Top 3 Next Best and Promising Cryptocurrency to Invest in 2018

2017 has been a good year for the cryptocurrency space. Although the technology is relatively new, cryptocurrency is already making waves in multiple industries. The increased demand for cryptocurrency surged its prices significantly and many have made good profits from investing in cryptocurrency. Wondering what’s the next cryptocurrency to invest in 2018 besides Bitcoin?

Disclaimer: This article should not be taken and viewed as investment advice, but only information and opinions. This article is for information and illustrative purposes only.

According to World Economic Forum, the number of people worldwide that do not have access to bank accounts amounts to over two (2) billion. This number represents around 35%% of our rapidly increasing population. What are the drawbacks of not having a bank account and what OmiseGo is trying to solve?

- No international payments;

- Have to carry a large amount of cash on you;

- If you are robbed, everything can be stolen (financially);

- Ease of transactions is reduced; and

- Narrow investment avenues

OmiseGo can see this problem, especially in the economically developing countries and they aim to use blockchain technology to solve this problem.

The payment processing industry is huge, with payment processors moving over $3.6 trillion per year. The largest processors are companies like VISA, Mastercard, Alipay and Wechat who each process billions each day. The problem with current payment companies is they operate in a centralized database model, they don’t communicate with each other.

A company owns a private database, which is a library of data, stocked on a computer or on many computers called servers. There are three problems with the traditional centralized database model:

- Security

- Privacy

- Trust

The idea behind OmiseGo is to solve the above-mentioned problems. The statistics have shown the fact that there are hundreds of million people in Asia, and 2 billion people worldwide, are unbanked. OmiseGO wants to provide unbanked people with an easy, open solution allowing them to own, send, receive money on a dematerialized form, whatever currency or asset they want to send, and at a minimal cost.

OmiseGO wants to provide users and merchants with a universal, decentralized solution, making it easy and cost less to send money from any network to any network, agnostically among currencies or asset types, and countries and jurisdictions.

While the blockchain has many very positive aspects compared to the traditional centralized database model, it still has a scalability problem that needs to be solved.

OmiseGo already aiming to be compliant with the Plasma scaling proposals. Buterin has a close relationship with the development of OMG, so it would seem to be a legitimate expectation that this project will indeed deliver the goods.

Plasma is a solution co-developed by Joseph Poon and Vitalik Buterin, both key advisors of the OmiseGO project, that allows an extreme scalability, potentially billions of state updates per second.

OmiseGo stands out because it is being developed by a well-established company, Omise that was founded in 2013 and is a venture-backed payments company operating in Thailand, Japan, Singapore, and Indonesia. It provides an online payment solution already used by thousands of customers.

The OmiseGo team consists of Omise core team and well-known blockchain developers. The advisors are the strongest part of OmiseGo project because they almost all are from Ethereum foundation.

Other than the lead team working on OmiseGo, the following are all officially advising the project: Vitalik Buterin (ETH lead ) , Dr. Gavin Wood (ETH and Parity lead) , Vlad Zamfir (Casper/ETH lead), Joseph Poon (Lightning Net lead) and Roger Ver of The Internet of Money as well as many others, including a professor of Quantitative Finance. I am not aware of any other BC project that has such a list of advisors of this caliber.

Some of the key investors in Omise include SBI Investment, SMBC, Ascend Capital, SMDV, Golden Gate Ventures, and East Ventures.

OmiseGo has released a roadmap for 2017 / 2018 year that shows various features and enhancements that will be to OMG users. In Q4 2017, first wallet SDK prototype will be released for workshop testing and development. This is followed by the release of wallet SDK public release in Q1 2018.

After that, public blockchain will be released to the OMG users which will make staking possible. Then in Q3 2018, cash in/out touchpoint interface with payment gateway will be released.

Plasma development and introduction are expected to be done in Q3 2018 as well.

Hence, 2018 will be the year of OmiseGo. Definitely, OmiseGo is the next cryptocurrency to invest in 2018.

#2 LTC

Litecoin is one of the best cryptocurrencies alternatives to Bitcoins that was designed to manage some of the issues that could be holding Bitcoin back. It is also one of the first altcoins in existence after Bitcoin. In fact, Litecoin was actually one of the first forks of Bitcoin. Unlike Segwit2x, it was not a hostile or contentious fork that sought to replace Bitcoin.

It was introduced 2011 (BTC in 2009) and it is almost identical to Bitcoin. So any trust and adoption rate of Bitcoin should bleed over to Litecoin.

Though it isn’t quite as innovative as Ethereum, it still has potential. Litecoin’s value is derived entirely from user adoption, and there’s also a difference in leadership for the companies involved too.

Litecoin was created by an ex-Google employee called Charlie Lee, who’s entirely transparent on social media about what he’s doing with the currency. Charlie is still leading its development and very active in the cryptocurrency community.

Litecoin is very similar to Bitcoin, but through tweaking to the settings, it is technically a superior algorithm.

Why Are The Key Advantages of Litecoin Over Bitcoin?

