Precious Metals Versus Cryptocurrency. Enemies or Allies?

Lately I’ve found myself consistently getting into debates or arguments on social media over cryptocurrency and how superior precious metals are due to them being tangible, physical and having a long history as a store of value. This split in the “Anti-Centralised Banking” community was epitomised a while ago when heavyweights Max Keiser and Peter Schiff clashed on the issue. Precious Metals advocates seem really quite angry about this years crypto bull market. I think its sad as we are all essentially doing battle with the same enemy. Anyway here are a few points that I believe make a very compelling case for crypto in this debate ........

Firstly I think Crypto does itself no favours by adding the word “currency”. Many applications on the blockchain will be payment systems and forms of digital currency but the overwhelming amount of projects are reinventing internet applications with the added aspects of decentralisation and security. Steemit is a prime example , rewarding shareholders for content and contribution on social media. D-tube is a decentralised version of youtube where advertising revenue cannot be cut because your videos don’t fit the owners ideas of whats politically correct. Again your rewarded for content, this is real free market. Presearch is an exciting project at ICO stage which aims to be a decentralised search engine, owned by the users that will not (like Google) decide which content appears at the top of their search pages.

Precious metals have remained quite steady in value over the last few years, imagine if you had bought shares in Facebook (not that this was an option as its centralised ownership) when it first began, a company now valued at 437 Billion dollars. Crypto gives you the chance to benefit financially but also to be a part of something ethical. Helping to fund internet projects that put the power and control back into the hands of the masses. I don't see this aspect in buying silver and sticking it away in a safe somewhere.

