How XRP Fits Into Ripple's Payments Products Explained

Ripple and the custom cryptocurrency it created, XRP, are having a moment.

Winning the attention of new investors (so much so that XRP shot up over 1,000 percent earlier this year) as well as new clients (with announcements rolling out at a slow and steady clip), the enterprise blockchain startup has been the talk of crypto in 2018.

Yet, newcomers should note that much of the enthusiasm stems from certain claims by the startup - namely, that its tech could revolutionize international payments, innovating on outdated methods for routing messages and money between financial behemoths.

Not only does Ripple claim its products are cheaper and faster, but it also touts them as generally more efficient than the services in the marketplace today, a claim that hinges primarily on its use of blockchain technology and cryptocurrency.

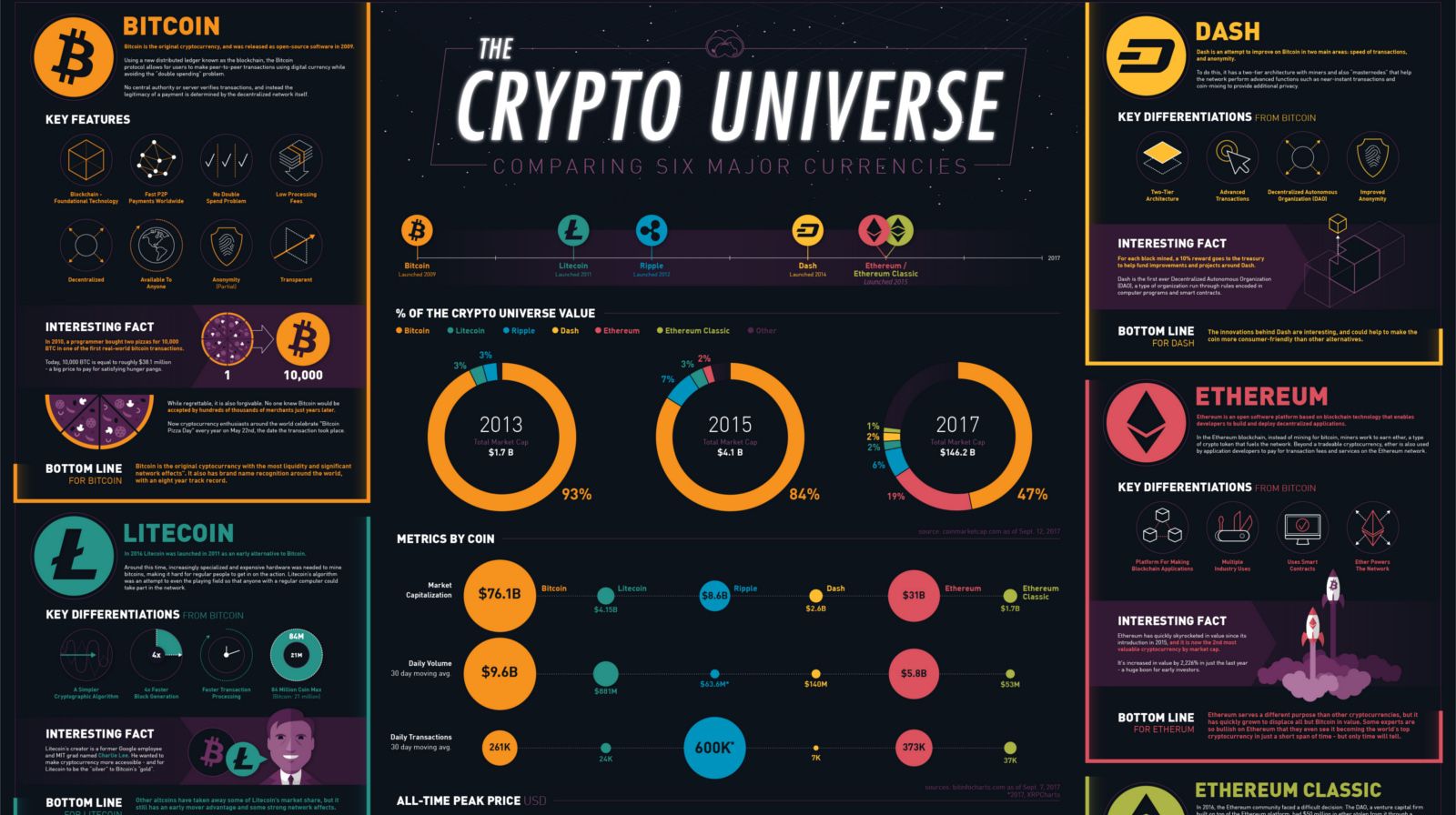

Still, not all Ripple products are created equal in relation to XRP and its $35 billion market.

In fact, XRP, the asset you can buy and trade, is just one small piece of a suite of products the San Francisco startup offers (some of which don't employ the cryptocurrency at all).

In the following piece, we outline Ripple's three products today - xCurrent, xRapid and xVia - and explain where XRP fits in.

xCurrent

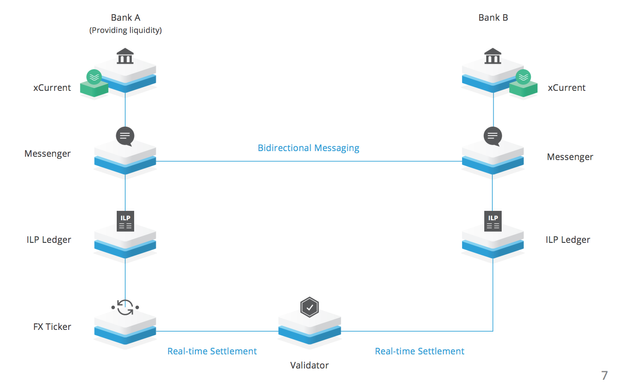

Built on a distributed ledger called Interledger, xCurrent doesn't operate on the same technology as XRP (which uses a separate system called XRP Ledger).

