Recap on Past Few Months in Crytpo and My thoughts on it

Photo courtesy of 10XTS

Investing in cryptoassets is risky, be sure to read the disclaimer at the bottom and only invest what you can afford to lose! And for the love of god, don't use leverage if you don't know what you are doing!

This is Just a Collection of My Thoughts

It's been about two months since I've posted on here and about six weeks since my last article released. Not writing much lately got me itching to write again, so I just started typing away here. This article is kind of general and me just unloading my thoughts onto the inter-web. Although a relatively new habit for me (started in July 2017), writing was something that let me express my thoughts on topics, specifically crytpo and finance.

I've still been very active on my Twitter & Instagram, posting daily content there.

My goal since I started was to help people understand cryptocurrency, blockchain, finance, and more. Obviously a lot of people jumped on the crypto train this past year and many got "rekted" in the process. Part of this is because of greed and part is because of lack of trading experience. Every investor is a trader, always keep that in mind when you invest.

We saw the scams and the last second crypto bandwagon people hop on the train in November and December. Some of the videos I was seeing on Youtube were just pitiful, with people from all walks of life offering investment advice on cryptocurrencies. These kids in the video linked above probably couldn't explain the difference to me between Proof of Work and Proof of Stake.

The point is, after this correction, many of these shills and scams were exposed, like a vampire to sunlight. I couldn't have been happier watching the likes of Bitconnect, USI Tech, and others folding in on themselves. All the bandwagon cryptoers were shocked to see the sudden crash in prices. "How could this be? Everything was going up in December, it must keep going up!?"

"In a bull market, everyone is a genius. But a bear market reveals who's got what it takes to achieve long-term success — and who doesn't."

-Unknown ( I believe Charlie Munger said this quote, but I couldn't find anything linking him to it.)

Sure it felt great to be right on all the calls I had from the summer when they finally came to fruition, but I knew it was only because I was able to seek out the trend.The trend is your friend. The trend then was bullish, and I could see it, even if others couldn't. Celebrities shilling ICOs, more main stream media appearances for Bitcoin, and general enthusiasm was increasing.

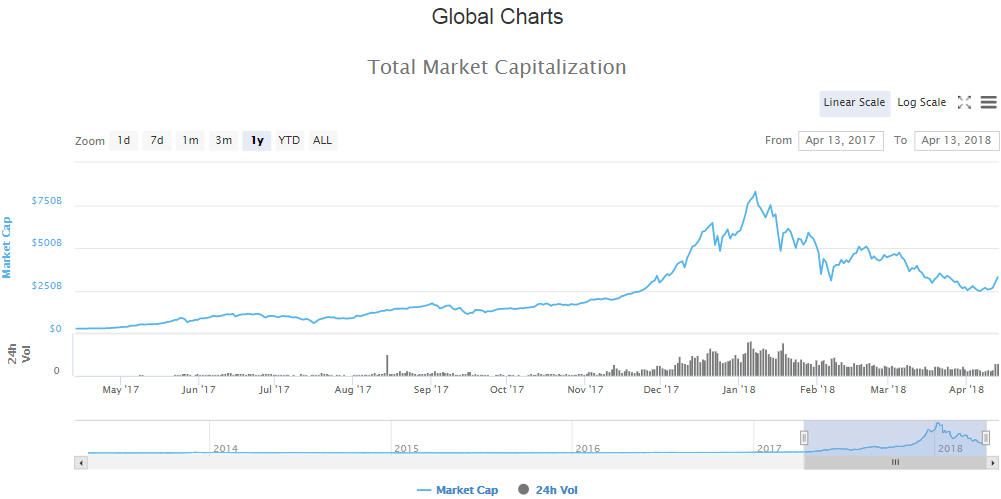

I never would've thought that from the July total cryptocurrency market cap low around $60 billion that we would be at $+825 billion by the first week of January, a mere six months later.

Wrong. Keep in mind the recent events of November and December for the next bull market cycle (likely starting now, and will run May, June, possibly peak in July.)