- Faster transaction times. Litecoin can produce blocks for its blockchain much faster than Bitcoin. In fact, it only takes Litecoin 2.5 minutes to complete one block (or transaction). It takes Bitcoin 10 minutes;

- Less expensive transactions. First to successfully implement Lightning network for instant, zero-fee transactions. Litecoin also has a far simpler algorithm. It doesn’t take as much energy or time to mine Litecoin;

- First to complete a cross-chain atomic swap (with Decred).

- In the process of adding confidential transactions; and

- Faster to adopt new technology, without community infighting over upgrades. Bitcoin’s community can hardly agree on anything, a fact that we’ve been keenly observing with the chaos surrounding the previously proposed “fork.”

Why Invest in Litecoin?

Litecoin has the potential to mimic Bitcoin prices but it will need a growth spurt in popularity for that to happen.

Litecoin’s scrypt hashing algorithm makes it easier for miners to access the system.This could cause a couple of things. First, it could encourage more novice miners to participate in the Litecoin system. This will help with widespread Litecoin usage since many users will be miners that never got a chance to mine Bitcoin.

Charlie Lee has ambitious plans for Litecoin. The arrangements have already been made for the Lightning Network to be introduced soon to reduce the transaction speed even further. We all thought Bitcoin would be the first one with the Lightning Network, but Bitcoin has hit so many stumbling blocks. This is exactly another plus point of differentiation that Litecoin is more adaptive to progressive change than Bitcoin.

Litecoin developers are also scheduled to add the Lightning Network to the Litecoin platform which is expected to improve the scalability of transactions and to investigate the feasibility of anonymous smart contracts.

One should start considering investing in Litecoin is that it is massively undervalued relative to Bitcoin, and in this undervaluation lies massive opportunity. The supply of Litecoin is four times greater than the supply of Bitcoin and Bitcoin should, theoretically, always be worth four times more than Litecoin.

Also, because you can now buy Litecoin straight from exchanges like Coinbase, you no longer need to buy bitcoin first. Now that the transaction process is direct from fiat money to litecoin, the need for BTC tokens will be reduced.

If Litecoin successfully goes ahead with all the planned updates, then the market may respond to it positively.

Internet of Things (IoT) holds one of the biggest potentials for human life change. It might become the fastest growing market in next couple years but the more important thing is that the development in related areas is interconnecting.

Using smartwatch and collect data from our morning run is what we experience today, but in couple years there will be interconnected every single device we use and all machines will communicate to each other.

Since we imagine such a world with billions of devices, machines, and humans that are communicating with each other, we are facing a huge problem with actual infrastructure and hardware/software standards. In other words, scaling will cause problems.

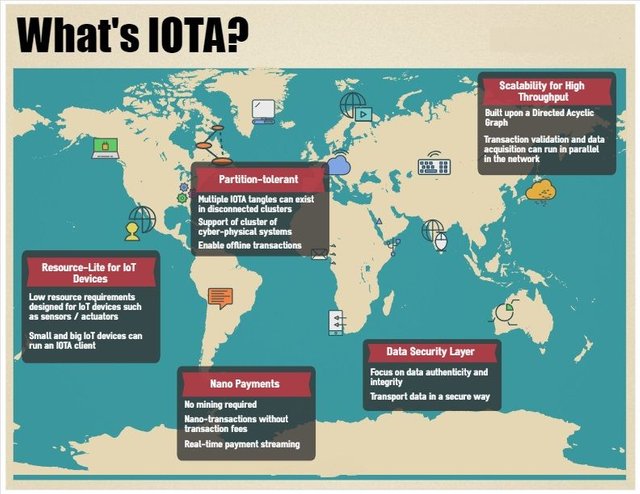

IOTA is a new cryptocurrency that focused on Machine-2-Machine (M2M) transactions. The main purpose of IOTA is to serve the machine economy by enabling feeless M2M (Machine-to-Machine) payments. IOTA is a new currency that enables a machine-to-machine economy that powers the Internet of Things (IoT) infrastructure. It’s radically different from other cryptos because it doesn’t even use blockchain for its transactions.

Instead, it uses a completely new concept called the tangle.

Tangle is an acyclic directed graph. It looks like a web, which is unlike the blockchain. Each transaction is confirmed by only two other nodes. So, IOTA allows for:

- Unlimited scalability. The more people adopt IOTA, the faster its transactions work.

- No transaction fees

- True microtransactions are possible (because of no transaction fees).

Why Invest in IOTA?

I personally love the concept and we think it would take off heavily post 2018 and 2019 as more IoT and artificially intelligent (AI) devices become prevalent.

Bitcoin, having been created in 2009 and distributed to hundreds of thousands of computers around the world, is starting to become well understood. There are certainly many areas we need to explore, but certain things like blockchain security have been tested globally and have yet to file.

In addition, Bitcoin is being tested in many other ways, like in scalability and performance in different environments. This has given people a better understanding of the technology and more confidence in what it can or can’t do.

Tangle, on the other hand, has only been in existence since late 2016 in mainnet and is not as widely adopted as blockchain. There’s a lot left to be proven about the technology and it just needs the time to prove itself. Until then, we shouldn’t just ‘assume’ the tech works as expected, but watch it carefully and understand what it excels at and where it fails.

