The 3 Top Ethereum Stocks in 2017

By: Motley Fool

Image source: Getty Images.

Move over bitcoin, and make way for Ethereum

When the calendar finally changes over to 2018, investors will likely look back and marvel at the annual gains of cryptocurrencies.

Just how good have cryptocurrencies been as a whole? Since the year began, the aggregate market cap of virtual currencies has increased from $17.7 billion to $293 billion as of Nov. 26. That's a better than 1,550% gain in less than 11 months. Of course, bitcoin has played a big role in this advance. The largest and most popular cryptocurrency in the world (out of more than 1,300 cryptocurrencies) has seen its market cap climb to $155 billion, up from around $3 billion just a few years ago.

However, bitcoin is arguably not the story of the year when it comes to virtual currencies. That title just might belong to Ethereum . The second-largest cryptocurrency by market cap vaulted to a new all-time high last weekend, touching $480 per Ether token, and placing its market cap at $46 billion. By comparison, Ethereum began the year at just $7.98 per token. That's a gain of more than 5,900% in less than 11 months. It's taken the broad-based S&P 500 six decades to deliver comparable returns.

What's driving such impressive gains in Ethereum, you wonder? It looks to be a mountain of excitement regarding blockchain technology. Blockchain is the digital and decentralized ledger that records transactions without the need for a financial intermediary like a bank, and it's what underlies most cryptocurrencies, including Ethereum.

Blockchain technology has been shown to be incredibly cost-effective relative to current financial services industry software, but it's the security and settlement times of these open-source networks that really have investors pumped. Since it's an open-source network, changing logged data without someone else noticing would be almost impossible, meaning blockchain is incredibly secure. It also allows for the possibility of real-time settlements in the business world, which would open up new doors for cross-border transactions.

Investors are stoked about the 200 organizations, including some well-known companies , that are currently testing a version of Ethereum's blockchain in pilot or small-scale programs. For Ethereum, nabbing enterprise customers with its proprietary blockchain is the ultimate goal.

Image source: Getty Images.

The top Ethereum stocks

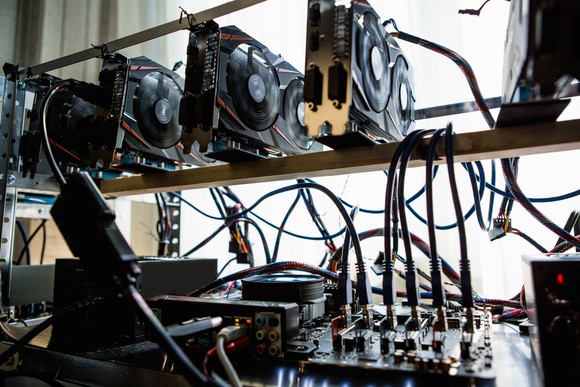

But investors in Ethereum aren't the only winners. Stocks that have some connection to Ethereum or Ethereum mining have also received a boost from investors. Here are the three top Ethereum stocks in 2017.

NVIDIA

Unlike bitcoin, which is treasured by digital-currency enthusiasts and investors for its payment potential, the Ether token isn't all that popular as a form of payment -- at least not yet. It's possible it could be used to facilitate real-time transactions in the future, but that's not where Ethereum investors are currently focused.

Instead, the money is being made by mining Ethereum, which is a far less intensive process than mining bitcoin at the moment. Still, mining Ethereum and getting paid for solving complex equations and verifying transactions requires some heavy-duty technology. That technology includes high-powered graphics cards from the likes of NVIDIA (NASDAQ: NVDA) .

According to a test run by HotHardware in June, NVIDIA's GeForce GTX 1070 graphics card delivered the second-highest hash rate (a measure of calculation speed) of the eight graphics cards tested, and it looks to be the best overall with regard to performance per watt. Remember, mining cryptocurrencies can be a costly venture, and not just because of the hardware purchases involved. Electricity costs can be nothing to sneeze at.

Long story short, NVIDIA has witnessed a surge in its gaming segment revenue, which incorporates graphics cards sold for gaming purposes, as well as cryptocurrency mining. Though the company doesn't break out how much of its sales are related to mining, it's pretty clearly seeing positive benefits from the rise of Ethereum. Shares of the company are up 101% year to date.

Image source: Getty Images.

Advanced Micro Devices

Along the same lines as NVIDIA, Advanced Micro Devices (NASDAQ: AMD) , which is better known as AMD, has also taken advantage of rising graphics card demand.

AMD is perhaps best known for its all-out war against Intel over microprocessor market share in personal computers (PCs) in the 1990s and 2000s. However, given the decline in standard PC usage and the rise in mobile devices, AMD has turned its attention elsewhere. The company's graphics card unit has become a major player in gaming, as well as in mining various cryptocurrencies, including Ethereum.

According to the aforementioned HotHardware study, even though NVIDIA's GeForce GTX 1070 looks to be the best all-around graphics card for performance per watt, AMD's Radeon series graphics cards were right behind NVIDIA's. Virtual-currency miners probably aren't seeing meaningful differences in cost or performance between AMD and NVIDIA, meaning both can benefit.

As noted in AMD's third-quarter operating results in October, computing and graphics sales grew by 74% year over year, with the average selling price of its graphics cards rising "significantly" year over year. The only reason its graphics card sales would rise significantly is if higher-powered units were being sold, which would signify strong demand from virtual-currency miners.

Though AMD shares are relatively flat this year, they're up 388% over the trailing-two-year period.

Image source: Getty Images.

Overstock.com

Another top stock that's been somewhat linked to Ethereum's success is online retailer Overstock.com (NASDAQ: OSTK) . Overstock has been at the forefront of the digital-currency revolution , and it's the first major company to accept what could be described as the six most popular digital currencies: bitcoin, Ethereum, bitcoin cash, LiteCoin, Monero, and Dash. As noted, Ether tokens aren't exactly a popular choice for paying for goods and services, but Ether can be used to buy items through Overstock's website.

However, it's pretty much impossible to understand how much Ethereum's move higher has really impacted Overstock, given its gung-ho nature toward all cryptocurrencies. A subsidiary of the company is currently working on a project, the Medici t0 blockchain, which is a blockchain-based securities-lending system that could be cheaper and more efficient than the software Wall Street currently has in place. The expectation of an initial coin offering from this development, which might be the largest ever, along with Overstock's being tethered to around a half-dozen cryptocurrencies via its website (the company generally retains a small percentage of its virtual currencies, as opposed to converting them to U.S. dollars), has transformed it into a highly volatile crypto-driven stock.

Shares of Overstock.com have jumped by more than 215% since the year began.