Unlike others (despite my lack of articles), I've worked on improving myself for the next run. Reading white papers, books, blog posts, working on trading strategies, because there will be another cycle like December shortly. What goes down fast, will come back up just as fast. With all coins retracing 70-90% from their all time highs in December & January, we are near or at the bottom. This is where you make long bets. It's going to be painful sitting in a position that is red for a few days, weeks, or months, but when it pumps you'll know why you held that position.

If there is something you can learn from the last bull run and recent bear market, is that no one on main stream media (CNBC, FOX, CNN, etc.) has a clue what they are talking about when it comes to Bitcoin. They laugh at it like it's magic internet money and don't grasp how big this is. Don't believe this has happened before, just look up videos of talks shows and news discussing the internet in the mid-1990's. It's hard to explain the scale of this to the everyday person who could care less about Bitcoin and altcoins themselves. I've been trying to tell this to people for the past year.

I am clearly by no means a "crypto OG." I've been following the space for a year now and it is pretty much my life. It has fundamentally altered the course of my life, stumbling upon Bitcoin and giving it a serious look was one of the best decisions I've ever made. Previous to coming into crypto, I was really spending a lot of time studying financial markets. I have a passion for them and they are so important to our society, whether we like it or not.

Security

I can't emphasize enough how important it is to make sure that you are doing the proper protocols when it comes to storing coins. Over the past year I have become a freak when it comes to security. I use Two-Factor Authentication (2FA) for all my crypto related accounts. It is so necessary. If you realize how easy it is to brute force hack an account, then you realize that an email/user ID and password will not protect you that well. I recommend DUO mobile for 2FA, I personally have used it for a year and it's phenomenal.

Emails, emails, emails. Make yourself separate email accounts for your crypto related business. It makes it harder for hackers to get access to your account if they don't know what email you use. Don't use a personal or business email that is widely available. Take five minutes out of your day and make a new gmail account.

When it comes to passwords, never use the same passwords for different accounts. If there is a data breach to one account, all your accounts become accessible. That is no bueno when those accounts have crypto in them.

Make sure to save and write down all passwords and pertinent information. I have multiple hard copies of my info on paper to make sure that I'm not in trouble if my laptop is stolen. Speaking of which, you should keep passwords, secret keys, and other info off your computer. It's alright to throw it on a USB stick or external hard drive, but keep it off your computer.

Storing your crypto safely is something that should not be taken lightly. Treat your private keys like the "football" used by the US President, which gives him access to the nuclear codes. Write them down on paper. I always recommend cold storage (cold storage = wallet that has no internet access to it in the strictest form) like hardware wallets and paper wallets for long term holds. If it's trading money, then it's alright to have a little on an exchange, just keep in mind, you don't own your coins on a centralized exchange.

If you have the private keys, you OWN the coins. If you don't have the private keys, you DO NOT OWN the coins.

Hot wallets are wallets that can be accessed via the internet. Examples include desktop wallets, mobile wallets, MyEtherWallet, Exodus, etc. Mobile wallets are no doubt the future of cryptoassets. It is an easy way to move your coins around and not have to worry about carrying a Trezor or Ledger Nano S.

Where We Are Heading

This was something I tended to talk about last summer/fall when the bull trend was kicking in high gear. We saw a blowoff top in December. When you look at a chart you can see the parabolic advances across the entire crypto market itself. Lots of new buyers coming in to buy the "next Bitcoin" (don't fall for this. There is no "next Bitcoin", there is just Bitcoin and a bunch of shitcoins.)

Many people were panicking after the large sell offs in January and February. The texts I got were hilarious and showed the close mindedness of many people with their ability to observe out past the horizon. Sure, short term things were not looking pretty. But for me, I was happier than ever, because now I could scoop a bunch of altcoins on major discounts at the bottom of their cycles.

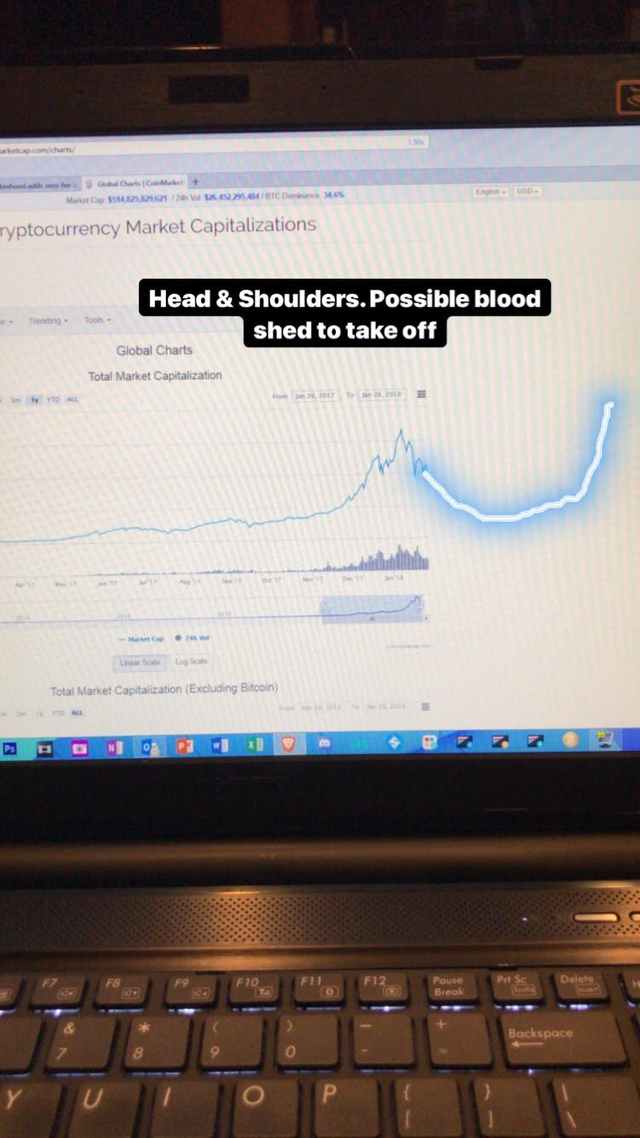

Here is a chart I drew with my finger on Instagram over top of the Coin Market Cap global crypto market cap chart on January 26th, 2018.

That was why I was not worried. Everyone's running around, blood is all over the streets. Developers are all still working, Lightning Network Beta had come out, yet people thought it was the end of the world.

Not bad for finger chart.

This next push will likely push us through the trillion dollar mark. The cryptocurrency market cap peaked around $830 billion, so it won't be a shocker to see us push through that barrier.

This is scary for nation states and central banks. Why? Separation of State & Money.

This may seem like a crazy concept (I could write a whole book on this, but I'm going to try to keep it brief here), because in the past hundred years, countries have controlled the monetary systems very tightly. What you see from this is abuse, misappropriates, bubbles, lack of transparency, and many other bad things. But when you look back over a long period of time, you realize central banking is this new experiment that has been around for only a hundred years and is likely to lose control during the 21st century. The central banking system itself is archaic, and is no way ready to handle four billion people that still lack access to the financial system and then the other two billion that are under banked. Many people take for granted the fact they can open a bank account and have access to the financial system. We don't think about how lucky we are to have access to the NYSE, NASDAQ, FTSE, etc. from the comfort of our home on our laptop.

Bitcoin is unbanking us. Why try and struggle to expand the already archaic legacy banking system. You are the bank with Bitcoin. Bitcoin works with transactions large and small and does not recognize the difference. It's dumb. It doesn't know if you are black, white, old, young, rich, or poor. It just follows through with transactions and when a transaction is settled, it's settled. No reversals or failures to go through.

Any kid under the age of 13 will have no memory of a time when Bitcoin did not exist (the earliest memories start around three and recent studies show most don't remember much before the age of seven, a phenomenon known as childhood amnesia.) Keep this in mind. For these kids, Bitcoin and other digital assets are a norm. They will be asking their parents and grandparents about these grandiose banks they use to go to where they deposited checks and handled their financials from. It will seem so foreign to these kids who can access Bitcoin from anywhere and store their coins in a hardware wallet for safety.

Wake up & smell the roses. Changes are coming, whether you like it or not.

Think about how much separation of Church & State changed countries. Citizens went from obeying the ruling class, the people who were supposedly given divine right (cough* cough* bullshit) to rule everyone in their region or where ever they decided to draw arbitrary lines on a map. This was a radically new idea then, separating the two, and it was part of the cause and outcome of both the American and French revolutions during the late 1700's.

