Ethereum Price Technical Analysis

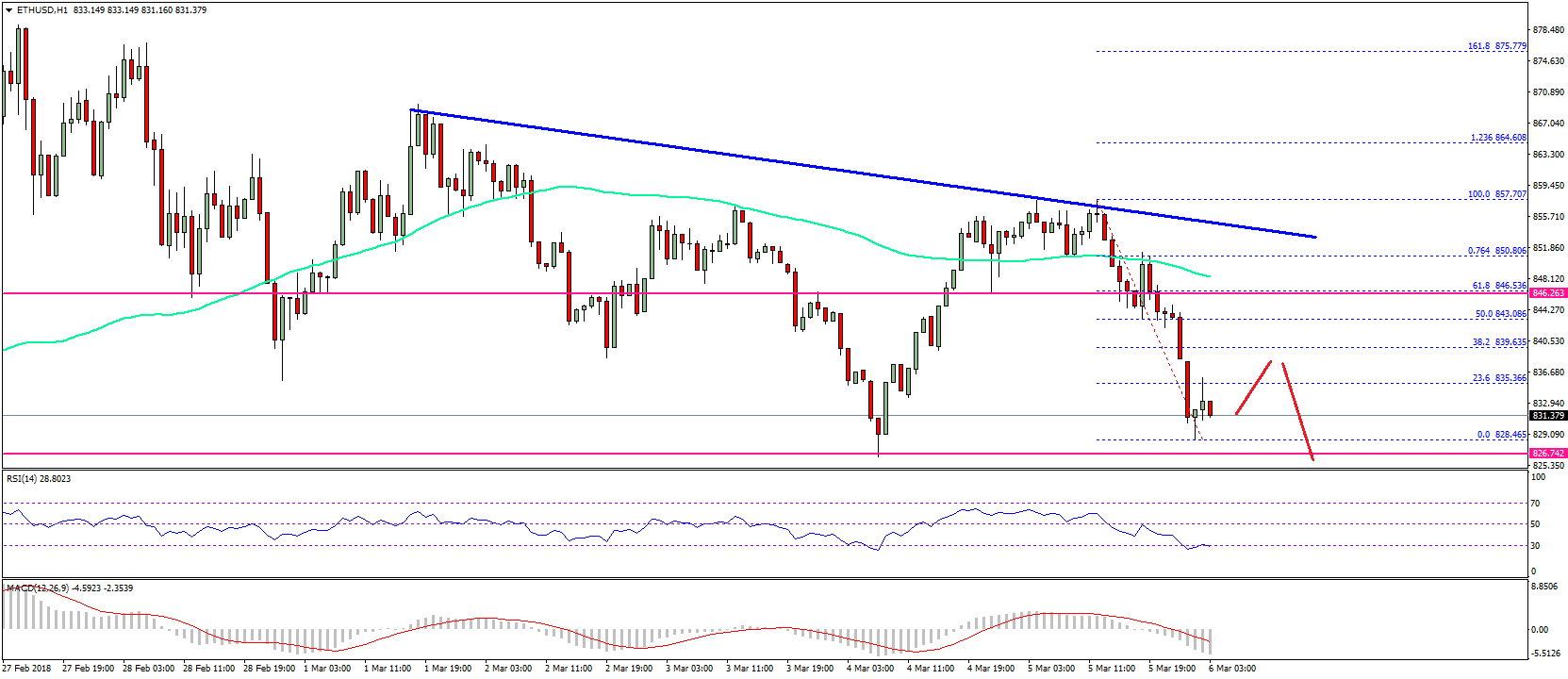

The price of Ethereum has entered a downward trend against Bitcoin and Dollar. ETH / USD may fall even further by breaking support at $ 828-830.

As of yesterday there was a good exit up to $ 850. However, the price lost momentum and could make $ 857 peak. A trend started in the downward direction and the price broke 850 support.

The last decline ended with a daily dip of $ 828. Right now, the price is making a correction over $ 828. The last $ 857-828 downward trend was 23.6% Fib. tested. However, it seems that he will not be able to catch up with the main trend again and reach the value of $ 850. A resistance of $ 843 is seen at 50% fibonacci correction of 857 * 828 last drop trend. Moreover, there is a bearish trend line resistance on the 1-hour chart at $ 855.

The price of Ethereum has reached a peak of $ 857 on a short-term basis and has fallen afterwards

On the 1-hour chart, there appears to be resistance at $ 855 on the bear trend line

The price is currently trading in the $ 828-830 band and is likely to fall further

Thus, we can predict that somebody ready for sale at a level of 840-850 dollars will be waiting for an upward direction. Below is a support level of 826-828 dollars. If the 826 dollar support breaks, the price could go down to 800 dollars.

Hourly MACD - MACD is gaining momentum in the month of the month.

Hourly RSI - below RSI 50

Main Support Level - $ 826

Main Resistance Level - $ 850

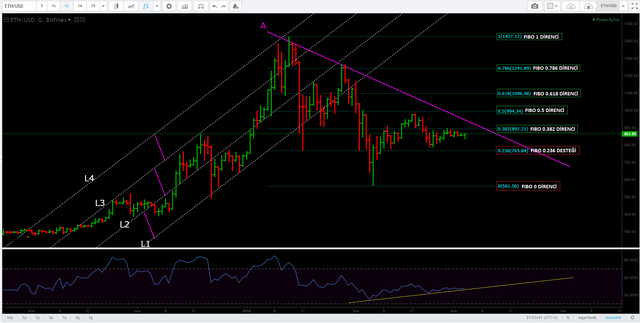

I think ETH is positive for the medium and long movements of the continuation of the horizontal motion in these levels for a while. The elapsed times at these levels will lead to the formation of a support zone as the upward movements continue. If it is, the FIBO is just below 0.382 ($ 892). In addition, the falling trend is approaching. If the FIBO 0.382 ($ 892) level breaks down, the resistance will fall into a resistance to the A pair. The uptrend of A trend and its persistence is very important in terms of ascension. If the trend breaks down, the FIBO 0.5 ($ 994) level will be on the agenda. This may lead to a trend towards a trend towards future sales. If the trend is not lowered, we can assess that there is an approval for the ascension (note that the money technique always shapes). If FIBO is above the 0.5 ($ 994) level, the FIBO should be at 0.618 ($ 1096) as resistance. FIBO 0.236 ($ 765) will be our most important support point if market conditions will be adversely affected. If you pay attention to this level, you will see that you work as a very good resistance and support. And you see that the RSI indicator keeps moving with the yellow trend support that I have drawn. Under this trend, there is a potential to increase sales pressure even if it is short-term. However, when the value is around 48, I can say that the stability is still going on.

The information and comments contained herein are not investment advice. Analyzes and evaluations I have done should be based on technical data.

You got a 3.35% upvote from @upmewhale courtesy of @gokselgok35! Earn 90% daily earning payout by delegating SP to @upmewhale.

Agree. Could go to 600$ in a hurry if btc continues the freefall

it's going to be inversely correlated with btc for now.

We will see in next few days