Bitmex Internal Trading Desk - A Serious Conflict Of Interest?

Did you know that Bitmex has its own trading team for market-making, that trades for profit against its customers?

Did you know that mostly all retail brokers implement this strategy?

Furthermore, did you know that under the hood, Bitmex uses a index created via a price taken from Bitstamp and GDAX so moving the underlying is invisible to Bitmex orders?

First of all - just to clarify things before we begin. The price you see on Bitmex is not dictated by your trades, but rather by the movements on Bitstamp and GDAX, weighted 50/50 between the two, designed to try and give some allure of fairness to the unwitting public.

It still stuns me that most retail traders just don’t know that Bitmex is actively market making against them.

Yes that’s right - creating a market by taking the other side of the trade is common practice for retail brokers, and in this unregulated world it’s really no problem to spoof order, and manipulate the order book of the underlying on Bitstamp and GDAX to great gain on Bitmex.

This is due to the way the XBT contract works and how much smaller volume it requires to affect its market.

The only saving grace is if this was a conventional equity retail broker, this news would be one huge big shit hitting the fan, due to the industries strict regulation.

Since cryptocurrency is still very much a wild west, are Bitmex abusing their power in the retail sector?

Will the SEC sheriff ever catch them, or is there already a growing bounty on their heads?

Do 95% of Traders Really Lose Money?

We all know the old adage, 95% of traders lose money. Well is it true?

IG one of the UK’s largest retail brokers, regulated by the FCA (UK’s Financial Conduct Authority) - provides detailed information, by law, on the percentage of winning traders on their platform.

Official reports from IG state that it’s not quite as high as 95%, although a whopping 78% of clients do loose money.

This means that in nearly 8 out of 10 trades, the money went into IG’s pockets.

Now you can see why being the broker is so profitable, and how they managed to sponsor Spanish and Australian football teams in the past.

After all IG produced annual net income of £169 million in 2017.

We also know that binary options cost the average trader £23,000 in loss in 2015 before the FCA stepped in.

We know also that since 2015 the FCA has been working more actively to protect retail investors, for instance when they worked with the UK’s Ombudsman to return losses to traders, that were stuck in a fast moving swissy (CHF) forex trade that they could not get out from, as attempts to close the trade were not executed due to extreme market conditions.

Well what is the FCA doing for crypto traders using Bitmex? Currently, nothing.

Because Bitmex falls in a grey area, outside of the remit of the FCA and also presently outside of the US equivalents SEC and FINRA.

Although the ex-wall street guys at Bitmex are no dummies and know how to play with fire, if you are found to be a US Citizen, you will be permabanned from the service without question.

For example American Youtube pundit, Tone Vays, found the hard way when his Bitmex account was blocked due to Bitmex discovering he was an American citizen. Despite logging in from outside of the US.

Many other US traders have experienced the same, so using a VPN is common practice.

This loophole enables US citizens to trade on Bitmex, although should we be more wary as to why this exchange has a problem with the US?

The United States has one of the most regulated financial jurisdictions in the world, with a plethora of acronym agencies that look out for the investors rights to a free market.

There is a reason high leveraged contract for difference (CFD) trading is illegal in the US, the play is just not considered a fair game.

Leverage is capped to 3x in the states, where as in the UK and Europe, only until MIFID II came into place in the last couple years - traders were able to access 3000x leverage with such small margin requirements, margin call (what Bitmex refers to as liquidation) was an inevitable outcome.

Although now since the changes, margin requirements have been raised considerably and leverage is capped at 200x to protect retail investors from what was described after the audits as a provably highly unfair trading environment in which risks outweigh the benefits by default.

The US is a country with some of the largest casinos on earth, featuring a sprawling neon metropolis dedicated to gambling in the heart of the desert.

So why doesn’t Bitmex want to be more involved with the gaming community?

Is it because they feel they are not a gamble, and rather a institutional grade futures trading platform?

If that’s the case, then why does it feel like such a casino? Retail traders often go all in and get rekt. It’s clearly a high risk investment vehicle.

With the largest mercantile futures clearance houses, allowing traders to take positions on anything including weather - Why don’t Bitmex have offices open in the US?

Is it because they are worried about what rocks may be turned over, and the ugly truth that lurks beneath?

The Bitmex Trading Desk

Internally operating inside the beast that is Bitmex - is a fully manned trading desk, working essentially as a covert subsidiary which can monitor the entire order book, as they have direct API / Backend server access and are employees of the company, so are privy to any dark pool data.

Although Bitmex are very clever with their wording, stating Bitmex "doesn’t offer 'special access to anyone,' and doesn’t trade against its customers, it also doesn’t make money when customer trades are liquidated," Bitmex CEO Arthur Hayes told Yahoo Finance.

Although exactly how can this be possible when the firm clearly does profit in fees and from counter trades?

