Idiot Takes All(ok most). Be very suspicious of huge short-term winners.

Take a random selection of 20 new traders on Wall Street. Out of that 20, there will probably be at least one that roughly fits each of the following profiles.

Profile One: Bainbridge

From a long line of wealthy businessman. Bainbridge believes in aggressive business moves, his gut instinct, and dedicated gym time. High school dodgeball champion.

Profile Two: Wexler

Immigrant parents who worked their way up from the gutter. Top of his class despite consistently cleaning the family workshop floor until 11pm. Likes to keep his calculator in his pocket so he can stroke it and feel secure.

During their first year of trading, Bainbridge’s networking activities lead him into a life of drinking and partying. Further hindered by a blossoming cocaine habit, his trading habits consist of shoving his entire monthly budget into a new stock recommended by a drinking friend at the end of the month.

Wexler on the other hand, proves to be a diligent student of the trading game. His days are filled with careful research of various companies, followed by careful investments with textbook stop loss points and a well worked out plan, continuously adjusted for new information.

Now, for the sake of a bigger sample size, let’s say our group of 20 traders consists of 10 Bainbridges and 10 Wexlers. After an in-depth analysis of the strategy of each trader, we find that Wexler on average is going to grow his money by 20%. Very admirable for a first-year trader. We find that the haphazard strategy of Bainbridge is on average going to go nowhere with neither a return or a loss. His return on investment is zero.

After six months, the 10 Bainbridges and Wexler’s are taken aside. The most successful trader will be given a large increase in his budget and put on the fast track to management. The odds are that the number one trader will be a Bainbridge.

Why?

The Wexlers have an average return of 20%. The Bainbridges zero. Surely we would expect a Wexler to come out on top? To understand why we are likely to get a Bainbridge, let’s look at some sample graphs for each profile.

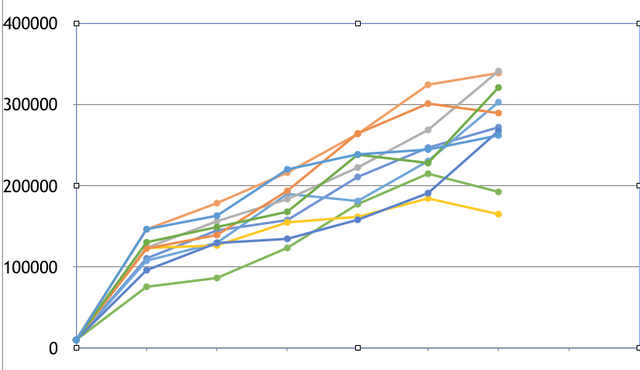

Wexler

Starting funds: $100,000

Average return: 20%

Standard deviation 0.2

Using a Monte Carlo generator, we can input the parameters above, and generate 10 sample paths for the Wexlers. A Monte Carlo generator creates random sample paths using the probabilities you enter into it. By running them a few times, you can see some likely outcomes. For a full explanation of how they work, you can read about them here

The Wexler’s are consistent. All of them make pretty good money, with the best at $340,000.

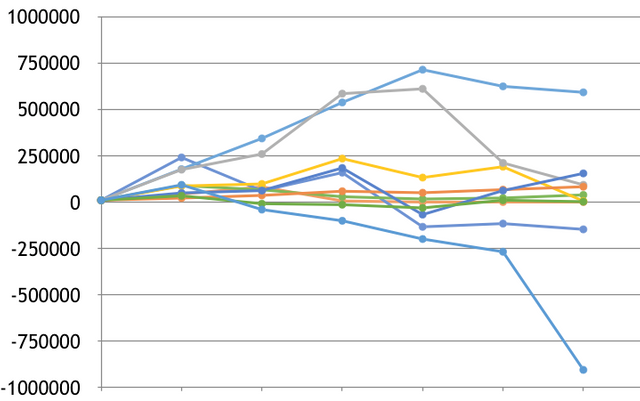

Bainbridge

Bainbridge randomly throws all his money for the month at a new company. This approach has a high variance, he will usually lose most of his money, but every now and then one of his start-up companies will take off.

Starting funds: $100,000

Average return: 0

Standard deviation:1

While most of the Bainbridges cluster around zero, there are two that takeoff gloriously, soaring to well over 500,000 after four months. One of those unfortunately crashes back to nearly 0, but the other finishes at just under $600,000, comprehensively crushing all the Wexlers! We have our promising young trader. Unfortunately one of the Bainbridges manages to lose nearly 1 million. He will need a very very healthy cash injection from his parents to continue his trading career.

Explanation

The much higher standard deviation for the Bainbridges reflects their much higher risk high reward strategy. The strategy is unquestionably worse than the strategy of the Wexlers, but we don’t see this when we just pick out the single highest performer.

To illustrate this with a second example, imagine we take 2 million Americans. 1 million buy a lotto ticket each week for five dollars, while the other million put five dollars in a savings deposit. The ‘best performer’ will probably be one of the lotto ticket buyers, even though their ‘strategy’ will on average perform much worse than the savers.

Is this relevant to cryptocurrency trading? Yes. Cryptocurrencies generally show huge variance, huge up-and-down swings in price. Traders who follow an ‘all in’ high risk high reward strategy will usually produce the biggest winners. They will produce the biggest losers as well- and quite likely the strategy is not optimal, so the average trader following the strategy will have mediocre results.

Over time, results will tend to move back towards their expected value. The longer we tracked the results of the Wexlers and the Bainbridges, the more they would tend to move towards their average returns. 20% for the Wexler’s and zero for the Bainbridges.

Takeaway

Don’t put too much stock in short-term results in a activity like crypto trading, where the variance is enormous. It doesn’t mean too much if someone enters trading and immediately puts up some great results. We need a bigger sample to really draw reliable conclusions.

Successful people whose careers require them to deal with a lot of variance, such as financial traders or poker players, put their emphasis on making good decisions, and calculating expected returns. In the long run, good strategies will win and bad ones lose.

Crypto, Money in the future on digital transaktion

Zero transaction fees are certainly nice

I know virtually nothing about trading or crypto. Nonetheless, enjoyed your post, as the examples are very clear, and I found it interesting anyway.

Thanks for reading. I’ve got quite a fascination with random numbers and probability, but not sure how much of an audience that has!

Resteemed by @resteembot! Good Luck!

Check @resteembot's introduction post or the other great posts I already resteemed.

You were lucky! Your post was selected for an upvote!

Read about that initiative

Congratulations @flyyingkiwi! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your Board of Honor.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP