How to set up your crypto arbitrage bot with HaasOnline TradeServer

What is a crypto arbitrage bot?

A crypto arbitrage bot is a tool you will use that executes a series of predefined instructions based on your user-defined settings. Our custom and trading bots can vary widely in performance and complexity, but the basic premise is the same — the bots will try to take advantage of price spread discrepancies between crypto pairs on select exchanges where the opportunity has been identified.

We’ve previously written about crypto arbitrage in a prior published article, which will give you a much greater detail into the background of this proven trading strategy.

What are they different types of crypto arbitrage?

Inter-exchange arbitrage

Our crypto arbitrage bots typically take advantage of market discrepancies between crypto pairs on different exchanges. A pseudo example of this would be buying Bitcoin ($BTC) from Bittrex and selling it for profit on Binance. The basic arbitrage strategy generates profits from price differences between the exchanges that have been identified to have profitable arbitrage paths. Historically, these inefficiencies have proven to be significant when identified and executed on quickly.

Intra-exchange or triangular arbitrage

There’s another variation of crypto arbitraging, which is it’s riskier cousin commonly known as triangular arbitraging. With this strategy you would buy three different assets on the same exchange. For example you might buy 0.5 BTC, exchange that for 50 ETH, and then finally exchange that for USDT and net a profit. There’s a lot more moving parts, however when designed and executed properly has the potential to generate profitable trades.

Configuring your HaasBots to execute crypto arbitrage

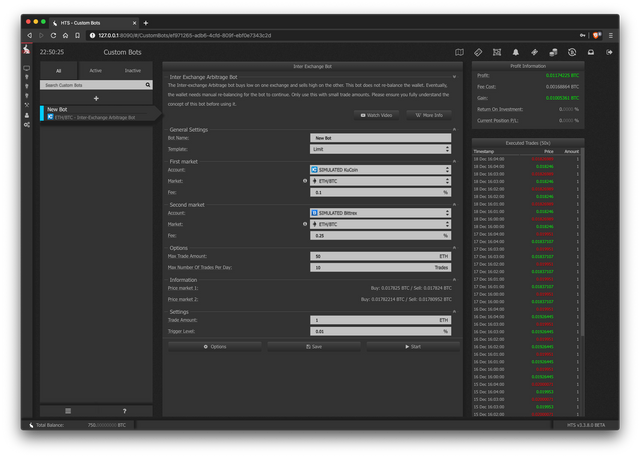

Using our legacy crypto arbitrage bots

Legacy Custom HaasBots

Our legacy trading bot framework is a great choice for traders looking to use the simplicity of having limited configurable settings. This is a great way to start to familizare yourself with crypto arbitrage as you can full backtest with historical data or run it on all your spot trading exchanges in real-time with simulated trading.

- Login into HaasOnline Trade Server

- Navigate to “Custom Bots” from the left-hand menu

- Click on the “+” icon to add a new trade bot

- Select “Inter-Exchange Arbitrage Bot” from the drop menu

- Give it a unique name

- Select the simulated or live exchange to use with this arbitrage bot

- Click “Add Bot”

- Select your desired order type

- Configure your primary market first

- Configure your secondary market

- Define your arbitrage options and trade setting

- Click “Save”

- You’ve created your very own crypto arbitrage bot. Now use the options section to backtest and run simulated trades and fully test your current settings.

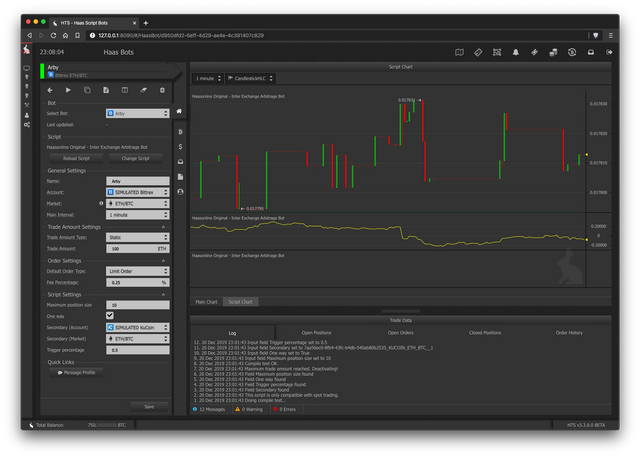

Using next generation crypto arbitrage HaasBots running on HaasScript

HaasScript powered Arbitrage HaasBot

Since this automated trading script leverages HaasScript you can not only view the code for the script, but also modify everything in it. This means you can add extra validation, triggers, alerts, and much more.

- Login into HaasOnline Trade Server

- Navigate to “Haas Bots” from the left-hand menu

- Click on the “Add bot” button to add a new trade bot

- Give your trading bot a unique name

- Search “Arbitrage” in the script library

- Select the “Original HaasOnline Arbitrage Bot”

- Similar to our legacy arbitrage bot, you will need to configure your primary market and desired crypto pair:

- You will need to define your interval, which is the time in-between chart price checks the script will use

- Enter the amount you want to use with this trade bot

- Select your specific order type

- Define a fee percentage to use with backtests and simulation

- Set the max position you want your arbitrage bot to use

- Specify whether this bot should only execute one way

- As always backtest and test your arbitrage bot with simulated trading to iron out any bugs* If you want to modify the script head over to the “Script Editor” in the left-hand menu, make your changes, and retest.

Risk to consider and avoid when possible

Settlement times

It is important to know the average settlement time for the selected exchanges you are using. This will help with rebalancing and help define timing when markets have higher than normal traffic.

Fees

Fees can quickly eat up your profit margins and should be one of the first things taken into account while developing a successful crypto arbitrage strategy. These fees should include withdrawal, network, maker, taker, and any other fees the exchange may impose.

Market liquidity

If you’ve identified a crypto pair on an exchange with low liquidity, you won’t be able to enter or exit positions fast enough to take advantage of the spread. Use a HaasScript powered arbitrage bot to add extra checks for exchange volume.

Broadband connectivity issues

More often than not your residential broadband connections will experience intermittent outages or spikes in latency. This is why we recommend using a virtual private server that is geolocated as close as possible to the known locations of your exchanges.

Hardware or software issues

Using hardware that’s not meant to be put through constant stress and combined with poor conditions like heating or running several high-intensity applications in parallel will drastically degrade an automated trading engines ability to perform.

Final thoughts on using crypto arbitraging strategies

While this strategy is popular and reliable with traditional markets like Forex, it’s still extremely risky with cryptocurrency due to a combination of the risks mentioned above. Make sure you’ve done your due diligence and understand how this strategy works as well as understanding the intricacies of how HaasOnline Trade Server will execute the strategy.

Originally published at https://www.haasonline.com on January 15, 2020.

Congratulations @haasonline! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!