Ethereum's Market Cap Looks to Overtake Bitcoin's

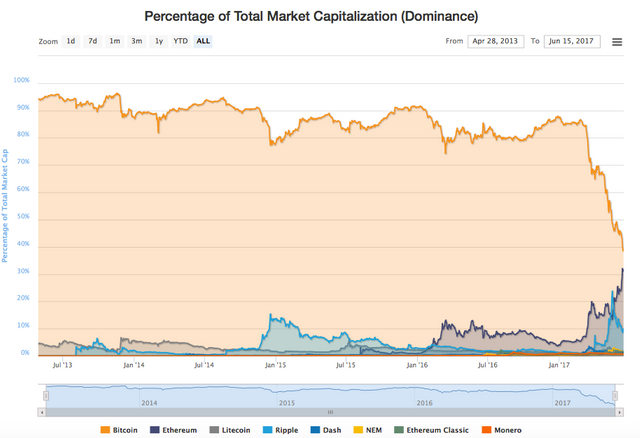

Bitcoin has led the cryptocurrency revolution for nearly a decade. In the process, it has become the most recognizable name in the new world of digital currencies, and for many years it dominated the industry by maintain a position of 80% or more of the total cryptocurrency market cap. In the past few months, Bitcoin has also skyrocketed in price, practically tripling in value since the beginning of the year. And yet, in spite of these indicators of its dominant status, there is reason to believe that one of Bitcoin's competitors, a much newer cryptocurrency called Ethereum, is on pace to overtake the iconic digital currency in at least one respect: market capitalization.

39% to 31% As Of Last Week

By Wednesday, June 14th, Bitcoin had seen its share of market capitalization drop from 87% among all cryptocurrencies down to 39%. This sharp decline is in stark contrast to the precipitous gains in value that have accompanied the coin over the same time period of roughly the past four months. At the same time, Ethereum has seen its share of the total market capitalization of digital currencies rise by a considerable amount, too. From 5% of all market capitalization just four months ago, the two year old currency has now claimed nearly a third (31%) of all market capitalization for the industry.

A graphic representation by analysts at CoinMarketCap reveals both the extent of Bitcoin's former dominance in the cryptocurrency field as well as the rapid shift which has brought Ethereum much closer to Bitcoin's level.

Analysts Predict "The Flippening"

Analysts have developed a term to categorize a time at which Ethereum overtakes Bitcoin in terms of market capitalization, as some cryptocurrency followers have expected to happen. "The Flippening" refers to this shift in dominance in the field and, some say, may indicate a permanent shift in which Bitcoin steps out of the spotlight in the cryptocurrency world.

The Flippening could occur for a number of reasons. Bitcoin has long been the most dominant cryptocurrency, but it also suffers from significant problems of scaling which have threatened to dismantle the entire cryptocurrency system. Ethereum, on the other hand, having been developed much more recently, may have been able to anticipate some of the issues that Bitcoin's creators did not when they first programmed the code a decade ago. In doing so, Ethereum, could find itself in a better position for long-term growth than Bitcoin.

As of June 14th, Bitcoin's market cap hovered around $45 billion, with a price per coin just below $2800, according to a report by Market Watch. Ethereum's market cap was roughly $36 billion at the same time, with a price per token of $390. In some ways, Ethereum may have already overtaken its older brother: a Motherboard report suggests that Ethereum has "almost five times as many nodes in its network as Bitcoin, meaning more people are using their computers to support it."

Source : http://www.investopedia.com/news/ethereums-market-cap-looks-overtake-bitcoins/#ixzz4kmvtyLJ4

August 1st when Segwit 2X/UASF goes down might be the best time for a flipping in the short term future due to the potential for a chain/value split.

This a good observation. I have also noticed the decrease of Bitcoin dominance and the subsequent increase of Ethereum's market cap and price in general (think past few weeks). I do hope that an increase in Ethereum interest will not be a detriment to the Bitcoin market cap and price as I have noticed that drops in Bitcoin price tend to echo through the whole cryptocurrency market and cause all prices to lower.