FLO, tZERO, and how the DLR aims to disrupt.

On January 10, 2019, tZERO is slated to go live. In August, I published a detailed analysis of the connection between tZERO and an obscure blockchain known as FLO. With the launch of tZERO just under one month away, it should be readily apparent to all that tZERO intends to go live with FLO serving as the back end for the Digital Locate Receipt.So why FLO? Two FLO lead devs offered some reasons in the FLO telegram channel:

Bitspill: FLO is out now and works, versus these new chains “developing”

Joseph Fiscella: It’s for a number of reasons:

1. floData is accessible and easy to read. You don’t need to decompile a smart contract or have a special software to read it. It’s in plaintext on the chain. This helps with auditing and explaining how it works to regulators. Any extra steps are a barrier to adoption.

2. floData is easy to write. It is appended to the blockchain using a simple RPC command. This makes maintaining the software around the solution less costly.

3. FLO is a fairly launched blockchain with no premine or ICO. Again, this helps for practical regulatory reasons, but also is a philosophical choice made by those who maintain the software. It guides the decision making for our software and also allows those implementing it to check off a box they couldn’t check using another chain without those features.

4. FLO is secured by proof of work. This is arguably the best security a network can get, requiring actual buy in of physical devices and constant operational cost in both manpower and electric power.

5. FLO has open source software built on top of it (OIP) that can be used for building more advanced applications (this is how etdb.caltech.edu became a thing).

And here’s a video of tZERO board member Bruce Fenton confirming at 01:30:38 that Overstock donates money to FLO development.It would make no sense to abruptly switch to another blockchain, as opposed to using the one that they have been building on since January 24, 2018. Some have speculated that FLO is nothing more than a “test network.” FLO has been “tested.” Now it is being “used.” It is the network that tZERO uses to register DLRs. In fact, the FLO based DLR is ALREADY seeing commercial use, which will be further elaborated on in the next section of this piece. tZERO publishes hundreds of DLRs each day the market is open, and has been doing so for many months. This can be verified by examining the floData.

Execution Report: SOI(5049) STI(12504) Broker(817) Account(010508GEBR) Time(12/12/2018 09:47:52.919) Side(Buy) Symbol(MLSS.DLR) Qty(2000) Price(0.01250) OrderType(Limit) TimeInForce(IOC)

That said, it’s time to do a deep dive into the Digital Locate Receipt, examine why it is necessary, how it works, and what implications it has for disrupting the wall-street status-quo.

The Naked Short

In order to fully grasp what the DLR does, it’s necessary to have a rudimentary understanding of Naked Shorting, and Regulation SHO. Simply put, naked shorting is when a short sell occurs without a stock to back up the short. A crude example of this, would be a stock that has 100 shares. A big banker doesn’t like the owner of the company, so he sells short 120 shares. This cripples the stock price. How can this happen when there are only 100 shares to short? Well, the current system gives the banker 3 days after the short sale to locate stocks to borrow. He could locate 40 shares on day 1 and borrow them. Then the owner could sell those stocks to someone else. On day 2, the banker locates the new owner and borrows those 40 again. Now he’s located 80 shares, even though he only put his hands on 40. This behavior can produce irregularities in pricing and liquidity, opening the door for manipulation, and making it easy for insiders to play the market unfairly. Patrick Byrne has always been an outspoken critic of this, and his entire reasoning behind creating tZERO was to bring trust and transparency back to the financial markets.

How Does It Work?

In the present system of stock lending and settlement, if you own a share of Apple stock, that stock sits in your brokerage account. When another person wants to short Apple, your brokerage will lend the stock to them, often collecting exorbitant daily interest rates, which are represented in APR. Brokerages currently make roughly $19.2M per day by lending out their client’s stock, while simultaneously providing archaic, 20th century type service.