"They are a customer too," Hayes said, referring to the firm's internal market-making desk. "It is treated like any other account." Except in reality it’s not just any other account, it’s the firm's own money on the line, and there’s the rub.

So for sure, I do not debate it - they trade like any other account on the platform right, he’s not lying. How else can you trade, everyone has the same order book sitting in front of them. Same user interface.

Except the difference here is a huge budget, enough that they can trade on the underlying. So they don’t profit from liquidation? I guess that could be said as in not directly, but there is profit in fees and from their own trades.

Silver tongued Frmr Citigroup trader, Bitmex CEO Arthur Hayes

Not only should this make you wince, but please keep reading. It doesn’t stop there.

You open long, they open short. Ok, well doesn’t matter right, the market is on a weighted index across two exchanges and Bitmex is just following that indexed price, everything is fair and square.

Wrong. This is the perfect situation for manipulation, Bitmex traders can sit on the indexed underlying assets and move those books.

Just look at the volume difference between Bitmex and Bitstamp / GDAX. Bitmex dwarfs the volume of exchanges, and has a huge liquidity to play with.

There is no reason they cannot affect these other markets that make up the index. After all it’s in their best interest to do so. Bitmex will have to close it’s doors if they were losing.

If Bitmex traders wish to move the price by 10% and execute every liquidation level they can, making a huge red list on bitmex rekts.

They can do so, not by moving the Bitmex order book, but by moving the underlying.

So you actually need to monitor the order books of the index exchanges of Bitstamp and GDAX, NOT Bitmex if you wish to have any clue as to what the fuck is going on.

Because Bitmex price is reflective of those indexes, not of what traders are doing on the platform.

Getting Rekt

This first misconception about the ‘advanced’ trading interface Bitmex offers, is most probably intentional so that newbies, and even advanced traders alike - believe the setup is fair, and that they are just unlucky on that trade.

If you wish to open a futures account with your bank or CBOE, you will have margin requirements that are overly clear and a entry hurdle for many retail investors. They won't buy a futures contract because they need such a large deposit in the account.

But Bitmex imposes no such margin requirements although it has a deleveraging system that apparently looks out for your best interests by closing you out before margin call automatically.

Deleveraging as in a auto margin call for people who don’t understand how margin works and over traded.

Instead of putting the industry accepted protections, they will take care of it for you. How Lovely.

“...They don't want us to be able to trade man, I mean have you ever seen that reptilian eye on the dollar bill, I mean it’s the 1% bro.. Sssh did you hear that click? they are listening to us right now. Come on go long 100x and lets fly these lambos to the fucking moon and get away from these bastards.. Buy the fucking dip.. use that credit card, fuck fiat....it will never go below this level again...man i’m FOMOing so fucking hard right now...”

Due to the easy access of Bitmex some feel the door is open to everyone in this wonderful age of Aquarius - where we sing and dance in unity and hold hands in a great big circle where everyone profits, whilst vomiting rainbows and pissing pure gold on the streets.

I’m sure you’ve met him - the guy who tells you on Bitmex we are free from those evil dark overlords, the regulating bastards of the conventional grey world!

...Something something, huge conspiracy for a one world currency, something something, 10,000x returns….

Oh what’s that? I’m liquidated. Ah well, try again

How social media expert traders tell me Bitmex works, 60 percent of the time, every time. Also remember to click like and subscribe guys, and turn on the bell notifications, oh and please, please, please use my link if your signing up to bitmex...

The truth really is hidden in plain sight, if you are wily enough to decipher it, if we take a direct quote from the Bitmex documentation it’s clear as day what’s going on here.

Be design we are getting royally shafted.

A trader goes long 100 XBT of XBTUSD at a price of 600 USD. He is long 100 XBT * 600 USD = 60,000 contracts. A few days later the price of the contract increases to 700 USD.

The trader’s profit will be: 60,000 * 1 * (1/600 - 1/700) = 14.286 XBT

If the price had in fact dropped to 500 USD, the trader’s loss would have been: 60,000 * 1 * (1/600 - 1/500) = -20 XBT. The loss is greater because of the inverse and non-linear nature of the contract. Conversely, if the trader was short then the trader’s profit would be greater if the price moved down than the loss if it moved up.

Source: https://www.bitmex.com/app/seriesGuide/XBT

Remove the fancy wording, in plain english.

Profit is 14, Loss is 20.

The odds are stacked against you.

That means for every loss trade you will need 1.4 profitable trades to breakeven.

What it looks like when $34mln worth of shorts are being liquidated

So even conservative trading with a limited risk exposure has to outperform by a factor of nearly a trade and a half. What the fuckity fuck?

They end their statement with the light at the end of the tunnel, that if inversely, you were trading in the correct direction then the traders profit is greater also.

