Why Are Crypto-Currencies Valuable? Understand What it is You're Investing in

Why Are Crypto-Currencies Valuable? Understand What it is You're Investing in

Since around 2012, crypto-currencies have gained steam in the international markets. We've seen Bitcoin go from under $100 USD to nearly $20,000 USD per coin. But what gives these crypto-currencies their value? Are they only a viable substitute for government issued currencies? Or is there something much greater at play here?

Common Misconceptions

Since the release of Bitcoin and other crypto-currencies, there has been a lot of speculation regarding what they are and what they are used for. For every investor that believes in the future of crypto-currencies there is another investor that hasn't bought the hype. There are some common misconceptions on both sides of the table, however.

Misconception #1:

Crypto-Currencies are Currencies

While in their most common use the above may seem true, crypto-currencies aren't actually currencies. The only reason that they seem to be currencies is because they are widely exchanged for government-issued fiat currency. In fact, if crypto-currencies were only currencies, they'd be as worthless as a fiat currency. This is a widely misunderstood facet of crypto-currencies that is misunderstood by their enthusiastic investors and haters alike and it doesn't make it any easier that they have been dubbed "crypto-currencies".

Misconception #2:

Crypto-Currencies Lack Regulation and Therefore Aren't a Viable Means of Exchange

Many people who are hesitant to invest into crypto-currencies believe that the lack in regulation of these currencies means that they aren't viable as methods of exchange. Because most people are used to systems of trust, a trustless system such as Bitcoin is a hard pill to swallow. The reality of the matter is, methods of exchange such as Bitcoin, Ethereum, Litecoin, and Ripple are only trustworthy due to the trustless systems in which they have been established (we will touch on this later).

Misconception #3:

Crypto-Currencies Must Have Intrinsic Value to be Valuable

There are many people who scratch their heads at how much value has been put into crypto-currencies. After all, aren't crypto-currencies just as worthless and intrinsic as the USD? Not really. In fact, one could argue that the system that these crypto-currencies are built on inherently give them much more value than any government-issued fiat around. In the end, there will only be about $26 million Bitcoin in existence. Unlike government-issued fiat currencies, crypto-currencies such as Bitcoin cannot be printed into existence to effect the economy. Because crypto-currencies are only as valuable as the market as a whole dictates, there is actually more viability in crypto-currencies as a store of wealth than government-issued fiat currencies. Why else would China, in a time when they are rolling out the petroleum-backed petroyuan, ban transactions in Bitcoin?

What are Crypto-Currencies and Why are They Valuable?

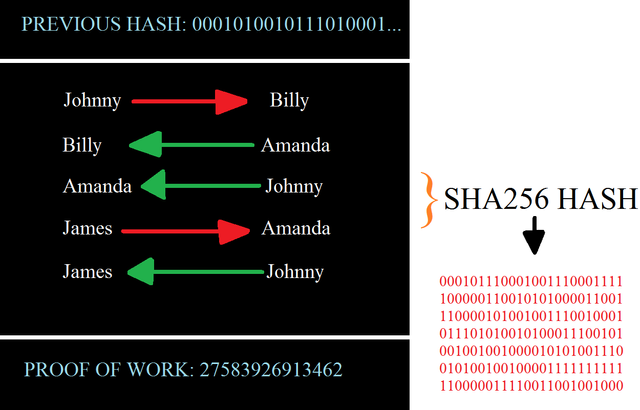

Crypto-Currencies are, at the most essential level, global ledgers of transactions. These transactions are cross-checked across a network of computers, called "miners", that verify these transactions by discovering the digital signature that lies behind any one transaction. Instead of one centralized system to verify these transactions (such as JP Morgan Chase Bank), a peer-to-peer (P2P) system of computational work is used as verification. When you send a friend Bitcoin you are adding a transaction to the current block. But how do we know that you actually sent Johnny 5.000 BTC?

Bitcoin and Crypto-Currencies of the like use a computational "proof of work" system that is used to verify transactions. Whenever you make a transaction you are adding one line to the current block. Technically, until the next block of the blockchain is mined, your transaction is invalid. But how do we know that the transaction is valid?

Since Bitcoin uses a SHA256 Hash Algorithm (other currencies use different one-way functions), the word "orange" will always come out to be "00100110...". What Bitcoin does is encrypt a digital signature (proof of work) to the current block. By adding "24603853" to the bottom of the block, the block's new hash is randomized. Changing that number would render a different hash entirely. To verify that the new block extends from the last known block in the blockchain, every new block has the previous block's hash at its header; denoting that it is indeed the next block in the blockchain.

Because all of this is conducted on a decentralized network, the system in play doesn't require trust. The ledger with the most computational work put into it is the ledger that is used as the current block in the blockchain. Due to the fact that all blocks contain the previous block's hash, going back and changing any previous blocks to fabricate Bitcoin out of thin air is impossible. Changing any previous block would change that block's hash which, in turn, would change the next block's hash and so on. The system would inevitably find which block is the invalid block in the blockchain and remove it.

The value of Crypto-Currencies isn't derived from their value as currencies. It is the value of the system in which it is built upon that gives it its value. It is completely peer-to-peer and to fool the system is to fool every other node connected to the network that is checking and balancing the books (the ledger). Reversing the hash function of a particular block in the reverse direction is so mathematically infeasible that these systems don't require the trust of a central authority. Because of this, crypto-currencies are quite possibly the future of upholding free and fair markets. The political implications that crypto-currencies have on the future and the way business will be done is so proprietary that the world's governments don't know what to do with it. Centralizing the currently established currencies isn't possible without banning block contributions worldwide. Eventually, after time, many will wake up to the freedoms that these currencies can employ through their system of peer-to-peer checks and balances. Crypto-Currencies will completely replace fiat currencies as a medium of trusted transaction in the future (should they not be hindered). It is only a matter of time before the world banks are exposed for the ponzi-scheme that is government/central bank-issued fiat currency. Money that is printed in abundance, out of thin air, with no real value to mankind.

Conclusion

I hope that my rough outline of crypto-currencies has helped to clear up some of the misconceptions and confusions about what they are and why they're used. Remember, you're not investing solely in a currency; you're investing in a system of transaction as a whole. Crypto-Currencies are not currencies rather than systems of peer-to-peer balanced check books in which one can be confident in the transaction history without needing to worry about fraud, theft, and tampering. For a more in-depth look into what crypto-currencies are and why they're valuable, please watch the video below by "3Blue1Brown" on YouTube. It is an incredible video that, in an unbiased way, persuaded me of the value of the blockchain. If you enjoy his content please like his video and subscribe to him!

Credits:

3Blue1Brown YouTube Channel

Congratulations @i-venture! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP