Bitcoin’s Breakdown Will Take ‘Weeks, If Not Months’ to Rebound, Says Fundstrat Analyst

Bitcoin’s Breakdown Will Take ‘Weeks, If Not Months’ to Rebound, Says Fundstrat Analyst

Bitcoin’s Breakdown Will Take ‘Weeks, If Not Months’ to Rebound, Says Fundstrat AnalystNEWS

lt will take “weeks, if not months” to repair the “technical damage” caused by the recent collapse of Bitcoin (BTC), according to a Fundstrat Global Advisors analyst, Bloomberg reports today, Nov. 15.

In a note to clients yesterday, cited by Bloomberg, Fundstrat’s Rob Sluymer predicted that Bitcoin’s collapse yesterday has pushed crypto markets into a “deeply oversold” area, while “longer-term technical indicators aren’t so favorable.”

Sluymer concluded that Bitcoin will be able to support a “multi-month rally,” but only after the “significant” damage done this week has been overcome:

“This week’s breakdown produced significant technical damage that will likely take weeks, if not months, to repair to create a durable enough price ‘structure’ to support a multi-month rally.”

Yesterday, the largest cryptocurrency Bitcoin dipped below the $5,600 price point for the first time since October 2017, breaking longstanding recent support around $6,000 and hitting multi-month records of volatility.

A trader at eWarrant Japan Securities K.K. in Tokyo, Soichiro Tsutsumi, told Bloomberg today that the loss of $6,000 support looks like a “dangerous sign” for industry players, especially the ones with “business models reliant on a client pool.”

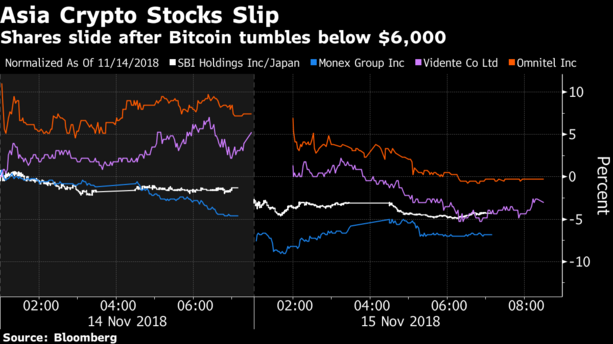

The recent crypto market slump has also reportedly caused a decline in the shares of crypto-connected companies, including Japanese SBI Holdings and Monex Group. Both Monex Group, owner of crypto exchange Coincheck, and SBI Holdings suffered a slump of more than 2 percent to close at two-week lows in Tokyo, Bloomberg reported.

Impact of Bitcoin’s slump on Asia Crypto Stocks. Source: Bloomberg

Fundstrat’s analysts has subsequently commented that the year-end market trend is “stressed, but not broken,” according to a tweet of CNBC journalist Carl Quintanilla. According to Quintanilla, Fundstrat claimed that they expect the “sectors hit the hardest to lead into YE,” which will lead to growth of stocks.

Earlier in summer, Fundstrat’s head of research Tom Lee reiterated his prediction that Bitcoin will trade between $22,000 to $25,000 by the year’s end. Most recently, Lee expressed content with the recent stability of Bitcoin, claiming that he expected its volatility to be much higher.

In early November, Galaxy Digital CEO Michael Novogratz claimed that Bitcoin has to “take out $6,800” in order to hit $8,800-9,000 by the end of the year. He also predicted that the biggest coin could hit “$20,000 or more” in 2019.

#BitcoinNews

#Cryptocurrencies

#Japan

#ASIS

#BitcoinPrice

#Markets

#Stocks

#Predictions