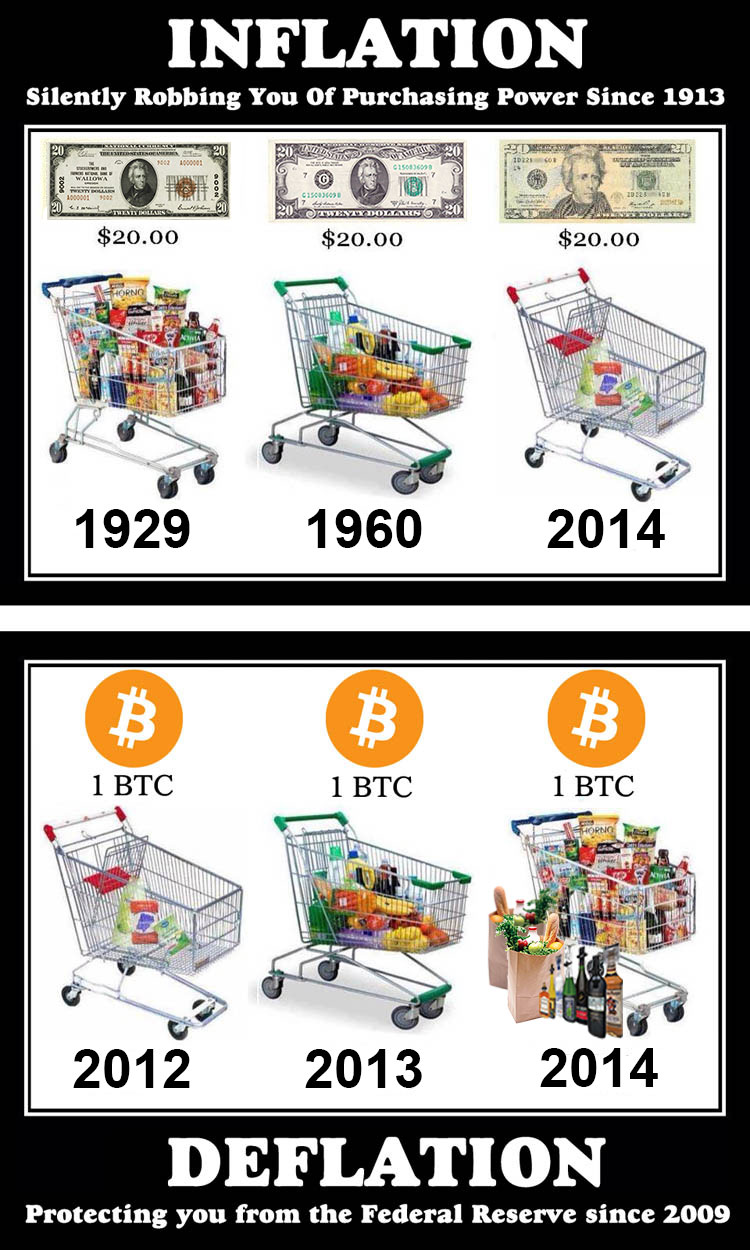

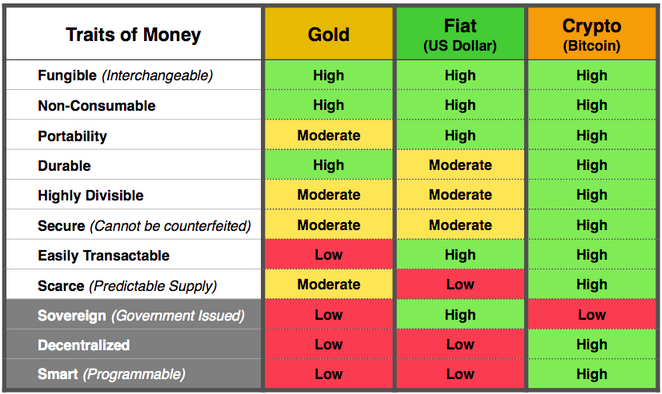

Its not true to say Bitcoin has no intrinsic value as many opponents do. Gold is scarce but so too is Bitcoin, scarcity adds to value but so too can more abstract utilities like convienience. It takes work to produce a bitcoin, energy and a lot of investment in hardware. I believe the average production cost of 1 bitcoin is around $1000. Value is also derived from the cryptography which makes it incredibly secure and from the portability which means value can be sent across the world in seconds and the transparency which allows anyone to view transactions in a public ledger. Conceding that the actual digital Bitcoin is not tangible but gold is we would then have to say there is no value in the hard work involved in digging metals from the ground, no value in an uncrackable top quality safe in which we keep it and no value in transportation that would be needed to take my valuable metal across the world to pay for something. Also no value in a professional bookkeeper to keep track of all transactions.

This is the digital age, its idiotic not to take that fact into account when trying to come up with a solution to mans great problems. Like using a donkey to get to work instead of using a car.

Many alternative media types are convinced that cryptocurrencies are the final step in all out surveilance plan by the state. If all our transactions are there on the blockchain for all to see then Big Brother will have a field day right. This is nonsense, transparency in finance stops the type of criminal banking activity thats all but destroyed the world economy. Instead of a parasitical middle man stealing your wealth you transact completely securely with someone you never met and both parties cannot be swindled as its all out in the open. If however you want completely private transactions then this option is available with coins like Monero and many other privacy coins. Believing Bitcoin is all Blockchain can do is like believing email is all the internet can do.

As for a store of value its undeniable that precious metals have a long history of maintaining purchasing power while fiat currency inflates away. However if you had one ounce of gold in 2010 it would of cost you $1087 ..... today its worth $1335 so you'd of made a $248 profit. Had you spent your $1087 on bitcoin in 2010 at its highest price of 39 cents you'd of bought 2,787 BTC today worth over 11 million dollars. You see this is maths, it really isn’t an argument.

Hardly anybody was astute enough to hold on that long but the possibility of huge gains far outweighs anything ever known. Even if the detractors are right and Bitcoin goes to zero (which it won’t) you have still missed out on the opportunity of a lifetime and I think this is where a lot of the resentment comes. Even Peter Schiff said he wished he had bought Bitcoin low, funnily enough within weeks of him making that statement Bitcoin doubled again so if it wasn't for his blindness he still could of doubled his investment.

Finally the point that makes me chuckle the most is that if the power is cut or if the internet is shutdown only precious metals will have value. I firmly believe we will live through a financial crisis that is worse than anything we have ever seen but does this mean power and internet will disappear? We would also need to collectively forget how these things worked so we can never get them back online. I personally think precious metals confiscation is far more likely than the internet getting cut off. Theres many cases of this in recent western history already but never a case of the national grid being permanently cut off. If this Mad Max style scenario did play out then the only real things worth having are food and water and I very much doubt anyone would trade these life saving commodities for shiny pieces of metal.

Its time for the precious metals advocates to give up these nonsensical arguments and do some real research into Cryptocurrency. Stackers of metals understand what sound money is and understand the central banking criminals that are stealing from them so its surprising more aren’t embracing the age of the blockchain. Nobody is telling you to dump your metals the two can exist together, you wouldn’t go out to the barn and shoot your donkey just because you just bought a shiny new car.

Remember if Mad max doesn’t arrive you might of missed out on the opportunity of a lifetime ..... Again!

I was investing in precious metals before crypto and i've always felt like they were the perfect compliment to one another...if your holding both you are indeed ahead of the game!

Agreed, i don't see why people argue over one or the other when both are still available, anything that turns worthless fiat into something of value has merit in my eyes. thanks for comment

what's good about crypto is that it will allow easy trading of gold and silver in time and makes legal tender laws ineffective and obsolete, it would make much more sense if we could all use gold and silver coinage for large purchases and savings but that would spread the wealth and governments don't really want that