Brokerage firm Monex to buy Coincheck?

In news out this morning, the Japanese Brokerage firm Monex is considering buying cryptocurrency exchange Coincheck.

This is very big news and has far reaching implications.

Monex is a traditional brokerage firm located in Japan.

It also owns TradeStation here in the US.

The release can be seen here:

https://news.bitcoin.com/monex-shares-jump-following-news-of-coincheck-acquisition/

The specifics:

Monex is said to be offering several billion yen for a majority stake in Coincheck as soon as this week.

They will also set up a new management team to rehabilitate the exchange according to the Nikkei Asian Review.

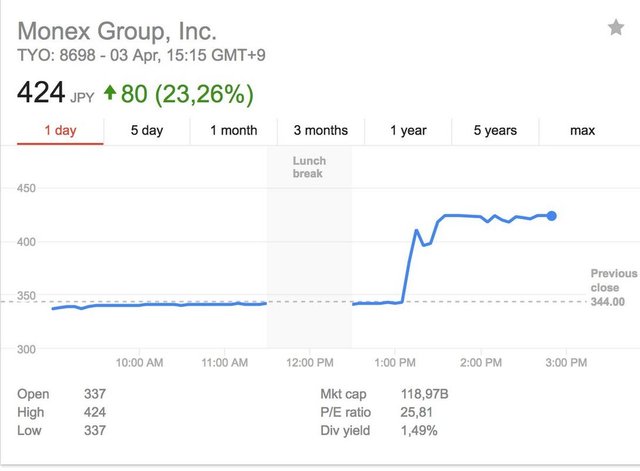

The shares of Monex, which is a publicly traded company, skyrocketed on the news:

(Source: https://twitter.com/cryptomanran)

Climbing nearly 25% after the news was released.

If you recall, Coincheck was the Japanese exchange that was hacked several months back to the tune of $535 million worth of NEM coins.

They have been in hot water with Japanese regulators just about ever since.

What this news means:

This acquisition has major implications in that a fully regulated Japanese firm is getting involved in the space.

It also has implications out West as Monex owns TradeStation, which means that TradeStation will have an indirect tie to Coincheck as well.

TradeStation currently already offers bitcoin futures as well as real time cryptocurrency prices and this may mean they are going to be getting involved in the crypto space in an even bigger way.

Something I am sure Etrade, TD Ameritrade, and many of the other retail brokers are currently taking note of.

A Monex purchase of Coincheck would also further put a stamp of approval on the entire industry and further indicate that mass adoption of this as a legitimate asset class is likely on the way.

Stay informed my friends.

Image Source:

https://news.bitcoin.com/monex-shares-jump-following-news-of-coincheck-acquisition/

Follow me: @jrcornel

Poloniex acquired by Circle, Coincheck by Monex, who's next? JP Morgan buys Bittrex? Goldman acquires Binance?

I would not be surprised to see Etrade dip their toes in somewhere. They have been desperate to becoming relevant again.

Let them have it. They may think they are one step ahead until they realise there are at least a dozen operating DEXes. One major event of any disruption to crypto fan base in these whales and trade volumes will start picking up on DEXes and LocalBitcoins.

The Canadians are loving LB: https://steemit.com/bitcoin/@techwizardry/canadian-investors-are-pouring-millions-into-localbitcoins-following-banking-blockade-on-crypto-transactions

Okay people.. STOP for a moment and think about the significance of this..

Why would anyone spend money ($ millions of USD) to buy another brokerage exchange if they thought crypto and blockchain was dead? I think the answer here is that it's only going to get bigger and we're likely to see more buys and mergers and acquisitions like this one. This is GREAT NEWS!

Bingo. My thoughts exactly.

Monex Group’s asset portfolio is focused on providing services mainly to retail clients. The firm’s Japanese subsidiary Monex Inc, along with US TradeStation and Hong Kong-based MONEX BOOM Securities have been well established on the corresponding markets. As pointed out by none other but the CEO of Binance, Changpeng Zhao, the share price of the Japanese financial services firm spiked higher on the news

Thanks for sharing this. Good info here.

Completely my pleasure to share it

Thanks for sharing this cryptocurrency news update providing....I appreciate your blog.

There is little new anyway that is about money crypto

On one hand it seems to take away from what bitcoin has always been . Untouchable and unsullied by government hands. On the other side it will help clean up some of the slime balls that have been scamming people.

So it seems that after the storm that we are experiencing right now, the sun will shine through back again😉

This is really a great news for crypto markets. Thanks for sharing the information.

thanks for information.. know a new metter.. it help us.i follow your post, and also know some thing...

Another example of the amount of institutional capital waiting to be deployed into the space. The focus is now on the companies involved in the space instead of the assets themselves as regulation remains a wild card. Capital will continue to build as regulation and adoption is clarified.