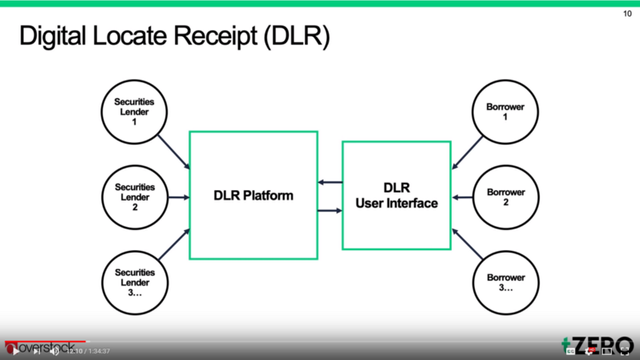

Per Overstock Q4 Earnings Call — Slide 10

The FLO based DLR technology matches lenders with borrowers, and allows for share owners to set the price at which they are willing to lend to short sellers. Conversely, it also allows for short sellers to make bids on the price at which they are willing to pay to borrow those shares. The net result, is the creation of a marketplace for the lending of shares under the umbrella of short selling.Consider for a moment, the opportunity made available to pension funds, retirement accounts, or investment firms. These institutions often hold their shares for decades. They are now able to enter into this newly created marketplace and put their holdings to work. These institutions gain the ability to designate a price to lend out their shares to short sellers and earn extra income, rather than have their broker do it behind their back and keep all the profit. Conversely, think about short sellers. They no longer have to pay the price that is mandated by a brokerage and isn’t transparent. This new marketplace allows for price discovery and a more fair price that short sellers will pay to go short on a stock.By leveraging the immutable and permissionless nature of the blockchain, the DLRs published leave no room for the possibility of naked short selling. For the first time, there is zero question as to whether a share is in possession or not, and that is thanks to the DLR technology and the FLO blockchain.

OSTK Q4 Earnings Call

In early November, two Overstock events took place. The first, is the Nov 8 Overstock earnings call.

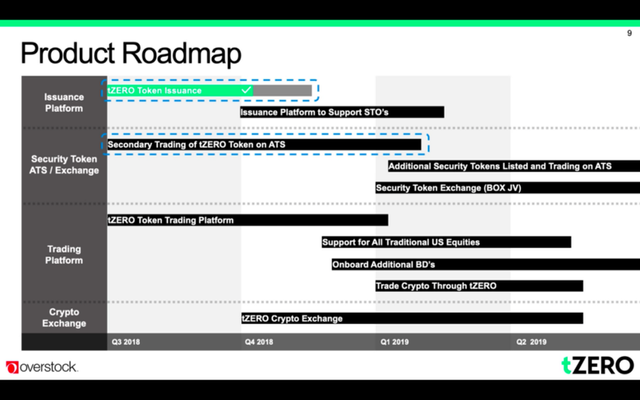

tZERO Product Roadmap

The security token and tZERO roadmap (pictured above) were important in giving an idea of just how close tZERO is to launching, but by far the biggest highlight was the specific attention given to the DLR. The DLR section of the quarterly earnings call video runs from 11:17 to 12:07. The speaker, a senior executive at Overstock, states:

Our blockchain based DLR technology matches securities lenders with securities borrowers, as it allows inventory providers to set offer prices for their long inventory, and borrowers to bid for this inventory. This product is still in beta testing. We have a stock loan commission sharing agreement between stock-cross and our broker dealer, Speedroute, and as such, Speedroute revenues from stock loans have grown 5–6x since the beginning of the year. So nice progress on revenue growth with this platform. We’re also currently ramping up the resources to scale this business and move it out of beta for wider adoption.

Simply put, that is pretty significant. This not only confirms that the DLR is already seeing commercial use on the FLO blockchain, but also that it is generating significant revenue, before tZERO even launches and the DLR is scaled to market. The potential profitability of the DLR was further hammered home during the Overstock Investor Day event.

2018 Investor Day Event

I’d like to preface the next part, by stating that unfortunately I am unable to provide a hard source on what was stated at the Investor Day event, as Overstock has yet to upload a recording or a transcript. This event was not private, and was in fact open to all on their investor relations website. I have emailed Overstock investor relations, but I have not yet heard anything back. As soon as Overstock provides a recording or transcript of the event, this article will be updated to reflect it. Until then, I can’t blame you for being somewhat skeptical of this portion. I was one of the fortunate individuals to listen to it live. (If anyone happens to have a recording, feel free to contact me!)During the Investor Day Conference Call that took place on Nov 13, CEO Patrick Byrne noted a view things. First, is that there are multiple pension funds lined up to lend their stocks using tZERO and the DLR (FLO) technology. He proceeded to state that they will be fully on-boarded and operational by March of 2019. Byrne also indicated that he has overheard from some of these pension funds, that they are effectively being threatened by big banks, stating “if you use tZERO, we aren’t going to let you bank with us anymore.” This is not the first time that Patrick Byrne has spoken publicly on the disruption potential in securities lending that tZERO seeks to capitalize on.Also of major relevance to the DLR/FLO, was when Patrick Byrne went into the 5 major contributing factors to the $1.5B tZERO valuation. For reference, the valuation of $1.5B stems from the announcement back in August that the private-equity firm GSR Capital is investing $404M into tZERO, at a $1.5B valuation. Patrick Byrne stated these 5 factors as:

1. Issuance

2. Exchange (ATS and Security Tokens)

3. Trading Platform (retail broker dealer)

4. DLR

5. Crypto Exchange

Byrne went on to state, “If any one of these 5 ends up working, it alone will justify the valuation of $1.5 billion.” In essence, based on Overstock’s internal projections, the DLR technology alone justifies a $1.5B valuation if successful. How could GSR and OSTK come to an agreement which values tZERO at $1.5B before the platform is even launched? Well, let’s dive deeper.I also strongly urge you to read the first two sections of this 2015 WIRED interview with Patrick Byrne before continuing forward. It will help you understand the full concept of DLRs, tZERO, and FLO’s role.

