Dead Cat Bounce? Bitcoin worth Recovery may be impermanent

Dead Cat Bounce? Bitcoin worth Recovery may be impermanent

Bitcoin (BTC) is wanting to regain poise when its drop to two-month lows on Sunday, however the recovery can seemingly be impermanent , the technical charts indicate.

At press time, BTC is dynamic hands at $6,825 on Bitfinex up three % from the two-month low of $6,619.

The recovery may be related to extreme oversold conditions highlighted by the relative strength index (RSI) yesterday and will be extended additional within the next twenty four hours.

However, crossing $7,000 during a convincing manner are going to be easier aforementioned than done, because the space round the psychological hurdle is packed with key technical resistance lines. Further, the long period charts have turned pessimistic, thus holding on to gains on top of $7,000 are going to be a challenge for BTC's bulls.

Hence, the recovery may end up to be a dead cat bounce a short lived recovery during a market that's followed by a start of the downtrend.

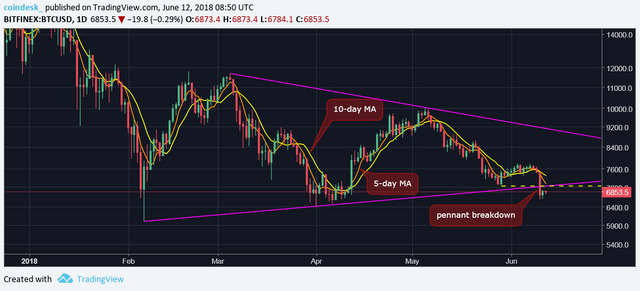

Daily chart

On the method higher, BTC may face stiff resistance at might twenty nine low of seven,040 (former support turned resistance). curiously, the pennant floor (former support) is additionally lined up at $7,040.

Further, a key Fibonacci retracement level is found around $7,000, as seen within the chart below.

Hourly chart

The 38.2 % Fibonacci retracement of the most recent leg down in costs is $7,008.

What's a lot of, the cryptocurrency is troubled to seek out acceptance on top of $6,859 (23.6 % Fibonacci retracement). The failure to beat a decreased Fibonacci hurdle solely indicates however powerful it may be for bitcoin to scale $7,008 (38.2 % Fibonacci hurdle).

The pessimistic moving averages may additionally complicate the recovery in bitcoin costs. The 50-hour, 100-hour and 200-hour moving averages (MAs) ar all trending south indicating a pessimistic setup.

Meanwhile, the long period charts ar biased to the bears too.

Monthly chart

The pessimistic crossover between the 5-month and 10-month MA additionally indicates the tide has turned in favor of the bears.

Weekly chart

As mentioned yesterday, the draw back break of the pennant pattern has revived the market and opened the doors for a drop below the Gregorian calendar month low of $6,000. The pennant breakdown additionally adds credence to BTC's pessimistic shut below the 50-week MA in might.

And, last however not the smallest amount, the charts additionally show there's loads of house to the draw back as a serious support is seen directly at $6,000 (Feb low). A violation there would open up draw back towards $4,496 (100-week moving average) and $3,300 (trendline drawn from the August 2015 low and March 2017 low).

View

A minor corrective rally may be within the offing, however can seemingly run out of steam on top of $7,000.

The broader outlook remains pessimistic with bitcoin seemingly to check $6,000 during a week or 2.

Only a daily shut (as per UTC) on top of the 10-day MA, presently seen at $7,376, would abort the pessimistic read.