My Top 5 cryptocurrency rules for beginners!

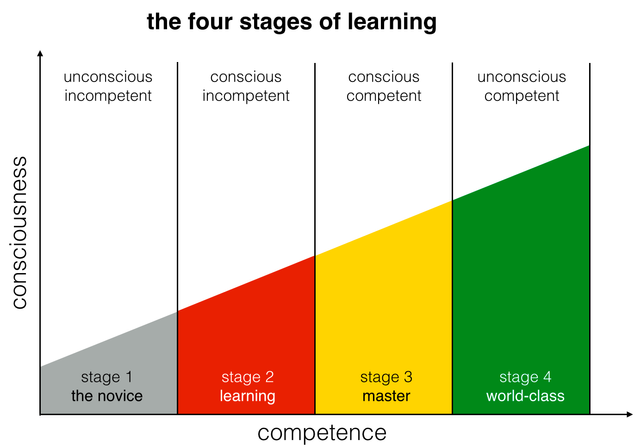

There are four levels to learning :

- Level One Unconscious incompetence. You are just starting out and have no experience on the field. All you know is that you want to get involved. This is the most scary level to be at, but non the less a crucial step in the process.

- Level Two Conscious incompetence. You have just started learning. There is a lot of information that you need to go through. Do your best to soak up as much information as possible while avoiding bad resources.

- Level Three Conscious competence. You have learned a lot and you are performing in the best way you can. You have formed your own opinions on the matter, but you need to put all your efforts and mental energy to the task.

- Level Four Unconscious competence. You have performed this task so many times that you can do it without thinking. It requires dedication and persistence to achieve, the true price of becoming a master!

I am prefacing with the levels of learning to make everyone understand that we are all here to learn regardless of how good we think we are.

