Some common mistakes which should be avoided while cryptocurrency trading

Whether you’re a crypto expert or just getting your feet wet with investing, there is enough to be aware of when trading your way through the cryptocurrency industry. Unlike in traditional markets, cryptocurrency trading is chock full of nefarious players, volatility, and irrational price movements.

In this article, we’ll teach you about some of the common mistakes in cryptocurrency trading and how you can avoid them:

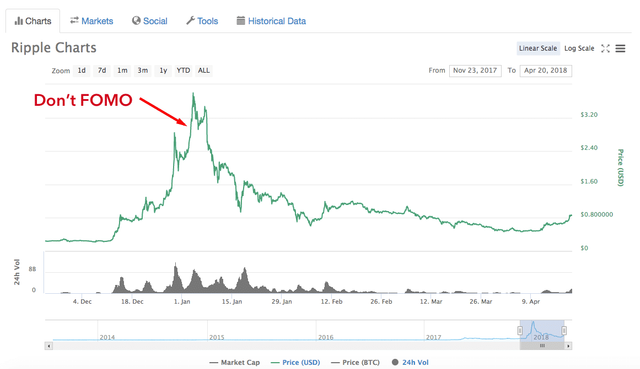

Mistake 1: Chasing Pumps aka FOMO

Probably the most common and most accessible mistake to make in cryptocurrency trading is buying into a coin after it’s already risen a significant amount. Investors that bought into Ripple (XRP) and Tron (TRX) at the peak of their runs in 2017 felt the pain just a few weeks later in 2018. It may be your instinct to throw some money in the ring when you see a coin shoot up 30-40% because it’s “hot.”

Don’t

Extreme increases in price are almost always accompanied by some type of pullback. By the time you hear about a “hot” coin, it’s usually too late. Unless you’ve done your research, believe in the fundamentals of the coin, and want to hold it for the long-term (>1 year), wait until the pullback to invest.

Pump and Dumps

Pump and dumps (PnDs) are a special breed of pumps that are guaranteed to leave you burned. If you see an unknown coin skyrocket all of a sudden, be wary. It’s most likely part of a PnD scheme. We go into more detail about PnDs in this article, butthey’re basically coordinated efforts to artificially drive up the price of a coin (the pump) before selling it to those who FOMO’d in (the dump).When you come across a coin like this, the first thing to check is the trading volume. CoinMarketCap is a great resource for this. Any 24-hour trading volume under $1 million should raise a red flag.

Mistake 2: Not Knowing Your Investments

Don’t just blindly follow the advice of some Twitter or YouTube “guru” for investment picks. Many times, these high-profile individuals are paid to promote certain coins. Even John McAfee, one of the most well-known figures in the space admitted that he gets paid to promote projects. Question the coins that you’re told to invest in.At the bare minimum, you should devote a half hour to researching any project in which you plan to invest in. Check out what problem it’s attempting to solve, the team building it, and the economics of the coin. Has the project partnered with anyone significant? Any notable names as advisors? These are all things you should know.Even a quick Google search could unveil some information that turns what may seem like gold into trash. Taking it a step further, you should ideally read the whitepaper of each project you invest in.

Joining or forming an investment group can do wonders to help with this. It forces you to do research so you can explain your investment reasoning to your peers. It also puts you an environment in which you have to challenge your assumptions as others question your reasoning.

Mistake 3: Selling at Inappropriate Times

The opposite of chasing pumps, emotion-driven selling is still cut from the same cloth. It’s difficult, but you need to stay level-headed when trading – keep emotions out of it. Time and time again, coins have dipped down double-digit percentages before rocketing to 200-300% gains.When a coin you own starts to drop in value, before you sell, re-evaluate your position. If you invested because you believe in the coin’s fundamentals, there are a few questions you can ask yourself:

- Have any of the fundamentals changed?

- Were there any announcements that would have affected the price?

- Have you stopped believing in the long-term vision of the coin?

If your answer to all of these questions is “No”, then consider holding on. This strategy becomes much easier when you follow the golden rule of cryptocurrency trading: Don’t invest more money than you’re comfortable losing.On the other side of this equation, seeing some solid gains may also tempt you to sell. Although taking profits is wise, you may want to avoid selling your entire stack. Depending on the situation, the coin could rise further. A popular trading strategy is to take out your initial investment while keeping your earnings invested in the coin after gaining a certain percentage. This decreases your downside risk while still exposing you to the upside potential.

Mistake 4: Being Uninformed

In a market that moves as rapidly as cryptocurrency does, you need to stay up-to-date with industry news. Without tuning in weekly, or even daily, the investment tides could shift without you even knowing.

Great advice @hamzayousaf. What I want to add here is that just hodling all of your coins is also not a great idea. BTC has crossed $9000 four times. Those who just holded it, would have profited more, if they also traded some of their BTCs, as in sell at peaks and buy at dips. Some people say the best ratio is 80/20, that is, hodl 80% of your coins while trade with the rest 20%.

We heard about bitcoin's incredible bull run if we'd bought some a few years ago, we would be a lot richer. Well, it turns out some people did just that. Those who bet big on bitcoin in recent years are now getting more benefits.

It is accepted that crypto trading is confusing and intimidating, even measuring one's profit can be tricky but if we go according to a suitable strategy we can get benefits.

Very informative topics and helpful to stay and connect the better in crypto market ..

Thanks

Thanks

These are the great tips regarding crypto trading. we have to follow the rules of the game. It is very volatile & risky market. 80/20 Pareto rule is very important.

Thanks brother @hamzayousaf for such a handy post.

Yes cryptocurrency market going is very volatile and risky, The volatile nature of the cryptocurrency market might seem daunting for individual investors. While some believe Bitcoin to be the next global currency, others remain weary.

Those are some great tips for those who trade and invest in crypto. The biggest mistake many people are making is not doing research and listening to youtube gurus. Look at what happened with bitconnect. I advise people to read the whitepapers and understand the coin before investing :)

Yes some of the people haven't got the clear vision of using and trading cryptocurrency. Every new user needs to take the time to learn about how the crypto market works

This post, with over $50.00 in bidbot payouts, has received votes from the following:

upme payout in the amount of $61 STU, $106 USD.

For a total calculated bidbot upvote value of $61 STU, $106 USD before curation, with approx. $15 USD curation being earned by the bidbots.

This information is being presented in the interest of transparency on our platform @hamzayousaf and is by no means a judgement of your work.

Thanks for pointing out the common mistakes. Maority of new user commit the same mistake. It is better to analyze yourself before investment. Thanks for valuable suggestions @hamzayousaf

To build a solid trading foundation, new users of trading need to take the time to learn about how the Forex market works or any market you're trading and really get a solid understanding of all the jargon, etc before they actually dive in and start learning a trading strategy.

Wonderful post. Thanks for sharing.

Thanks dear

Thanks dear

there have no dout that we keep those major mistake on cryptocurrebcy..

its need to follow your ide ,,,mainly i appreciated investing which is great way to raising future

Every new user have the clear vision necessary for a persistent and patient approach to trading

really great information for crypto trading

its necessary to know those common mistake solve for make a great future ..

thanks a lot for inform those point ,if we invest its become great profite no dout.

thannks a lot dear sir

Yes of course it need to learn. many beginners began to day trade, jumping onto the new online trading platforms without applying tested stock trading strategies and they fail because they don't know the market up and down value