What is a ETF ? Why does a crypto investor care?

Right now, there are many Bitcoin ETF's trying to get approved. So what is a Bitcoin ETF?

An ETF, or exchange-traded fund, is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold. ETFs typically have higher daily liquidity and lower fees than mutual fund shares, making them an attractive alternative for individual investors.

Because it trades like a stock, an ETF does not have its net asset value (NAV) calculated once at the end of every day like a mutual fund does.

An ETF is a type of fund that owns the underlying assets (shares of stock, bonds, oil futures, gold bars, foreign currency, etc.) and divides ownership of those assets into shares. The actual investment vehicle structure (such as a corporation or investment trust) will vary by country, and within one country there can be multiple structures that co-exist. Shareholders do not directly own or have any direct claim to the underlying investments in the fund; rather they indirectly own these assets.

ETF shareholders are entitled to a proportion of the profits, such as earned interest or dividends paid, and they may get a residual value in case the fund is liquidated. The ownership of the fund can easily be bought, sold or transferred in much the same way as shares of stock, since ETF shares are traded on public stock exchanges.

ETF Creation and Redemption

The supply of ETF shares is regulated through a mechanism known as creation and redemption. The process of creation/redemption involves a few large specialized investors, known as authorized participants (APs). APs are large financial institutions with a high degree of buying power, such as market makers that may be banks or investment companies.

Only APs can create or redeem units of an ETF. When creation takes place, an AP assembles the required portfolio of underlying assets and turns that basket over to the fund in exchange for newly created ETF shares. Similarly, for redemptions, APs return ETF shares to the fund and receive the basket consisting of the underlying portfolio. Each day, the fund’s underlying holdings are disclosed to the public.

ETFs and Traders- Arbitrage matters!

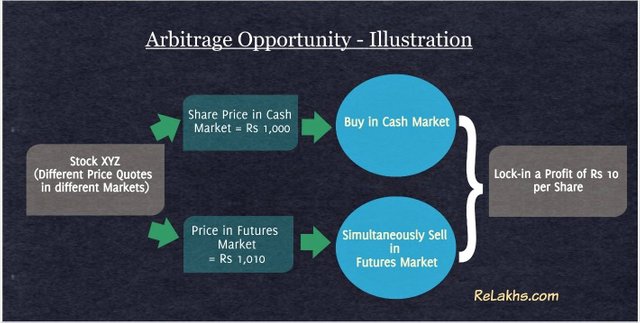

Since both the ETF and the basket of underlying assets are tradeable throughout the day, traders take advantage of momentary arbitrage opportunities, which keeps the ETF price close to its fair value. If a trader can buy the ETF for effectively less than the underlying securities, they will buy the ETF shares and sell the underlying portfolio, locking in the differential.

Some ETFs utilize gearing, or leverage, through the use of derivative products to create inverse or leveraged ETFs. Inverse ETFs track the opposite return of that of the underlying assets – for example, the inverse gold ETF would gain 1% for every 1% drop in the price of the metal. Leveraged ETFs seek to gain a multiple return of that of the underlying. A 2x gold ETF would gain 2% for every 1% gain in the price of the metal. There can also be leveraged inverse ETFs such as negative 2x or 3x return profiles.

Advantages of ETFs

By owning an ETF, investors get the diversification of an index fund as well as the ability to sell short, buy on margin and purchase as little as one share (there are no minimum deposit requirements). Another advantage is that the expense ratios for most ETFs are lower than those of the average mutual fund. When buying and selling ETFs, you have to pay the same commission to your broker that you'd pay on any regular order.

There exists potential for favorable taxation on cash flows generated by the ETF, since capital gains from sales inside the fund are not passed through to shareholders as they commonly are with mutual funds.

Lastly, a ETF will allow many people to buy it, give legitimacy to the underlying asset, and lastly usually pump the price.

Thanks for reading - Give me some steem if you enjoyed reading!

Article has been posted online just reposting it and sharing.

Thanks robot!

ROBOT!

I think the ETF will get approved this Friday :)!

Congratulations @huobi1! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!