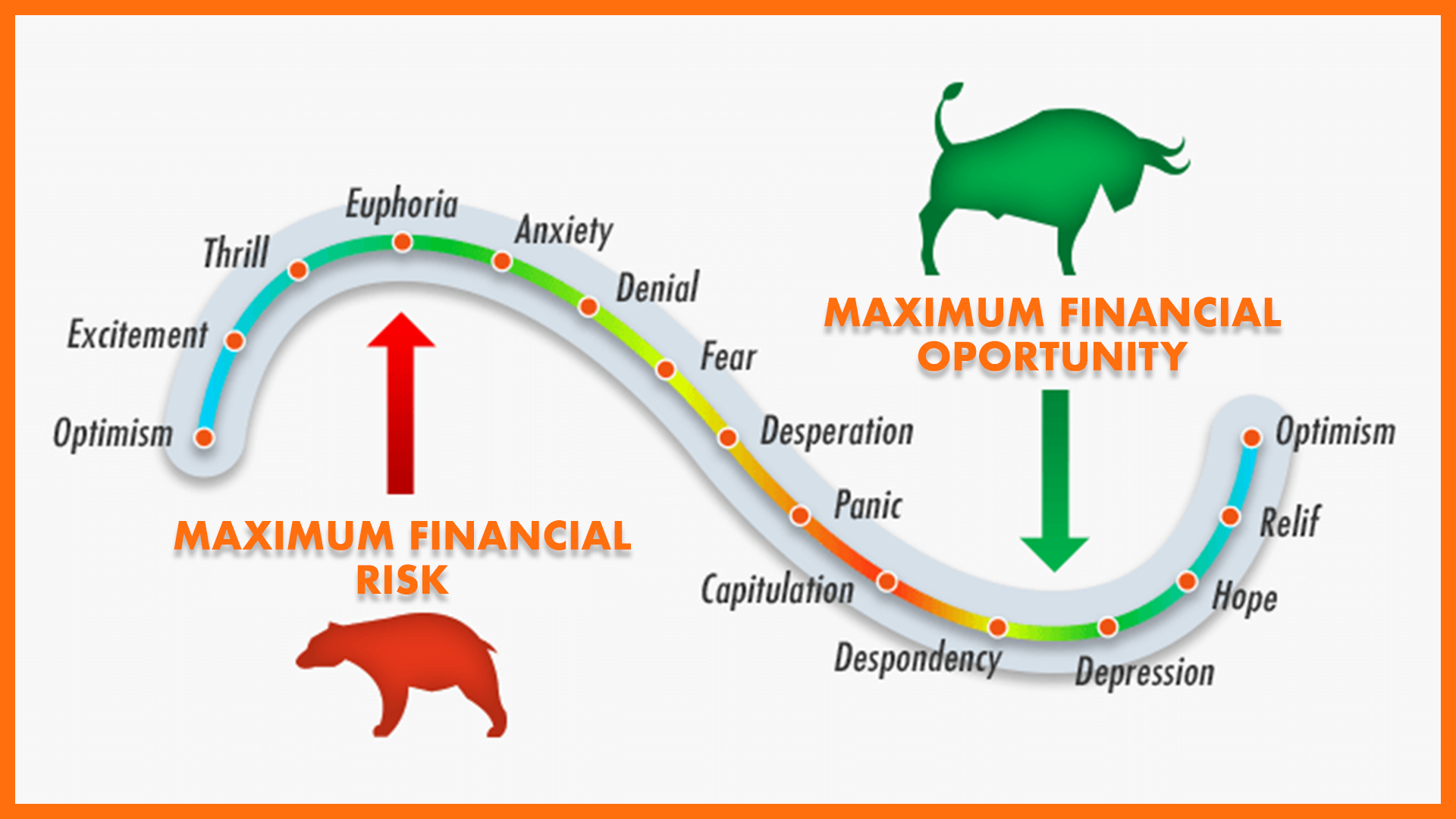

- Control your emotions. Don’t let your emotions control your actions in this space. What do I mean by that. Looking at charts, checking blockfolio / delta on your phone constantly, keeping up to date with news…it’s very stressful. The first month I got into crypto, I experienced first hand what crypto feaver is. Loosing sleep, setting 30m timers to check the markets…. it’s endless. I was beating myself up if I didn't exactly sell at the local highs or buy at the local lows. It’s something that you don’t want to experience -yet, it happens all the time.

- Diversify your portfolio. I am sure that some of you have bought at a bad point. Constantly waiting for the price to surpass that point and sell at a profit, but the price just keeps going down. Now you are faced with a dilemma : Sell at a loss, or become a bag holder.

Bitcoin as you have noticed, is by far the most expensive coin. It has a market dominance of 30% and all exchanges use it as a pair. Because of that, most coins follow the way bitcoin moves. Bitcoin goes down you gonna see the top 100 coins follow suit. Bitcoin moves sideways and all the other coins become independent forming their own track. Imagine a scenario where Bitcoin goes up but your holdings keep going down -that could happen. Maximise your chances of profit by investing in multiple projects that have established themselves over the years and you will be rewarded (in the long term). - Learn the basics of Technical Analysis (TA). Understand candle charts, key price levels, support/resistance and you will have a competitive advantage in this space. Do as much research as possible and take advice with a grain of salt. You will inevitably find people online that have succeeded. Do not let a single get rich quick idea pass your mind. which brings me to my next point.

- Patience. I cannot stress how important patience is. You need to understand that everyone is here to make profit. People want to buy low and sell high. It’s a never ending cycle and you can take advantage of it. There will be cases where you will see a coin increase in value very rapidly, 30+% increase. People are waiting to take profit at the top of that hype, creating a pullback effect. Which will make the price drop by a significant amount. That might be a good entry point for you on the short term perspective. But always think as a long term investor. What goes up must go down and vice versa. TA will also help you in this. Plan ahead of time and take the opportunities that you deem worthy.

- Take profit. I have fallen victim of greed a couple of times in the past. Prices are skyrocketing -I know that it is not going to be sustainable for long, but I wait non the less to take out my position at the most profitable point. Of course there is no way to determine the top / bottom, although -you can always determine if you are on a profitable stage. Take a sub 35% out and see what you are going to do with the rest.

There are no guarantees in this game, better play safe until you can afford not to. The golden rule of cryptocurrency investing :

Only invest what you can afford to loose.

Chat with me in the comments down below!

Cant stress the importance of taking out profit every so often. It is too easy to caught up in the excitement consecutive green days. But that profit isn't officially yours until it is exchanged back into fiat is you are a casual investor/speculator OR back in to Bitcoin,Ethereum, NEO or whatever you think will be the Crypto that will become the or one of the de facto cryptocurrencies.

Also decisions don't have to be an All or Nothing. Not everything has to be a monster call. Especially if you are new into the crypto scene. You are going to make mistakes it is inevitable.

I've been caught out buying a Circuits of Value at an ATH. I had done no research on it I bought some just because it was featured as a top gainer on Bittrex. Guess what it went straight back down and I was bag-holding and sold at a loss. It recovered a couple months later. One perhaps arguably two mistakes their but it only cost me about $15. About 1% of my worth in crypto at that time. I've recovered it back since then.

Consider mistakes like that an idiot tax.

I see people constantly reinvesting their earning back without ever taking profit out. I thought that it defeats the purpose of investing. Good to see that people learn from their mistakes, great comment @solanova.

Congratulations @georgeargyrousis! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @georgeargyrousis! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!