The Disruptive Potential

Take a look at these four quotes from the WIRED interview:

We’re taking a market that’s in the dark,” Byrne says, “and we’re putting it on an exchange.

It’s a market controlled by a relatively small group of players, most notably the prime brokers.

The agent lenders alone make about $19.2 million a day

[Patrick] wants to break the hold of the agent lenders and prime brokers, arguing that, as it stands, they make untold amounts of money from the loan market without giving stock holders their proper share.

By leveraging the immutable and transparent nature of the FLO blockchain, tZERO aims to illuminate a market that has historically been “in the dark”, and controlled by a relatively small group of players that are very rarely held accountable. tZERO intends to provide market participants with a much fairer deal, while simultaneously providing settlement services built for the 21st century. These rogue lenders profit to the tune of over $19M per day, or just over $7B per year. If tZERO DLRs on the FLO blockchain are able to capture even 10% of that market, they reap a profit of over $700M per year exclusively from the DLR. Referencing the $1.5B valuation above, a company that generates $700M in profit per year has absolutely no issue justifying a $1.5B valuation.

Future Growth

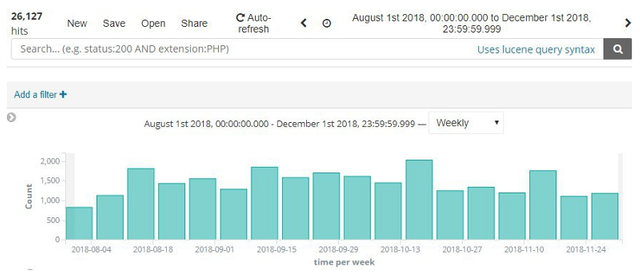

From August 1 to December 1 tZERO has posted between 1500–2000 DLR’s per week on FLO blockchain.

As exciting as the numbers and projections around the DLR and FLO may be, it’s important to have at least a basic understanding of how the technology actually works, and the current problems it is built to address. In a space recently defined by overvalued blockchains lacking functional products, it only seems right to dive into the tech behind one of the few with real substance, and revenue generating applications.

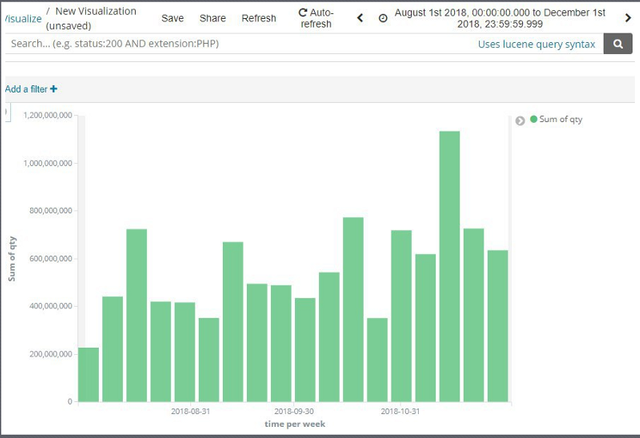

The present quantity of stocks traded per week based on published DLRs

From August 1 to December 1, tZERO registered roughly 400M stocks per week using DLRs on the FLO blockchain. These are real, actual stock receipts changing hands. Remember, that each DLR can register any quantity of a stock, and that this chart is strictly quantity of stocks. The price of each stock is not considered. Additionally, four types of DLRs are posted to the chain. The four types are: inventoryPosted (Security Lender Offering their Security), ClientInterest (Borrowers making bids), ExecutionReport (Completed trade), and Cancel (Cancel of an offer or a bid).On Jan 10, less than one month from now, tZERO is set to go live. The DLR technology built on top of the FLO blockchain, is theoretically worth $1.5Balone, without factoring in any of the other elements of tZERO. A blockchain with a $1.5B application actively running on it, has a current market capitalization of $3.8M. This is a blockchain that had the investment firm GSR commit to invest $404M in Overstock for part ownership of tZERO, the project that builds on top of FLO. That $3.8M valuation seems incredibly low for a project with a real use case, and a functional application built on it that is actively generating revenue, but that’s just my two cents…

*The information presented here does not constitute financial advice and is merely my personal opinion. In the spirit of full disclosure, I do currently have FLO in my portfolio, which was a decision made after doing ample research.

Link to the original article: https://medium.com/@valueprop/flo-tzero-and-how-the-dlr-aims-to-disrupt-5bd34634f928

Congratulations @indoline! You received a personal award!

Click here to view your Board

Congratulations @indoline! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPHello @indoline! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko

Congratulations @indoline! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!