoppers.blogspot.com/2010/10/

Follow me: @jrcornel

Solid fundamentals are crucial.

Thanks again for seriously good words of wisdom and reminders of historical proportions!

All for one and one for all! Namaste :)

Namaste!

First sell off/Bear Trap Imo...The public "may" have heard about Btc...But less than 1% of people in the world actually hold it...Definitely Institutional investors are starting to get into it...Big hedge funds are still waiting on the sidelines...By the time they get in, the price might be $10,000, $20,000, or more...But all the other cryptos...Certainly not, which is great for us early investors, or the 1%:)

That is where I am thinking we are as well. Hopefully we are right.

My question in this climate is "during the next stock panic, will money flee INTO cryptocurrency"?

meep

@jcornel very much agree with the take on crypto as opposed to a more mature market so to speak. If the crypto market was a bit more seasoned and had a larger market of participates than "blood in the streets" would be valid to buy the big names.

However, diversification is for sure the way to go in crypto, even regardless of this pull back....not all alt coins are going to make it. Avoid stock picking and get exposure to atleast 5. I'm finally starting to diversify myself.

Yep, it's what you have to do.

Stay calm and steem on ;)

Yep. that's the way it's done.

Bloody, man. bloody!

I was just speaking of this on another post. When bitoin drives up and people start dumping alts, time to fill your bags. When bitcoin bleeds alts go green sell and load up on bitcoin. It happens the same everytime, I watch the market everyday and love to trade but hackers wipped me out so all i can do is study.

Wiped you out? How so?

I been buying my 1\3rds back as I been selling my 1\3rds.

That is a great strategy!

I feel like in crypto a good time to buy is when everyone stops posting videos about their mining equipment and their holdings, the meetup groups go dormant, you don't really see anything on the news about it. Then when to sell is when very non technical people are talking about it and getting all excited about it.

Yep. My thoughts as well.