Tales from the Crypto Keeper: Item #011 - Short selling, Day trading, Goal setting, Let's go!

Phew! Been a few days and I've managed to subdue my addiction to trying to make moves in the market. And it's actually been working out. The only thing I've done is keep an eye out on some coins, and attempted to withdraw one ETH's worth for myself, into fiat.

My Investment Plan

When I saw ETH go down again so much a couple days ago, I was just looking at this dollar figure; happy when it up, and unhappy when it shot down. But I realized I had no idea at what number I could say I was happy with the return on my investment. I started buying ETH in April, so I'm really happy about anything that's above 20% on my investment. Or at least, that's the number I would like to be happy with.

Right now, with all the stupid moves I've made, my ROI is pretty measly. It was good, for a time, and then it went way way down. I didn't set any goals for what was long-term vs short-term, and now everything is pretty much long-term (until I'm not losing money, anyway) so I'm a little limited in what I can do for maximizing my gains. The problem is, I know how much ETH (in fiat) I've bought total, but I don't know how if much I've kept in ETH and how much went to investing in other currencies...

So here's my new and first goal: I want to have a 50% ROI on my investment. At which point I will take out 50% on my investment and convert it back into fiat and so on until I've taken back my entire investment. And then I can buy more crypto, RAWR!

Time to make a plan

So now the plan is to hustle and figure out when and how I'm going to take my investment back from the fold. First off, I'm not buying anything anymore unless it's ETH on limit orders. Which means I'm finally going to have to try using Gemini to deposit fiat into my account. Ethereum's volatility isn't going anywhere, not until they come up with a solution to the scalability issues uncovered by the rise of designer ICOs. Could be a good target for short selling?

Next, I have to stop thinking about my supreme losers (SWT, MYST, IOTA, ARK) because I don't think they're going up anytime soon. These are forced long-term holds.

Reddcoin I'm not even looking at until ReddID comes out. The roadmap looks like it's got stuff in the pipeline until Q1 2018. Swarm City Token still has news on the horizon, IOTA won't budge for a while methinks, and ARK is only 3 months old so I'd like to ride the wave for next year.

But the whole market seems like it's going to be dancing to this tune for the summer, until D-Day: August 1st. So I think I'll just concentrate on multiplying holdings in RDD, IOTA, adding some Antshares, Golem, Iconomi, Litecoin and Ardour to my stack, on the dips.

Keeping an eye out for news

Digibyte launched DiguSign and looks like it's going to take off this week? It's been real tame for the last few weeks... I will put in a sell order at > 790 sats and I will get back in when it dips in to the 740's or lower again. And then I think if it can break out from 900 sats, it'll be a nice climb back up to the 1500's. DGB will remain long-term hold for me, unless it hits < 700 sats. If it does, bags dropped until there is movement. Feel like I missed my chance to do this in the early afternoon today. See if tomorrow will give me another chance?

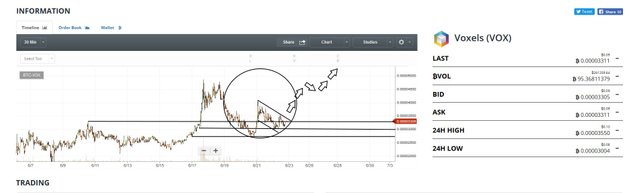

It might also be time for Voxelus to take off because of this thing is undervalued with a 200m market cap at this price and on a 2-yr chart, it seems to have bottomed out. This is also a long-term hold so short selling to multiply the stack for a while.

(twitter: Freedonia85)

Trading in Canada on QuadrigaCX

One plus I've found in the last few days is trading in Canada: we have this nifty exchange called QuadrigaCXthat support ETH/CAD and BTC/CAD pairs . As I've recently noticed, all exchanges sell coins at different rates and the rates are all over the place. To illustrate the differences between this exchange and others, *at the time of writing this post, ETH is $360.80 on GDAX and $383.92 on QuadrigaCX. So you're probably better off buying where the volume is highest, making the price lower (?); and then, selling your ETH & BTC on QuadrigaCX into fiat where you'll get more for your crypto. That is, if you're going to withdraw from there. I guess it's better to convert where you withdraw?

In any case, it could go something like this:

- buy ETH on Coinbase (or BTC on any other exchange - Coinbase is just the one I use and it happens to have lower prices than my withdrawal exchange, QuadrigaCX). Let's say you buy 1 ETH at $380.

- Send it to QuadrigaCX wallet where 1 ETH = $395; sell it, you've just made $15 on your ETH minus the transaction fees.

- Withdraw to your bank account, yay, money!

- Wait until ETH dips on Coinbase again, rinse, repeat. Withdraw to your bank account, yay, money!

- OR send to your hard wallet. Boom, you've probably scored yourself a few more fractions of ETH.

I don't know if this is considered an asshole move... but it felt nice to know my ETH is worth even more when I convert it back to fiat from QuadrigaCX. I'm sure it considered an asshole move, actually. But until arbitrage comes into play for exchanges... Yay, money!

Forget about timing the market here

That being said it's not a sophisticated website. Every time I actually activate the browser tab, the price updates which makes it pretty much impossible to time the market. I'm kind of absolutely shooting in the dark as to which short sell orders I should put in.

Withdrawing from QuadrigaCX

So yesterday I decided to withdraw 1 ETH back into my bank account in fiat at about $400 for the ETH. I'm glad I did that because it looks like ETH is in for a downturn, which is also why I converted all my ETH holdings back to fiat for the day. I want to say if, but I will when it dips back down again,

I'd actually like to learn TA, even though everyone says it's useless for crypto...

I chose the Interac Email option (1-2 business days), which now shows as completed so I'm expecting an email Tuesday or Wednesday with that money, because of the #Canada150 long weekend. I'll let you know how it goes! But it was the only option that would let me withdraw less than $500, down to $100.

So for now, let's cross our fingers that ETH goes down in the next few days and I can jump back in with a stronger position!

Use my Genesis Mining code to get more hashing power: 61Qx0o

I am long some of your names ETH, ARK, DGB and VOX, planning to buy and hold for a while to avoid tax complications and missing out on the long term upside. I am also long a few other low market cap slingshots ABY, DAR, BTA, LDOGE and XBY.

Nice, I'll have a look at a few of these! I like the concept of ArtByte for sure ;)

liked and followed :)

Disclaimer: I am just a bot trying to be helpful.

Great post erratik 😎. Please Check out some of my Cryptocurrency recommendations!

https://steemit.com/steem/@crypto-expo/cryptocurrency-altcoins-top-20-to-invest-in-2017