Of note is that, while Interledger was built by Ripple executives, it's not managed by the company - it's incubating in a World Wide Web Consortium (W3C) group, which is managed by a long-standing non-profit dedicated to furthering internet standards.

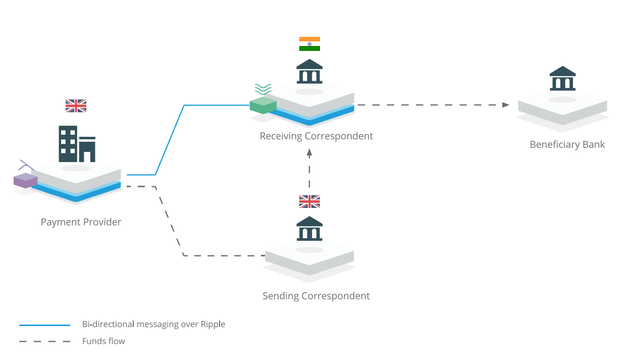

As such, the main goal of xCurrent is to provide interoperability between any and all currencies, not just cryptocurrencies.

By having connectors that hold value in a number of currencies, xCurrent allows banks to transact with each other, even if the sender wants to pay in U.S. dollars but the recipient wants to receive money in euros.

The product also features a messaging platform "used to coordinate information exchange between the banks," Thomas said, one that lets either bank send data back and forth.

The messaging platform allows for real-time updates so that simple errors, such as mistakes in spelling the recipient's name, don't delay payments from getting facilitated quickly. Another function allows payments to be tracked to their endpoint, all while preserving customer privacy.

As Ripple CTO Stefan Thomas explains:

"It provides a single source of truth for the transacting counterparties while preserving the privacy of banking customers' identifiable payment information."

So, while some of the hype surrounding XRP had to do with xCurrent customers, the product itself doesn't rely on cryptocurrency necessarily.

The same way that xCurrent can handle dollars, euros and other fiat currencies as well as bitcoin, ether and other cryptocurrencies, XRP can be traded through the system.

xRapid

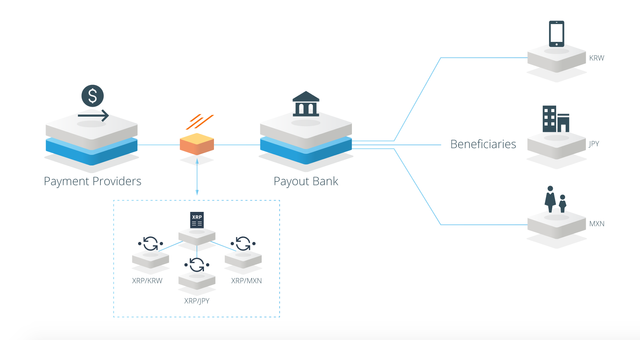

However, when XRP is traded through the xCurrent system, Ripple defines that as a new product called xRapid.

As the year has progressed, a number of existing and new Ripple customers have come forward to express their interest in experimenting with the use of XRP through xRapid.

Simply put, xRapid is a liquidity solution. Companies can swap assets in and out of XRP in order to move it through Ripple's xCurrent payment protocol faster. In short, this means these companies would create demand for XRP on the public market.

And while the product supports other cryptocurrencies, XRP is said to have express advantages.

Thomas told CoinDesk:

"While other digital assets could technically be applied, XRP is quicker and cheaper - at fractions of a penny and about three seconds per transaction."

Large remittance providers, such as Western Union and Moneygram, have begun piloting xRapid in their businesses; so have a handful of others.

While only one company - Cuallix - has begun using xRapid in live real-money transactions, Ripple tweeted in January that "three of the top five" global money transfer companies might soon follow its lead. (This set off a familiar chorus from doubters, who say banks won't ever embrace cryptocurrency).

Still, Thomas remains confident that xRapid would become more attractive to financial institutions around the world.

"What drives value is usage," Thomas said, "a quantifiable way to look at that is like how much liquidity is going through the token. So, I think that's like the name of the game here, it's trying to get as much liquidity through it, and the more liquidity, the more value, and that's what we're trying to do."

For Ripple, xRapid represents the final stage of a consortium effort called RippleNet, where XRP is the central asset connecting all of its disparate payment protocols.

Thomas told CoinDesk:

"As a store of value, as something that we're are very much invested in the outcome of the doctrine of XRP, by virtue of our holding of XRP, we are obviously believers in the long-term potential for XRP to rise in value as adoption improves."

xVia

Having said that, Ripple is also interested in moving clients to its xVia product, a payment interface designed to make the user experience of xCurrent and xRapid more intuitive.

In the same way that WhatsApp hides the complex inner-workings of online instant messaging with a slick user interface, xVia looks to mask the complexity of facilitating payments through Ripple's other products.

As such, xVia does not use the company's cryptocurrency XRP by default, though that is an option.

Just as xCurrent allows users to track payments, xVia does the same, allowing users to generate invoices of their transactions.

While it's the last stage of Ripple's product ecosystem, a couple remittance providers - Brazil-based Beetech and Canada-based Zip Remit - have announced plans to use the product.

Yet, there still seems to be confusion about what the product itself is, with a rep on Reddit explaining it's the facilitator of the payments themselves.

This likely stems not only from the overlap all of Ripple's products have with each other but also the fact that little is said, at this point, about xVia.