The SEC cryptocurrency question is really WHEN, not IF, and what the effect will be on prices

Coinciding with the massive recent run-up in the market capitalization of cryptocurrencies has been an increase in mainstream media attention. In 2016 the trend was just starting, with many top news organizations covering Etherium and the launch of an increasing number of altcoins.

https://www.nytimes.com/2016/03/28/business/dealbook/ethereum-a-virtual-currency-enables-transactions-that-rival-bitcoins.html?ref=dealbook

http://www.foxnews.com/tech/2016/03/30/look-out-bitcoin-here-comes-ethereum.html

https://www.wsj.com/articles/cryptocurrency-platform-ethereum-gets-a-controversial-update-1469055722

The June 2017 flashcrash on GDAX was also covered extensively in mainstream media outlets.

http://www.cnbc.com/2017/06/24/cryptocurrency-exchange-to-credit-traders-for-ethereum-flash-crash.html

http://fortune.com/2017/06/26/coinbase-flash-crash/

https://blogs.wsj.com/moneybeat/2017/06/23/ethereums-flash-crash-shows-hazards-of-trading-cryptocurrencies/

https://www.bloomberg.com/news/articles/2017-06-30/the-45-millisecond-ether-flash-crash-prompts-search-for-remedies

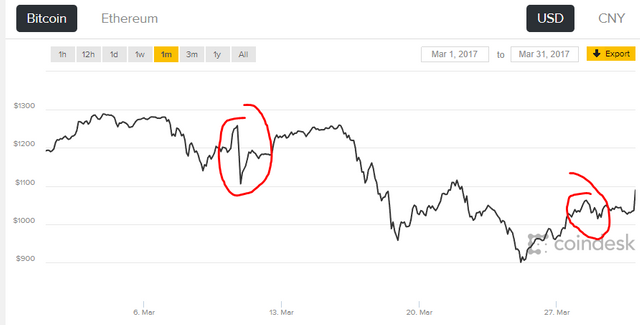

This attention comes with both positives and negatives for the industry. Media outlets around the world have started talking about its increase in value, its possible connection to the seedy underworld, and sometimes even mention the word 'blockchain.' It is likely also drawing the attention of the SEC, and moving it up the long 'to-do list' of regulatory challenges. The Winklevoss twins' Bitcoin ETF (COIN) was shot down by the SEC in March 2017, sending the price of BTC 18% lower, from $1350 to $980. A second proposed ETF named SolidX was rejected later in the same month, and BTC showed more resilience, dropping only 1.5%

http://www.financemagnates.com/cryptocurrency/news/sec-rejects-solidx-bitcoin-etf-listing-nyse-price-drops-1-5/

http://www.reuters.com/article/bc-finreg-bitcoin-ico-idUSKBN1942HF

https://cointelegraph.com/news/sec-is-still-eyeing-to-regulate-the-ico-market

The SEC is currently evaluating an ETF for ether, filed in July 2016 and named the TherIndex Ether Trust. The backers are hopeful for more leniency from the SEC, as Etherium was not designed as a store of value. However, many of the same online exchanges and infrastructures used to trade BTC are used to trade Ether, giving the SEC pause.

https://cointelegraph.com/news/bitcoin-etf-reconsidered-by-sec-ethereum-etf-version-may-be-approved

However, these instances weren't the first run-ins with US regulators for cryptocurrency. In March of 2014, the U.S. Internal Revenue Service released guidance on how to treat "Virtual Currency," concluding it should be treated as property for tax purposes. The price dipped briefly, but quickly recovered. https://www.irs.gov/uac/newsroom/irs-virtual-currency-guidance

Even more recently, two U.S. Congressman write the IRS Commissioner a request for additional guidance on reporting cryptocurrency transactions.

https://www.cryptocoinsnews.com/u-s-lawmakers-ask-irs-clarify-bitcoin-tax-guidelines/

Regulation from the U.S. is coming, but how the market will react really is the $1b question. So far it's been able to shrug off these regulatory sleights, and it's possible the market could even react positivly. Once certainty is included in the DCF valuations of institutional traders, the market whales of hedge funds and pension funds might enter. CalPers alone has $295.1b in assets, with $26.4b in private equity currently.

https://www.calpers.ca.gov/page/investments/asset-classes/asset-allocation-performance

Gaúcho from South America ? Brazil Uruguay or Argentina ?

Congratulations @gaucho! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Good article