[Inside ICO] Let's talk about SURETLY

About Suretly

Suertly is crowd vouching platform which guarantees loan fund to unspecified individuals.

Financial companies provides you investment product which is so called crowd vouching.

This is a system which guarantees urgent fund for people who need it.

It is similar to P2P loan, but you do not directly lend money.

Instead, you guarantees lender.

Good points

No need for investment fee

The difference between crowd vouching and P2p loan is that investors (mutual sureties) do not lend money.

Qualified financial institutions provide loan fund.

Crowd vouching takes a roles as a market.

If borrower is not able to pay off one’s debt, dozens of sureties should pay back.

Limit of guarantee less burdens as it is 2 to 10 dollars.

In addition, you are able to receive rewards according to credit rating of borrower.

Risk Break Up

Investors mutually sign up for partial amount of money. They do not sign up for the whole loan fund. A borrower becomes to have dozens of mutual contractors. As loan period is managed during short term (maximum 30 days), investors can obtain massive profits. Though there is a high risk, the burden is less as it is allotted to many investors.

Quick Reward

Suretly burdens 3% commission of loans, and this commission is distributed to guarantors.

Guarantor can receive profits after the day of loan execution.

Lower Loan Rate

The guarantor’s’ loan rate burden decreases as the risk reduces.

Good Opportunity to Recover Credit

For people who are not able to borrow money from bank due to low credit grade, it is possible for them to get guarantees through Suretly by only providing simple personal information.

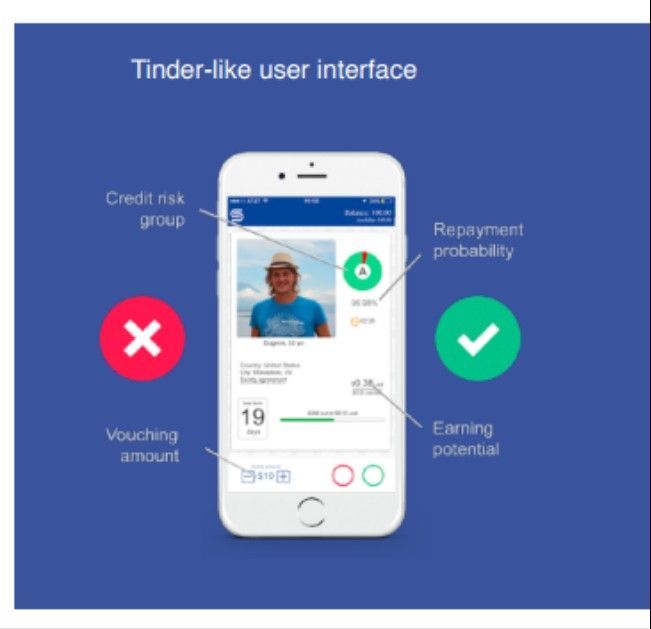

Easy User Interface

.It is possible to confirm basic information, salary, and debt redemption rate of borrower through mobile phone.

Current Status and Future Plan

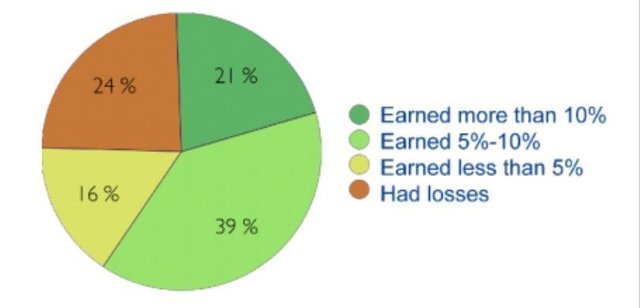

The Suretly is invested by ‘Higher School of Economic’ which is the biggest economic research institute in Russia. The Suretly application launched its beta test version in Russia. As a result, 76% of investors obtained profit.

About 2Q of 2017, it is planning to launch in Kazakhstan, and will have a contract with financial institutes of Russia and Kazakhstan

In addition, it is constantly working on technological and legal parts in order to launch and enter in the Unites States’ market around 3Q of 2017.

All funds from ICO will be used for development of application and new market.

Token Sales schedule

We are planning to execute ICO funding for new market frontier.

Period is July 11th~August 11th 2017. You can buy token through Etherium, Bitcoin, Litecoin, Waves.

The initial exchange rate for 1 SUR token will be 0.1 ETH or equivalent in bitcoin, litecoin or waves. All investors who will purchase SUR-tokens during the first hour after the ICO start will receive 70% bonus, which means that each ETH token will be exchanged for 17 SUR tokens.

After that, all investors who will purchase SURtokens during the next 23 hours will receive 50% bonus.

In the future, the bonus will decrease in a linear progression every day, until it reaches zero.

The creation of new tokens will stop after an equivalent of $10 million USD is raised or after the ICO expiration date.

How to use the Token

There will be a possibility to use all issued SUR-tokens as a method of ensuring guarantee on a granted surety in the Suretly app.

As by agreement between Suretly, Inc and SURcoin pte.ltd, Suretly, Inc. will be transferring 0.2% of each loan secured by Suretly's investors to SURcoin pte.ltd. It will begin doing this on a quarterly basis, after the 3rd quarter following the ICO is completed.

This money will be used by SURcoin pte.ltd to buy tokens from exchanges. All purchased tokens will be burned.

The core team

Eugene Lobachev, CEO

Eugene, founder of Suretly, is a serial entrepreneur and has created multiple startups in the last 10 years. He has two master’s degrees in IT & Economics. https://www.linkedin.com/in/elobachev/

Anna Paulova, CMO

Seven years in marketing & design, two years of experience with SMM & context ads at Yandex.ru, two years of experience in financial lid generation at Krediman.ru.

Svetlana Eydelman, CFO Two years in investment and banking, three years in business consulting, eight years in business development. Completed MBA at the City University of New York and was Trading and Compliance Analyst at New York Stock Exchange

Vlad Zubarev, Business Development & Advising

15 years in software development working at prominent Silicon Valley based start-ups and large corporations such as Cisco Systems as an engineering manager heading large development organizations. 10 years running his own consulting company.

Andrey Zverev, Business Development & Advising

Twenty years of experience in the financial technology and payment processing space. Completed post-graduate courses at Harvard University. Ex-founder of Cashoninternet.com, one of the first fin-tech companies in the U.S. to provide micro loans online.

Eugene Kovalev, Regional Director for Russia and CIS

More than 10 years of experience in management in different federal banks in Russia, worked closely with microfinance organizations to establish online lending in CIS and was responsible for business development, sales and new product launching.

Konstantin Vishnivetsky, Lead developer

14 years of experience in C++, Java, SQL. 5 years in fintech industry. Three years of experience in AI scoring industry

@hca

Nice Job!

Keep the good work up!

Thanks for sharing

Thanks