Revolutionising insurance claims handling by UniBright

As an Actuary, projecting claim amounts is critical in calculating a premium as well as several other factors like reserves and capital using the likelihood of a claim and its severity. One aspect which is even more crucial in Actuarial modelling is the accuracy of claim amount and its underlying importance on whether a claim is valid or not. Most claim denials are due to the lack of verifying benefit information prior to services being provided. Insurance fraud is an on-going problem for all insurers and has reached epidemic proportions around the world and the most effective way of tackling this problem ends up with a claim manager manually verifying each claim.

But what if this could be automated? Insurers need to improve the operational efficiency of their claim process and build an operating model that can minimise claim costs as well as eliminate the unnecessary expenses associated with claims handling. UniBright is introducing a solution based on blockchain technology to do just that by automating claim processing as well as take it a step further by paying out for insurable events automatically.

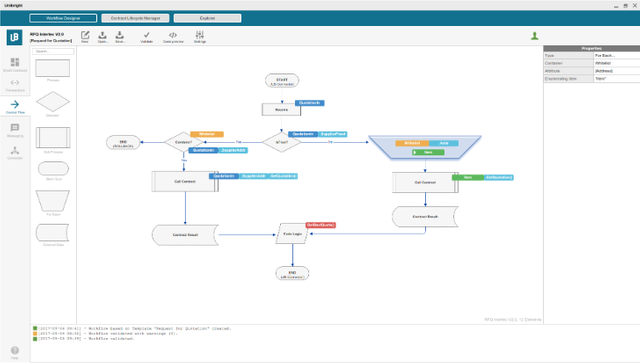

A workflow can be defined visually including the rules used to perform every claim. Input checks can then be executed based on past claims and specify the pre-requisite conditions for declining or approving. Utilising Ethereum's technology, a Smart Contract is generated containing the claim processing logic and is then connected to the ERP system using a Smart Adapter. Eventually, Unibright smart contract system performs error checking, initiates approval workflows and calculates payouts based on the claim, the underlying policy, and the event occurring and even pay out insurable events automatically. The job of a claims handler is suddenly minimised and this efficient system can save time and money for insurers.

By automating low-value work activities using UniBright, claims handlers can focus on claim activities that they know will help deliver a better service experience. Insurers are then able to take a more holistic approach and focus on high-touch items to differentiate themselves. Make no mistake, the job of a claims handler isn't obsolete but simply reduces the work needed. By combining best practices and efficient case management, insurers will be able to minimise claims costs, improve efficiency and enhance customer satisfaction. These improvements will ultimately boost key performance indicators, which will undoubtedly impact operating results in a positive way. These are no small tasks, especially when one considers the unique challenge that a claim organisation faces: when customers need its services the organisation has only one chance to deliver.

Details

https://unibright.io/

http://t.me/unibright_io

https://bitcointalk.org/index.php?topic=2892915

Author

https://bitcointalk.org/index.php?action=profile;u=1457262

This post has received a 6.27 % upvote from @boomerang.

@originalworks

Hi! There is no ideal insurance company, but there are those companies that strive for the ideal and try to do everything possible to ensure that their clients are always satisfied with the services they receive. One such company is Allstate, which provides a wide range of insurance policies at affordable prices. The reliability of this company is well confirmed by allstate reviews of their satisfied clients who have been using their services for many years, and generally speaking, they are satisfied with it.