Analysing trading scenarios using historical data

I shared my ideas about portfolio rebalancing and started testing out different scenarios using historical data. I've been working on some scripts to help me do some calculations, the scripts keep getting better allowing me to perform more tests. Maybe someday the scripts will be mature enough to share with others, but that is not yet the case.

For these tests, I used a dataset going from Jan 1st, 2017 until Nov 23th, 2017 for 4 cryptocurrencies: BTC, ETH, LTC and ZEC.

I assumed a starting budget of $2000.

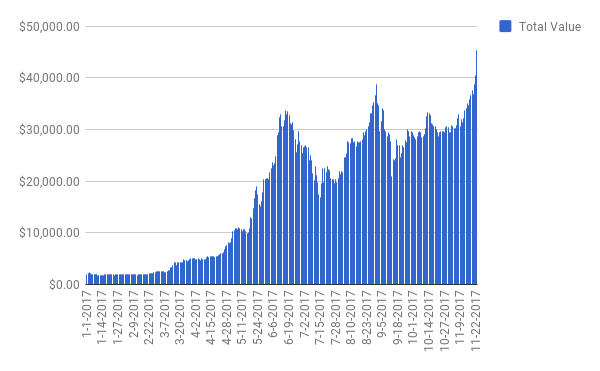

Use Case 1: Even Distribution, Untouched

If we distribute our budget evenly over each coin (buy $500 worth of each coin or BTC 0.5008363968, ETH 61.1995104, LTC 110.864745, ZEC 10.31565917), this would be the result today:

.png)

In other words, if we had invested $2000 and didn't touch our portfolio until today, the value today would be $45,415 (22,707% increase).

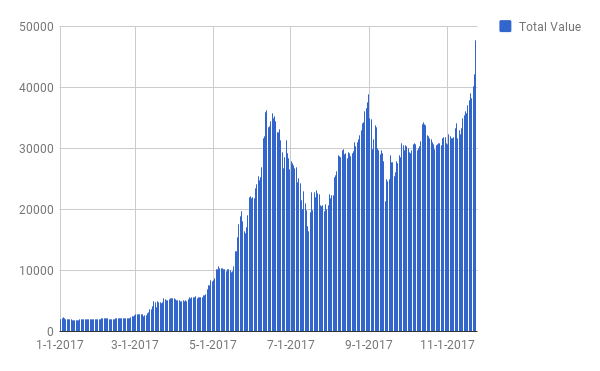

Use Case 2: Weighted Distribution, Untouched

For this I used the following portfolio distribution:

- BTC 35%

- ETH 30%

- ZEC 25%

- LTC 10%

So let's start with the same budget of $2000 on January 1st 2017 and divide it using our distribution ratio (BTC 0.7011709555, ETH 73.43941248, LTC 44.34589, ZEC 10.31565917).

This would be the result today:

.png)

In other words, if we had invested $2000 using our portfolio distribution and didn't touch our portfolio until today, the value today would be $47,694 (23,847% increase)

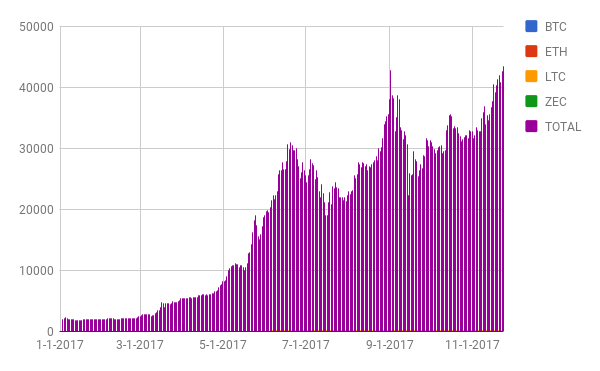

Use Case 3: Weighted Distribution, Reinvested Profits

In this scenario, I tested what would happen if I would take the profit (if any) from the best performing coin that day and invest the profits into the lowest performing coin.

For example, if BTC would go up $50, I would sell $50 worth of BTC and buy more of the least performing coin (because this one got cheaper).

