Crypto: The market timeline & the power of zooming out 2008-2018

Good evening Steemers I am delighted for finally making it to steemit community. At the time of my original writeup the btc price was dropping and plenty of people panicked - both events were expected. But also excited for this post as I wanted to share it here for quite some time now and I am more than happy I am now part of steemit too! This post is for a different school of financial thought in crypto sphere than the one of last post. It is for you, me, and anyone who along with day trading, margin trading and any other strategy, chooses to hold their long position and how the latter is the main reason this market is the future and the present. Of course everyone aims for higher profits and that is the reason others jump out of happiness due to margin trading/shorting or because they swang or day traded.

Today my full respect and love goes to the holders. The ones who either early birds or new comers, decided to believe in the movement and keep their long position regardless of factors that pushed price down. My respect to them because be it deep analysis, experience, information or just confidence, they are the ones who work hand in hand with daytraders in a very interesting thought; Day traders create volatility, but holders open the path for support levels , only then for new-comers, and more day traders or panic sellers that decide to buy back to break the support line and after it stabilizes in the crowd psychology that behavioral economics is about on anyway, to drive again the price on a new trading cycle. It is the main argument on why I never object to any trading approach.

Often we see people disagreeing, holders vs daytraders or shorters, TA enthusiasts vs FA ones, data scientists and meta analysts keeping quiet and smiling at all of the above like the “true neutral gamer” if you ever saw the funny meme, yet in my modest opinion we do need to first appreciate all the agents here since they are ALL moving the market , each group on its own way and for different reasons. And then appreciate holder alone, you guys are a big reason why this market will keep on growing. We are not psychics, we are logic advocates. And even when events and individually placed price change catalysts depreciate the price, we zoom out , we see the bigger picture, we analyze , check with current and future data be it social such as events and general information or strictly numbers.

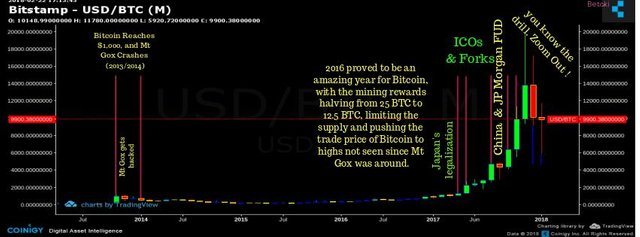

Speaking about zooming out, what an amazing feature that is., Let’s have a look at what happened in crypto in terms of BTC in past cycles.It is a lovely journey, each candle and each chart has a story to tell and being a chart reader you are a storyteller.

Let’s go back on April 17, when Japan legalized bitcoin. Legalized? Someone will ask. Was it illegal? No ! But when a valued agent such a government enacts a law that accepts a digital currency as a legal form,things in charts go very intersting

At that point shown in the picture, bitcoin showed an incline of 80% making Japan at that point the biggest btc holder even passing China.

Other events along with btc gold and btc cash forked and cloned the trust /confidence and skyrocketed the price even more. Why were they needed at that exact point? I had seen people calling them a pointless chithole and I was assuming they miss the bigger picture. At that point, btc trust was still there but the future was shaky bc of miners. You see, miners compete with each other for the best possible problem solution in order to solve the math and grab the gains. How? Miners and traders had conflict of interest regarding Bitcoin’s future scale in its protocol. The miners wanted Bitcoin to use bigger blocks for more data to fit into each block that is mined. The users and developers wanted to implement Segregated Witness (Segwit), an upgrade that would compress transaction data, so more transactions could fit in each block. Same outcome, different share of the pie. So regardless of the disagreement on hard forks, we still believed it was the best trade off for a smoother crowd psychology. Does it make sense? Please comment below.

Let’s see more events and why panic leading to dips on the long run did not outperformed the profits.

2008: bitcoin.org was created via anonymousspeech.com and the mysterious individual , or team or anything in between under the alias Satoshi Nakamoto released the White Paper of the digital currency which can found to this very day at https://bitcoin.org/bitcoin.pdf

2009: the Genesis Block (block 0) was mined, creating the first bitcoins.

2010: the first real-world transaction took place to purchase a pizza. A programmer from Florida sent 10,000 BTC to a person in the U.K. in return for two pizzas from Papa John’s . Yum !

2010: The Birth of the Mt Gox Exchange, Software Bugs, and Pooled Mining (2010)

2011: The Silk Road, an online market on the dark web, opens with Bitcoin as its native currency. I will skip the rest :)

2012: Coinbase is found

2013-2014: massive events and the start of both good and bad tradeoffs that kept the price growing. Despite the FBI shutdown of The Silk Road in October 2013 (that was good, silk road was not a kingergarten ), Bitcoin’s popularity continued to grow. The trading price of Bitcoin rallied above $1,000, and a whole new wave of wealth was created for many early investors.

Early 2014 would prove to be a hard time for the Bitcoin community. The largest Bitcoin exchange at the time (Mt Gox) was hacked, triggering a two-year bear market for Bitcoin.

→ Mt Gox was handling 70% of the Bitcoin network’s transactions. With 850,000 bitcoins stolen, the exchange closed. It was a hard and bitter lesson for many about the importance of storing Bitcoin safely and privately.

2016: Hundreds of altcoins and new blockchain-based projects, new exchanges, crypto world works now as a human and digital ecology. Mining rewards halving from 25 BTC to 12.5 BTC, limiting the supply and pushing the trade price of Bitcoin to highs not seen since Mt Gox was around.

2017: Bitcoin returned to previous highs and surpassed all records, despite a Bitcoin ETF being rejected. With highs as high as $5,000. 2017 btc manage to push away a dark cloud that loomed over Bitcoin for nearly two years. Did dips never occured? Of course they did. But holders did zoom out. That is the whole point of the post.