Although we know what happens with fees and slippage, and could not verify this to be true in the wild for modest moves under 10%, for larger moves yes, we could stop in profit.

Albeit with heavy hidden fees if using market orders that ate into the realised p&l. Using stop limits, are often not executed and then cancelled, this is all done by design and perfectly normal.

So unless the market is trending strongly, statistically you will be unprofitable more often than not in consolidating range bound markets, like we have had for a lot of of the past year. Just because of fee structure and the 1.4 ratio.

To rationalise these odds - it’s impossible to enter a coin flip on bitmex, because Bitmex owns 60% of the side you are betting on due to fees and just how it works. You are betting on half a coin flip. Huh?

So you're flipping a coin, and getting to take just under half of the winning side... Nice.

Statistically speaking, you would be better trading at Bitfinex, Poloniex or even using a CFD that has spread. Not to say collusion doesn't happen there also, but just from a mathematical standpoint, even with spread you have a fairer probability.

I’m not vouching for any exchange or saying there are not other problems abound, just stating the statistical probabilities.

On Bitmex - The only profit you will find to capitalise on comes when there are large extensions in price moves by more than approximately 10%, but this is few and far between in the present market.

Hodl me, if I hodl you?

Holding a position on bitmex really is not a viable strategy as the swap fees will be charged every 8 hours, so people get in an out before these funding times, causing a profitable trade in itself to be around when the funding expires and catch the volatility.

Like it or not - Bitmex wants your chips. They are sitting across from the table, mouth watering. Trying to catch a little retail fishy. And man oh man, do they catch quite the haul!

Just follow Big rekts for a couple days and take a good hard look at it. The sheer amount of liquidations is fucking mind boggling. I cannot imagine the feeling these traders have when they are liquidated out of literally millions of contracts day after day, again and again.

If you have lost your shirt on Bitmex, I’d love to hear from you. I know one trader who lost 10 BTC just due to a simple order mistake he’d made late at night.

There are no precautions, no warnings or alerts that protect the investors. Ultimately they just want your satoshi, and that’s obvious.

So you are long, they are short.

They can see your stop loss.

They can move the underlying.

None of this is regulated and we have no bloody idea how many traders won or lost in the past on Bitmex. Although we can see this wild list of liquidations on twitter and put two and two together.

All we know is, their business model is hugely profitable, they are not going out of business and the founder swans around in front of US audiences on Bloomberg and CNBC cameras like everything is grand.

All while never disclosing anything.

We present to you the Rekticator 2000, Complete with bleeding eyes.

In the eyes of many it’s a ingeniously executed successful business, but does the success come at the cost of respect?

Do you think this market practice is a grand achievement?

Do you feel comfortable trading on an exchange that avoids regulation, purposefully makes markets covertly of its members knowledge and clearly isn’t satisfied by its outlandish fees alone.

A sour taste is left in the mouth of anyone who finds these home truths about Bitmex. I think you can see why institutions don't use it, and why it’s not cool with having US traders on it’s books.

“There is not much of institutional presence in crypto, as of now it’s more of a retailer phenomenon. We hold bitcoin a large amount of it, we are secure but the risk is there in any business.” Arthur Hayes commented during a CNBC interview, adding a price prediction of $50k for BTC.

As a fund manager, I could never contemplate working with a cowboy provider such as Bitmex with my clients money.

Time and time again during my personal due diligence testing of the service during the past three years, I’ve noticed bizarre oddities. That just do not happen on my other trading platforms.

Bitmex PR machine in overdrive. Donating a few crumbs from the table, in the form of two ambulances to ministry of health in tax haven Seychelles, where their business is registered.

For example, out of sample of 100 trades, every single single stop that was in profit - executed with so much slippage that if it was at breakeven or moderate 2~3% gain, it would always execute at a slight loss somehow. If more leverage is applied, the higher then loss.

We found overall it’s better to just turn of the leverage and trade with your own money, and not use the margin facility by using the cross settings as this does give you a increased edge due to the lower fees.

If a market order was used to mitigate the slippage, the fee’s are so high that the breakeven must be over at least 5% from entry.

You need to forget trading modest moves, you must be in an established trend, even then expect around a third to just disappear if you close at market, just due to the fees. Making trailing positions using the inbuilt tools (that work exclusively as market orders) really not so profitable.

Closing is really crucial on Bitmex, and when you trade a market with low liquidity such as TRX or XRP, expect to get left hanging unable to fill, in a illiquid market akin to penny stocks.

100 Trade Sample Set

On the other hand, out of that sample of 100 test trades, every single stop that was out of the money - did execute instantly with no problem, no slippage there.

How convenient. I guess that must just be how markets work.

Mmm no no no, we can’t execute your order at that price, but hey - this one will have to do. Thanks for trading with us, our most valued customer.