.png)

In other words, if we had invested $2000 using our portfolio distribution and reinvested the profits today, the value today would be $47,187.40.

Use Case 4 Weighted Distribution, Rebalanced Profits

In this scenario, I tested what would happen if I would take the change in distribution from the best performing coin that day and invest the profits into the lowest performing coin.

For example, if my value of BTC would go from 35% to 37%, I would sell 2% of my BTC and buy more of the least performing coin (because this one got cheaper).

.png)

In other words, if we had invested $2000 using our portfolio distribution and reinvested the profits today, the value today would be $43,089.53.

So far, there isn't much difference between even and weighed distribution and rebalancing didn't give much better results either.

I decided to have a look at what would have happened if we had put all of our $2000 on one cryptocurrency

Use Case 5: Everything on BTC

Buy $2000 worth of BTC on January 1st, 2017.

.png)

While this was still a good investment, the result is only $16,534.99 .

Use Case 6: Everything on ZEC

Buy $2000 worth of ZEC on January 1st, 2017.

.png)

While this was still a good investment, the result is only $14,291.73 .

Use Case 7: Everything on LTC

Buy $2000 worth of LTC on January 1st, 2017.

.png)

The result is for LTC is $34,576.50.

Use Case 8: Everything on ETH

Buy $2000 worth of ETH on January 1st, 2017.

.png)

The result is for ETH is $116,257.04. Now that is a nice profit!

Conclusion

First of all, I expected to see a bigger difference between weighed and even distribution of my portfolio. Also, portfolio rebalancing didn't seem to bring the results I had hoped for. Maybe my script isn't smart enough yet. Also, I only used one dataset, I should test over multiple timeframes and compare results.

Another thing you can see is that the 2 biggest winners are Litecoin and Ethereum while Bitcoin and ZCash are performing relatively less good. But if you read most articles and comments on SteemIt and Facebook, most people feel happy about BTC performance and complain about ETH and LTC.

IMHO, this is because they only look at absolute numbers instead of the percentage. And probably a lot are also late to the game and only look at the short-term gains.

I hope these calculations offered people some perspective. If possible I will keep improving my scripts to do more analysis and include more coins. Currently there is still a lot of manual work to import the data that I need to try and automise.

Disclaimer: Be aware that I'm just a guy on the Internet writing about stuff that nobody really knows what is really going to happen. Do your own analysis and take responsibility for your own decisions. I'm just sharing my thoughts and might be completely wrong about this.

Have a look at my CryptoTrading Series

In Part 1 I talked about choosing your portfolio. We did everything on paper before actually buying any coin.

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-1-choosing-your-portfolio

In Part 2 I explained how to buy your first coins using Coinbase.

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-2-where-to-buy

In Part 3 I discussed how to use Exchanges.

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-3-using-exchanges

In Part 4 I showed how to transfer Bitcoin from Coinbase to your Bittrex wallet

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-4-transferring-coins-to-wallets

In Part 5 I wrote about what to look for when choosing a CryptoCoin to invest in

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-5-what-to-look-for-when-choosing-a-cryptocoin-to-invest-in

In Part 6 I discussed how to focus on the macro instead of the micro

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-6-focus-on-the-macro-instead-of-the-micro

In Part 7 I wrote about portfolio rebalancing

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-7-portfolio-rebalancing

In Part 8 I did some initial analysis using historical data

https://steemit.com/cryptocurrency/@gorik/cryptotrading-for-beginners-part-8-analysing-portfolio-performance-using-historical-data

Anything else you want me to cover? Let me know in the comments or join my free group on Facebook

I think rebalancing is a good approach, because this method is automatically reduce the risk.

For example, suppose we have $700 of bitcoin and $300 of altcoin. If bitcoin's value has a big drop, while altcoin's value remain steadily, our portfolio may change to $300 of bitcoin and $300 of altcoin. The bitcoin has 57% drop, and the total value has 40% drop.

If we want to recover our loss, we must wait until bitcoin has 133% growth. But if we sell part of altcoin to buy some bitcoin to have it's ratio rebalance to the initial state, maybe we just need 30% growth of bitcoin then our loss will be recovered.

Good☺