Crypto Currencies, Blockchain & ICOs - Beginning of a New Era

In September 2015, the World Economic Forum (WEF) predicted that by 2027 approximately 10% of global gross domestic product would be stored in blockchain technologies. That would be equal to more than USD eight trillion. Driving factors include increasing financial inclusion in emerging markets, disintermediation of financial institutions and an explosion of digitally tradable assets.

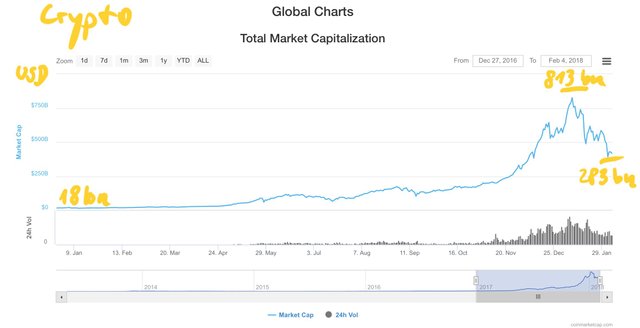

The fast ups and downs of crypto currencies are not for the weak investor nerves

Last year, 2017, the cryptocurrency pioneers evidently set off. The market capitalization of all crypto currencies was increased by a factor of 45 from $ 18 billion in January 2017 to a peak of $ 813 billion on January 7, 2018. That's already 10% of the eight trillion USD predicted by the WEF. Since then, we have become witnesses of high volatility. In just a few days, market capitalization fell to $ 283 billion on 8 February 2018. This corresponds to a decrease of 65%. At times, market capitalization changes by $ 50-100 billion in just a few hours. Nothing for weak investors or even conservative savers. But: who invested a year ago could more than tenfold his investment. What other investment does that produce?

New digital assets

At the same time, industry experts are observing astounding things: Almost out of nowhere, a new kind of corporate financing has become established. Through initial coin offering (ICO), startups and entrepreneurs can raise capital by issuing their own cryptocurrency, replacing traditional equity and debt capital instruments and even innovative crowd investments or crowdfunding. While seven companies worldwide raised $ 28 million from their ICOs in the first quarter of 2017, there were already more than 100 companies in the fourth quarter of 2017, which together raised $ 2.8 billion. That's an incredible hundredfold in just a few months. In Frankfurt, for example, FinTech savedroid, which is well-known for its saver app, is financing its product development "Cryptocurrencies for Everyone" using ICO. And Berlin-based FinTech NEUFUND is currently launching a blockchain and crowd-based financing platform for equity token offerings (ETOs). Both startups give us the hope that we will not lose touch with the innovation leadership in financial services in Germany.

The venture capital investments in the still very young blockchain industry have also increased annually since 2012. Starting in 2012 with a million USD, there were already more than 500 million USD in 2016, and the trend is still rising. Such investments indicate that the forecast of the WEF will be fulfilled.

Prohibitions and hacks cause the crypto currency markets to wobble

Bans on possession or trading of crypto-currencies in a few countries, such as Bolivia, Bangladesh or Morocco, are faced by many neutral countries, such as the US, UK, and Germany, and some, such as Switzerland, Singapore or Malta, are at the forefront of innovation in the financial sector.

Repeated sensational hacks on individual crypto exchanges, such as the recent theft of 523 million NEMs for the equivalent of $ 534 million at the Coincheck Japanese crypto exchange, have shaken the crypto markets. But the resulting price losses were usually made up for in good part within two to three days. A sustained market damage due to the hacks is currently undetectable.

At the beginning of a new era

Everything that we are currently seeing in connection with crypto currencies, blockchain and new digital forms of investment compares favorably to the emergence of a few megatrends over the past 30 years. While Second Life, a virtual world of its own, could not prevail as a fad, the Internet has become indispensable in private and business life today. The early mobile banking and brokerage applications using the precocious WAP technology for mobile phones disappeared as quickly as the turn of the millennium. The next stage of development, the smartphone, has forever changed our everyday lives down to the very core of human communication behavior. The crypto currencies, blockchain applications, ICOs and ETOs, ... are currently giving insight into the world of financial services in ten to 20 years. In doing so, investors can burn their fingers or gain considerable wealth. We are at the beginning of a new era - nothing more, nothing less.