Why not give everyone access?

With Bitcoin, anyone with internet access becomes a bank. (technically, you could send transactions over short-wave radio, so in the case of no access to internet, the Bitcoin network could still work. Just like the French Partisans did in World War 2 with the short-wave radios the Allies dropped behind Axis lines. You basically bounce radio waves off the stratosphere, in the WW2 case, it was done using Morse Code. Bitcoin is programmable money and as long as you have an encoder/decoder, you can send transactions through any messaging platform on the internet [Skype, Facebook, forums, Reddit, in the comment section on YouTube, etc.])

So now you understand why this is so big. Talent from Wall Street to Silicon Valley are quitting their jobs to work in the crypto industry. There is a reason, this will alter the way we do money.

Tech Adoption

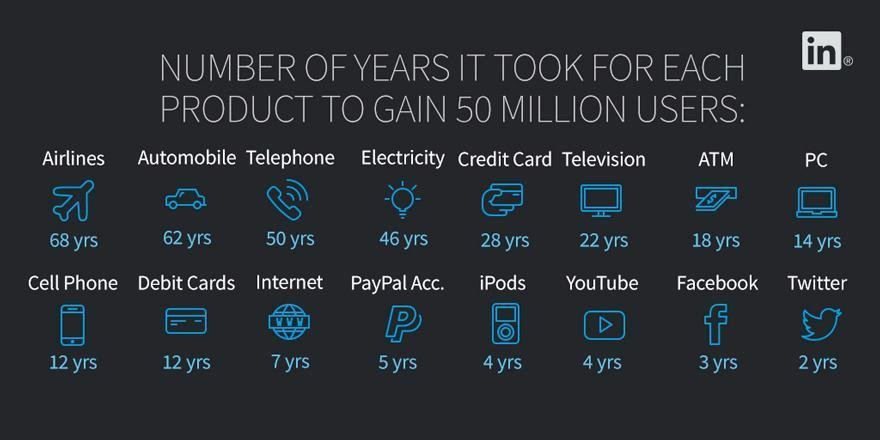

Do you notice the trend here?

Time for tech adoption has been decreasing over time, especially since the advent of the internet. With the free flow of information, people hear about and discuss things in real time.

Now think about crytpoassets. There is a lot of speculation, but there are also some of the most brilliant minds and developers looking to solve some of the worlds greatest problems. As I stated earlier, top talent from all industries are flocking to crypto. There's a reason, it's the next "big thing".

Predictions

I originally stated back in the fall that I was confident we will hit a trillion dollar market cap by December 2018, I still stand firmly by that call.

As things picked up in late November into December, I said that we could hit a trillion by March 2018, which was obviously wrong. We got too parabolic and the wheels fell of the train.

Considering the FOMO (Fear Of Missing Out) many are experiencing as they watch crypto prices double over night in altcoins is growing. Just like the last cycle, money will pile in as they see more gains (which is not how you should trade. Always think buy blood, sell greed.)

What's your guys prediction for the total cryptocurrency market cap by December 2018? Post in the comments below!

If you liked this content, please upvote, comment, share, and resteem it!

Follow me @investoranalysis

Follow me on Twitter @Brett_Kotas to stay up to date with the crypto scene.

Follow me on Instagram @crypto_coitas to keep up to date on crypto.

Thanks!

Check out my website and my Contributor site, Influencive.

Disclaimer: The views expressed in this article are solely the author or analysts and do not represent the opinions of the author on whether to to buy, sell or hold shares of a particular cryptocurrency, cryptographic asset, stock or other investment vehicle. Individuals should understand the risks of trading and investing and consider consulting with a professional. Various factors can influence the opinion of the analyst as well as the cited material. Investors should conduct their own research independent of this article before purchasing any assets. Past performance is no guarantee of future price appreciation.

Excellent article, you have a great blog! I followed you, I hope you will follow me. I'm interested in this direction as well as you, let's develop Steemit together.

Thank you very much! I put a lot of time into these. Always trying to provide top tier content.

Just tossed you a follow as well.

Congratulations @investoranalysis! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes