Financial Freedom #1 - Financial Planning

Good evening my fellow Steemitians/steemlings/steemates, whatever you guys are comfortable with.

Today I would like to talk about Financial Planning. Preached by many, practiced only by a few. I am sure that there are lots of crypto investors here, and among those investors, there will definitely be some, that are new to the world of investing. If so, you will be glad to have stumbled across my post. It may be simple, but nonetheless important.

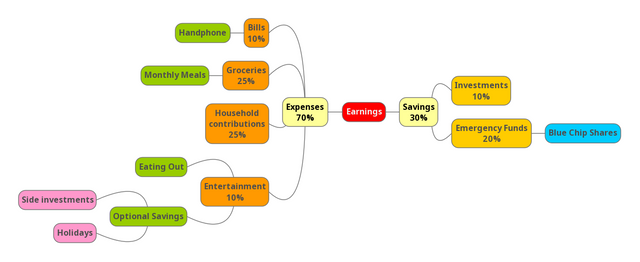

The financial mindmap

For illustrative purposes, you can take one's earnings as $1000 a month. For those who are still schooling like I am, the above mindmap is still very relevant.

As we can all see from the above mindmap, I have separated one's earnings into 2 different categories, Expenses, and Savings. It is then further branched out into several smaller sections.

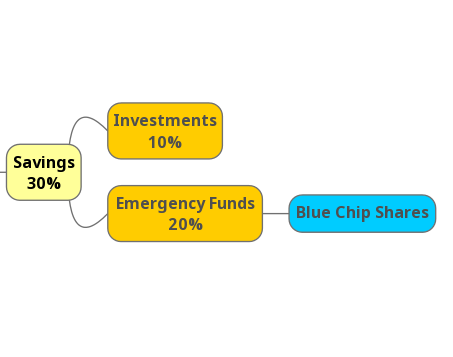

Savings

I like taking 30% of my net earnings out and place them into my savings. As we can see from above, 10% of which goes into investments, while the other 20% goes into my emergency funds.

Investments

Of the 30%, 10% are placed into my Investments every month. Now, these investments could vary with each individual. I have friends, who would use the money and invest in watches that will grow in value overtime. I have friends who would trade Forex and even traditional stocks. Bottomline is, the money should be spent on investment one is familiar with. For me, I'm a sucker for dividends and would place them into blue chip shares, and let it snowball overtime.

Emergency Funds

Now, I can never stress enough how important emergency fund is. Anything can happen these days, and you never know when one would dip into the emergency fund. I personally ensure that the amount of emergency funds I have in my bank could last me up to 6 months. External factors for those with extra responsibilities should also be factored in.

As for me, I invested my emergency funds into blue chip shares that have a higher yield. This way, I am able to grow my fund passively and at the same time beat the yearly inflation rate.

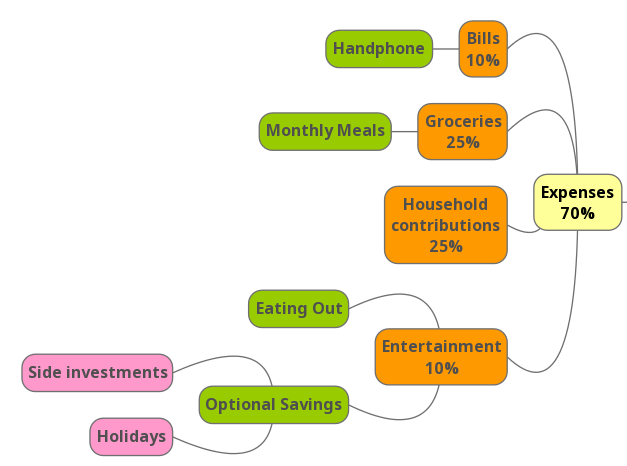

Expenses

Now here comes the fun part. Who doesn't like spending money? I mean we don't work our asses off, only to scrimp and save at the end of the day. But then again, many of us are trapped in the rat race, and without proper planning here, we will never break free from it.

Bills, groceries, and household contributions

Before you starting running about with that stack of cash, throwing them at alcohols, or at the Louis Vuitton x Supreme collection, remember, you still have commitments to attend to. Now, 60% of your expenses on bills, groceries, and household contributions alone may seem excessive. But do remember, we have assumed that one is earning $1000 a month to allow students like us to feel included. Should you be earning much more than that in real life, chances are you wouldn't need to allocate 60% of your expenses here. Which means, you would have more money to either spend on entertainment, or they could go right into your savings.

Entertainment

As we can see from here, I have branched out entertainment into two different parts. Optional savings and eating out. Of course, one is free to further branch entertainment into many different sub sections, like movies, gym member fees, or any others which you deem would fit under entertainment.

I will focus more on the optional savings part. Imagining yourself sun-tanning on the sandy beach, while attractive males and females run about playing beach volleyball? All these go under what we optional savings. These are money that spent within your means, and you should never ever borrow money or dip into your savings for such expenses.

For me, I used the money for side investments. True, I may not be able to enjoy that glass of mojito with my girlfriend at the beach, while looking at the sun set, but I do know that few years down the road, the choices I have made today, would allow me and my girlfriend to live comfortably in that three story terrace house with an infinite pool, and having attractive males and females feeding us grapes, while we play with our fidget spinners in the hot tub. Sorry to digress, but for me, I used the remaining amount I have left, and invested them into my crypto investments. That's right, I only touch the money under expenses to dabble with cryptocurrencies.

Comparing crypto investing and investing in traditional stocks, cryptocurrency is a fairly new market, which has only started to gain more attention from the public. Easily manipulated, with a very volatile market. Therefore, I only placed money into it, with money that I can afford to lose.

I would love to touch on some of my crypto strategies, but I prefer to leave that for another post. I don't want to bore my readers after all. With that, I appreciate that you have taken some of your time off and read all the way till the last word.

Do note that the above should only be taken for one's reference, as different people may have different income/responsibilities/living expenses. This is in no way a professional advice.

Thank you.

Signing off,

Jake

Congratulations @jakeglengin! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP