Cryptotrading 101 : Types of Market Analysis

There are three types of common market analysis: namely:

Technical analysis

Fundamental analysis

Sentiment analysis

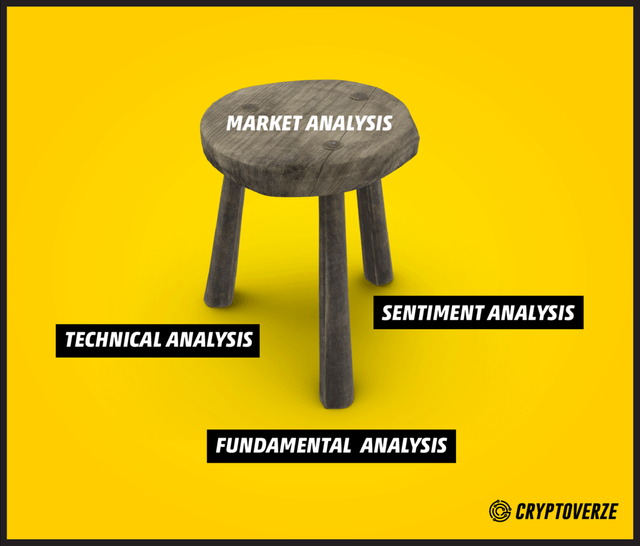

Well, deciding on which one is better has always been a long-running debate but the truth is without proper understanding of all three, you are bound to make huge losses in trading cryptocurrencies. The three analyses are like a three-legged stool if one leg is weak; you will inevitably come crashing down when you decided to put your weight on it , therefore getting the best out of cryptotrading means that all three analyses must be fully understood and integrated as part of your trading strategy.

Technical Analysis

This is the framework on which the price of cryptocurrency depends on, the highs and the lows. For any good trader to succeed in cryptocurrency, they must understand the technicalities involved with the constant change in the price of the currencies in the market

The ideology is that with proper study of the price history, a trader should be able to determine the current trading conditions and the direction of the price in the market. The use of technical analysis is based on the assumption that all the historical market data is somehow reflective of the present and future price movement. If the necessary price information is available then one would be able to deduce the direction of the market with confidence. As the popular saying goes, “history always repeats itself” , and that is exactly what technical analysis is all about.

Technical analyst will actively look for similar historical pattern and develop trade ideas around that, believing that it will behave in the similar fashion as it did before. This method has been used by successful traders to make profit just by understanding the patterns and looking profitable entry point.

When more and more traders rely on technical analysis and resort on similar chart pattern to develop their trade ideas, sometimes these price patterns will ironically become self-fulfilling

We can’t have technical analysis without a chart, charts are important because they create a visual representation of the price data and are used to spot trends, changes or any unusual patterns that can be the beginning of a huge trading opportunity.

Technical analysis is very subjective; just because two people are looking at the same chart does not mean that they will come up with the same idea in predicting the direction of the price.

Fundamental analysis

Fundamental analysis looks at the foundational technology as well as the economic, social, and political forces that are influencing the market supply and demand of a coin or token. Well, think about it, it does make a lot of sense, just like our basic economics class back in the days. The supply and demand of a product determine the price of the product or in this case, the exchange rate of the trading cryptocurrency.

Using the supply and demand strategy, the projection of the price is easily ascertained. The difficult part is analyzing all the basic factors which are likely to affect the demand and supply. In other words, you have to pay attention to the entire range of factors to determine what is hot in the market and which is heading downhill. You have to understand that there are many reasons that can affect the price of trading,

Fundamental analysis in the crypto market is undoubtedly quite different from a traditional market ( e.g. Forex & Stock ). In a traditional market like a stock market, we would typically be evaluating the performance of the company by looking at the financial track record company. In the crypto world, however, there is simply no financial statements of any sorts that you can based your analysis or judgment on. Most of the cryptocurrency projects are still in its infancy stages and the majority of them has yet to have a working product. The viability of a cryptocurrency unlike stock or fiat currency , is not based on the financial performance / economy status of a country but rather the prospects and the adoption status of the technology/cryptocurrency.

"Buy the Rumor and Sell the News" is especially true with the crypto scene due to its highly speculative nature. The crypto market is highly sensitive to the news and rumors and very easily subject to manipulation. Therefore, keeping yourselves updated with the latest news and updates regarding the project of interest is crucial if you want to be able to make profit in the process. Active participation in the relevant forums, subreddit and slack channels will potentially give you an edge in surviving and thriving in the market if you manage to react in a timely manner.

Sentiment analysis

The price action of a cryptocurrency in the market should hypothetically reflect the availability of the market information. We wish it was that easy.

Every trader will always act according to their own opinions and decide whether they should trade with or against the market trend. The market consists of a complex network of different individuals. The market trend fundamentally represents the overall opinion of all traders – you, Roger Ver or Tom from the dorm room next door – about the market.

The trader's opinions are translated into the positions that they takes and all these individual opinions will together form the so-called sentiment of the market .

No matter how strong your instinct is about a market, you can’t turn it in your favor when everyone else is bearish about it. ( Unless you are one of the WHALLESSSS ) The only thing you can do is to perform sentiment analysis and integrate the outcome into your trading strategy.

However, if you decide to ignore the market sentiment for your own ideas and opinions, well then, the loss is yours to bear. Being able to make the right judgment about the market sentiment is an invaluable skill to have. I will perhaps be writing another article in the near future on analyzing the market sentiment and how to leverage that to your advantage. So stay tuned!

Which is the best type of market analysis?

Can one sit comfortably on a two-legged stool? I don't think so. For awhile, probably yes but definitely not in the long run. All three analyses have to work hand in hand for any trade to be successful. Here's a summary of their relationship:

Fundamentals influence sentiment, while technical analysis facilitates the visualization of sentiment.

In short, to become a successful cryptocurrency trader, one has to know how to effectively leverage all these three analyses to his/her favor. We will be covering more regarding the individual analysis as well as other exciting topics like understanding common chart patterns, the dynamic behind the price action etc in our future article. If you would like to be informed when new articles are made available, subscribe to our email list or turn on the notification! That's all from me now, see you in the next article!

Source: Cryptotrading 101 : Types of Market Analysis