Afterall, if you know its potential, this technology naturally succeeds the blockchain technology as its next evolutionary step and comes out with features required for micropayments conducted on a global scale.

The team behind IOTA has been growing as of late and counts with many experienced individuals. If everything goes well, and if the team is able to accomplish their plans, then the sky is the limit for IOTA. We could be on a brink of seeing a superior technology to the blockchain.

#1 Partnership with Microsoft

The addition of IOTA’s latest partners comes not long after the announcement of collaboration with healthcare providers in Norway and the renowned Imperial College London’s Centre for Cryptocurrency Research and Engineering (IC3RE) in June this year. Along with academic research, the IOTA Foundation is actively developing the Tangle ecosystem in an effort to create an environment that’s functional, as well as attractive to enterprise and individual users.

Recently, IOTA has been making waves recently by signing major partnerships with Microsoft, Accenture, Bosch, Fujitsu, Samsung, and nearly two-dozen other companies to develop a blockchain solution tied to the Internet of Things (IOT). It has also been reported that the IOTA Foundation has partnered with Cisco, Volkswagen and Samsung around its Data Marketplace.

IOTA aims to provide crucial market data collected through sensors to various companies for a micro fee. As the company gains market share, the MIOTA crypto currency is expected to appreciate in price.

Beyond the partnering companies mentioned above, other partners in the new test data marketplace include Cisco, Orange, Daimler, Accenture, Deustche Telekom, EWE, Tine, PwC, Schneider Electric, DNV GL, and others.

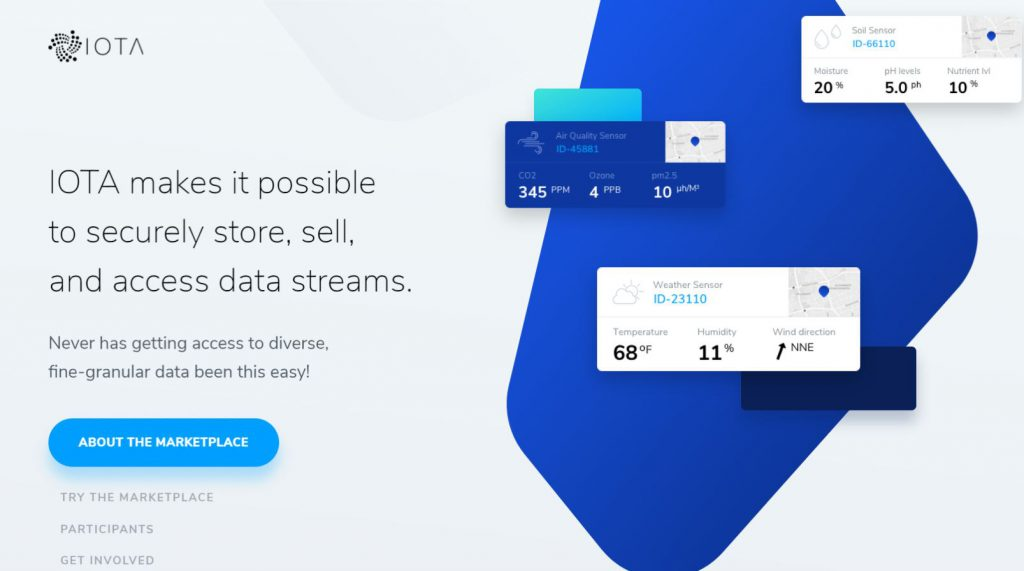

#2 Launch of Data Marketplace

The first publicly accessible data marketplace for the Internet of Things. What makes this undertaking especially intriguing is that the marketplace will be entirely powered by a distributed ledger. It is an ambitious project that has been in the making since 2015. The Data Marketplace is IOTA’s most comprehensive pilot study thus far.

For those who doesn’t know what Data Marketplace is, it is a decentralized data platform to open up the data silos that currently keep data limited to the control of a few entities. Data is one of the most imperative ingredients in the machine economy and the connected world.

The idea of the platform is to enable a future where any connected sensor or device can grab data from an open marketplace, for a micro-fee, to power an application. Smart city sensors, for example, could use environmental data collected via Samsung’s ARTIK sensors to drive IoT-based pollution alerts.

Not only that, connected cars could perhaps tap data from Bosch, the world’s largest automotive part supplier, to get details on a part that appears to be malfunctioning.

The IOTA ecosystem is itself still in beta testing, and the new marketplace is a pilot at this stage.

If IOTA (MIOTA) does scale as the developers claim it will then it will be a huge year for the still relatively unknown altcoin as people will be able to use it as a currency as well as a distributed ledger for the internet of things. That is the primary reason why people are buying IOTA.

Please upvote or resteem this post if you like it.Thanks!

Great post. I've never liked Litecoin, for many reasons, but OMG and IOTA float my boat.

Thanks man.I would appreciate a resteem im new to this and spent a lot of time creating this.Thanks!