Cryptocurrencies to bolster investment yield amid a world of inflated asset prices

Since the 2008 global financial crisis, the central banks around the world has gone on an unprecendented policy of negative interest rate policy (NIRP) and flooded financial institutions with helicopter cash via quantatitive easing. The impact of these policies are evident in the inflated asset prices across equities, bonds and properties.

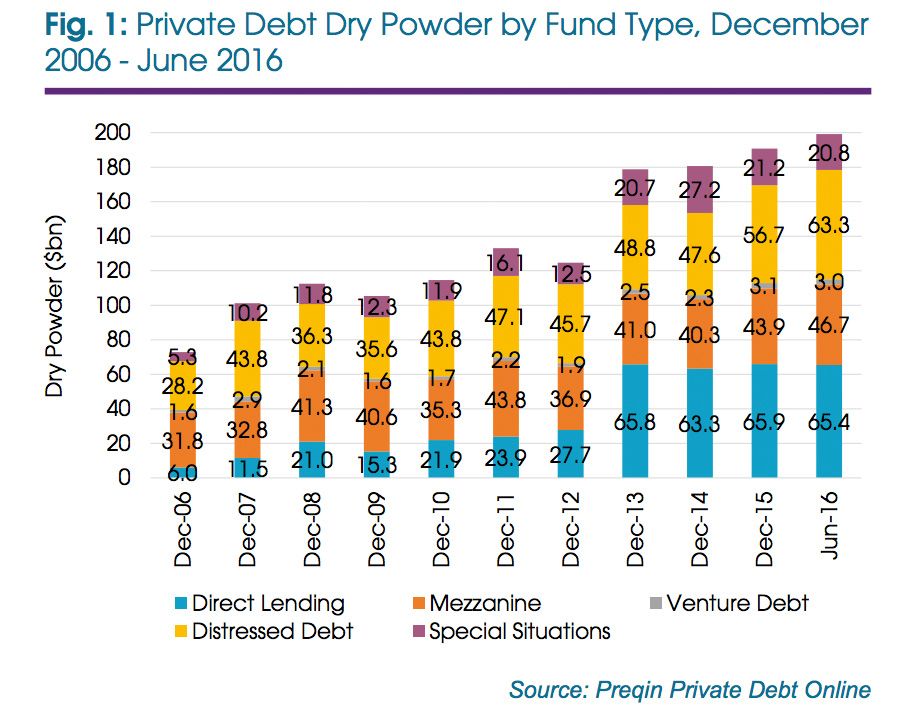

The stash of dry powder - idle money waiting to be deployed - by institutional investors and companies had grown to a whopping $200bn in the past decade.

These institutions are hoarding cash in hopes that a repeat of the 2008 financial crisis will occur again, so that they can step in as a lender of last resort and pick up high quality assets at steep discounts.

However, in Janet Yellen, Fed's chairperson, own words, she said that she did not expect to see another crisis of the same magnitude as the 2008 financial crisis in her lifetime. It is obvious that she is comfortable with the inflated asset prices because regulators world wide have been implementing stricter and tighter regulations to curb speculation across USA, And Europe. Even China has been taking action to quell shadow banking activities to reduce the systemic risks that speculation may do to the broader economy. If the bull market continues extend longer, institutional investors will be compelled to deploy the capital and seek alternative asset classes for investment opportunities. Why would you, as an investor pay exhorbitant fees to fund managers whom hold cash in their portfolio, and charge you for it?

With traditional asset prices at sky high valuation, there still exist alternative assets such as cryptocurrencies provide attractive opportunities to bolster investment yield. The blockchain is a new and developing technology which has immense disruptive potential.

Cryptocurrency has recently gain the spotlight and rose in prominence but still have compelling reasons why they will continue to grow:

- Virtually all institutional investors have yet to enter the scene, due to investment mandates which prevents them from doing so. The inflow of capital will be huge when they arrive;

- The public remains wary of cryptocurrencies, and most still think that cryptocurrency is a dud that will fade into oblivion;

- Continued technological advancement. Recent ICOs have raised substantial capital which would allow the developers to continue their work in the years to come, shielding them from potential temporary crashes in the markets;

- Real solutions are being developed to disrupt uncompetitive industries that are worth hundreds of billions (financial transactions, payment solutions, advertising technology, the list goes on); and

- Regulations in cryptocurrencies being explored and implemented by countries such as USA, China, Russia, Japan and Australia will give legitimacy to cryptocurrencies, and ensure that unethical practices such as pump & dumps, malicious spread of false information, and spoofing will be made illegal as it has been in tradiional asset classes.

The risks cannot be understated given that the industry is still in its infancy, but the potential rewards provide a tantalising risk-reward ratio for investors. The entire market capitalisation of cryptocurrency is currently ~$174bn (check update market cap from https://coinmarketcap.com/), which is small in comparison to other assets.