Kudos to crushthestreet for the sum.

Furthermore, 2017 was the year that btc showed it was slow compared to other new coins, Litecoin and Ethereum, and its core developers couldn’t come to an agreement on how to update the software. This raised the prospect of a fork as discussed above for the rivalry between miners, traders and devs.

More events seen in charts and conforming crowd psychology same way we work on it in stock and forex.

Market relaxed after the doubts over forks and bitcoin climbed close to $5,000 at the start of September before plunging 37% by September 15, shaving off over $30 billion from bitcoin’s total market cap in the process. Volatility was the keyword as it climbed back up 4K in just 3 days.

But volatility aside.. Why? Want a second keyword here? China : rumors about China banning the crypto trading altogether. Want another keyword here? FUD. Fear, Uncertainty, Doubt and that in fact are 3 ;) Added to that, Jamie Dimon, CEO of JP Morgan, labelled Bitcoin a fraud. At the same time that he and his clientele were securing deals UTC with btc , in order to secure a cheaper deal with higher returns within months in the following December.That’s what I call a free market though, cause you know who benefited from that ? Holders.

You see how things worked out, and yet again, holders kept their confidence.

Moving to some more certainty added afterwards that affected positively the charts,BIP 91 successfully activated in mid-July 2017 before BIP 148 enforced SegWit, creating huge relief in the community due to its 2MB block size increase

Lesson here: Rivalries for conflict of interest can actually be constructive and create something good. Always zoom out and see the bigger picture before you freak out.

2018: I believe by this point fam, it is quite clearer and it already feels more undertsandble and familiar what bitcoin deals with everytime a bad announcement is at play. Bitcoin prices fell about 14% to $7,200 in one day as major banks including Bank of America, J.P. Morgan, Citigroup, Capital One, Discover, and Lloyds say they have or plan to ban customers from using their credit cards to buy cryptocurrencies like Bitcoin. Even though I did agree with their decision since crediting upon volatility would raise unregulated debt, it was to be expected and many margin traders got very happy. Yet, holders knew the drill. They held their positions. More FUDs about S. Korea and India came showed up, and long story short the scale and game of which side outperforms the other signifies final and momentum outcomes. Yet, people held. Be it hedge funds, whales, bag holders, market manipulators or holders, and regardless of market and its roles changing strategies every single cycle, holding outperforms the dips. You should know the drill by the moment you read this line.

This is getting a quite long post, so let’s speak about how I deal with decision making regardless if my charts are read according to news or momentum values in TA.

Best to analyze both good and bad outcome. In trading terms, I like to treat any chart or prediction like I do with my statistical hypothesis testing; reject, and fail to reject. This way for me at least I am able to remain proactive rather than fall into my own possible mistake. The solid path for any trader as I see it should be decision making. That is a virtue that takes time, plenty of wrong hands and bad outcomes however at some point we manage to get the desired “robotic” reaction needed to decide effectively and on a timely manner our next move. Does it make sense fam? I know some here love TA, some stick to FA, some prefer to play OTC and stick to information while others may get it even further on pure data science and z scores. It is all good and it is all welcome, I am always an advocate of golden means therefore I do believe my truth as an individual or professional analyst lays somewhere around the middle but not exactly in it.

People sometimes ask where are all the analysts before a bearish prediction, they are everywhere same with the bullish talks. Perhaps if we allow people to speak their minds without fear of unfair judgement we will all benefit from it :) Even a new comer has something to say and we should consider all opinions, who knows what new perception or idea or way of thinking one has that did not cross our mind yet regardless of experience or perceived value. Remember in any given community, virtual or not , like in any other environment there are people who prefer to read/listen more than they talk, and when they decide to talk, they want to do it freely. Lack of their general exposure in the field should not perhaps be equal to lack of validity. We just have to always absorb information and intake with a salt of grain. Regardless who it comes from, I always follow the rule do not blame others for your failure” same way you do not share part of your profits during a correct call. We need to remember some people do this full time and sometimes they speak publicly, sometimes they stick to their clientele or are just busy.

At the time of writing , there were three different support levels that I expected, i will mention 2 and both were met; 10-at 10.1K followed by 9K-9.5K before end of either 5th wave or abc correction. Predictions were accurate and we already saw the rebound with 12.3K to be expected if patterns continue such as within the next days. We need to remember that corrective waves may be in this case declining in terms of value/ price, however in reality there can correct either up or down depending on each trend of higher degree.

To finalize my point for this post and thank you as well for taking time to read my lengthy post, charts cannot affect and will not affect the moves of holders, the whole point of holding is to keep a long position without day or margin trading. However,we speak about behavioral economics here and I do believe new entry agents in this crypto sphere need to understand it is not all out of coincidence or movement talk. There is data science behind the idea of holding that can keep your peace of mind. I appreciate whoever transparently believes in the movement but it is often relieving to also check what active traders do and think, it keeps in a way things on perspective and hey, if you advice other people, be it family or clients, people always tend to prefer visuals than audios and that is just a humorous analogy in terms of seeing analysis vs hearing “it is all good” even if the outcome is the same :)

With that being said, in this post I tried to analyze both the market since the very beginning paying my respects to the holders, as well as give my intake on why i believe TA regardless of opinions around is one of the greatest stories ever to be told.

Happy trading to all and I am waiting to hear your opinions.

Hi. I am a bot that looks for newbies who write good content!

Your post passed all of my tests.

You get:

I also write bots and other code for crypto....

Resteemed by @resteembot! Good Luck!

The resteem was paid by @greetbot

Curious? Read @resteembot's introduction post

Check out the great posts I already resteemed.

ResteemBot's Maker is Looking for Work.