For an exchange with next to no spread and insanely high fees, you know how they make their money now.

I mean come on, your chin should itch when you hear the setup on Bitmex, and rightfully so. On plain paper it’s just ridiculous, this is the reality of what we have for retail crypto derivatives:

No spread - so how on earth does the broker make his fair cut?

Huge fees to use market orders.

Stop limits that don't execute properly, if they do trigger in profit the slippage / re-quoting is substantial enough you must be at least approximately 5% in the money from your entry (at a ratio that works out at 5 wins to 2 losses to break even!)

Stop limit orders that cancel themself and be removed from the book if they cannot be matched instantly, by design. How novel.

Indexed derivatives based on other markets price feeds, of which no law prevents Bitmex from trading on, or reporting their activity.

Openly tell the public they have an internal market-making trading desk, which takes positions on the platform just like anyone else. But don't’ worry about that, it’s normal.

It’s possible that Bitmex will never open its doors to US citizens because the gig will be up. The mask will fall off and all the plebs getting rekt will realise, they are not all just incredibly shit unlucky traders.

They are serious conflicts of interest going on at Bitmex, and traders are merely lemmings walking along a cliff.

Market Go Up Now?

Even though you may think there is a bullish case for the market to recover right now, don’t rule out the conflict of interest in the huge build up of shorts on Bitmex.

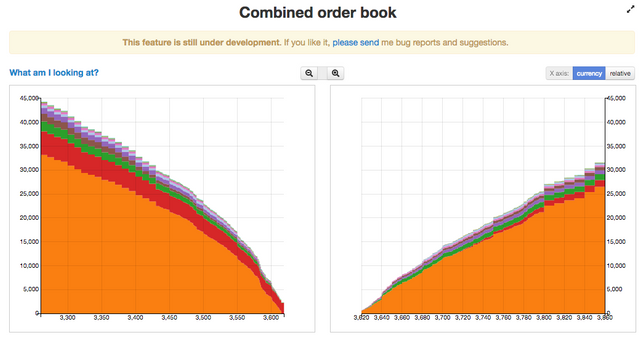

Watching the combined order books available on the excellent free service bitcoinity - offers some light on the situation.

Time after time, the dwarfed volume of Bitfinex, GDAX, Bitstamp and other popular exchanges goes long.

But the elephant in the room, the gigantic volume on Bitmex will remain short. Regardless of exchange market pressure. Purely due to the conflict of interest in the vested hedges sitting on the book.

Finally when markets rise, Bitmex shorts begin to abate and start going long. Only to quickly flip short again as contrary as can be, when exchanges begin to sell and take profit.

Obviously going short now would be the safe bet on Bitmex.

Wrong again, Bitmex will obviously have to go long in this situation, just long enough to trigger some stops and get some high wicks to get people ordering in for the break out, before quickly dumping their holdings on the underlying, and liquidating their books of longs again.

There is no such thing as a free lunch, and thinking that you can eat at the Bitmex buffet for free is like saying you can beat the house at blackjack without counting cards and ending up being taken downstairs and loosing some fingers.

How was your experience trading with Bitmex? Do you think the topics covered in this article deserve more attention?

Should Bitmex display the statistics on winners to losers on the platform, like other brokers are regulated to do so?

Please let us know in the comments, so we can continue this discussion!

solid article - so much going on in the market but you clearly defined some of the most important factors especially with Bitrekt lol

Thanks for the feedback Majorleeblunt! So I guess you've got rekt by mex before? Care to add anything we missed?

Cheers!

lol i think u not experienced crypto unless u get rekt on bitmex at least once

its really best for experienced hedgers but can be a bit of fun with low amounts and riding the train in the right direction :)

Couldn't agree more, I've not got liquidated but I've found the experience to be the least profitable exchange to trade margin on by far just due to the market fees.

Although when you need to short that's what it's there for I guess.

sure, only now there are so many other better options, i guess some people when they find a good thang its hard from them to move to another platform

Congratulations @icnn! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPWow, from the times i traded (got rekted) on bitmex i completely identify with alot of what you are saying, weird behavior, orders not executed, poor control on the margin and violent manipulations (spikes) in the most abrupt price changes in comparison with the actual price, maybe they weren't so organic.

Time will tell, but you are correct that we are better off with regular trading or simply hodling, but alot of people are being misled in their trading if this is true.

Thanks for your comment and sharing so honestly your experience with Bitmex! Time will tell like you say, we can just only wait and hope some light gets shed on the situation. Sorry to hear that you got rekt on there man, but onwards and upwards. You can always make back the losses.

img credz: pixabay.com

Nice, you got an awesome upgoat, thanks to @icnn

BuildTeam wishes everyone a bullish new Year!

Want a boost? Minnowbooster's got your back!

Hello @icnn! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko

Congratulations @icnn! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!