CryptoDay News - Daily Pick 1.3.2019 - Facebook Coin?, Wall Street's popular strategy is failing

CryptoDay News is a hub that gathers crypto, blockchain and finance related news to one place. This is our daily pick up of most interesting tidings right now.

1. Facebook Coin?

Facebook is working with blockchain and cryptocurrency but we don't know what they are acually going to do. Here is article from New York Times and also Ivan on Tech covered the subject on Good morning crypto show this morning.

Nytimes (28.2.2019):

Facebook and Telegram Are Hoping to Succeed Where Bitcoin Failed

By Nathaniel Popper and Mike Isaac

Some of the world’s biggest internet messaging companies are hoping to succeed where cryptocurrency start-ups have failed by introducing mainstream consumers to the alternative world of digital coins.

Facebook has more than 50 engineers working on its project, three people familiar with the effort said. An industry website, The Block, has been keeping track of the steady flow of new job listings for the Facebook project.

Bloomberg (21. 12.2018) :

Facebook Is Developing a Cryptocurrency for WhatsApp Transfers, Sources Say

By Sarah Frier and Julie Verhage

Facebook Inc. is working on making a cryptocurrency that will let users transfer money on its WhatsApp messaging app, focusing first on the remittances market in India, according to people familiar with the matter.

The company is developing a stablecoin -- a type of digital currency pegged to the U.S. dollar -- to minimize volatility, said the people, who asked not to be identified discussing internal plans. Facebook is far from releasing the coin, because it’s still working on the strategy, including a plan for custody assets, or regular currencies that would be held to protect the value of the stablecoin, the people said.

Ivan on Tech:

BITCOIN $67,193 FAIR PRICE? Programmer explains (1.3.2019)

Ivan is covering the Facebook part from 10:30 ->

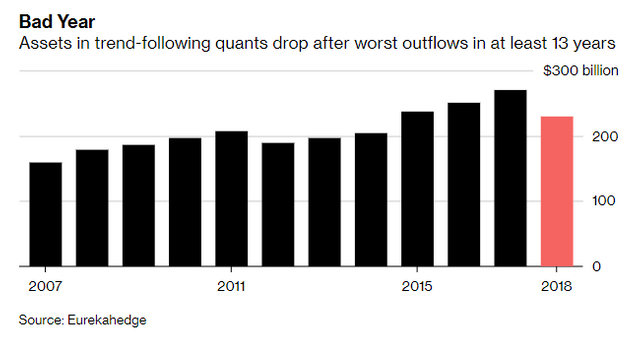

Wall Street's popular strategy is failing

Today's trading bots are not perfect and if your bot can't read Trump's tweets right it may cause some damage.

Bloomberg (1.3.2019):

One of Wall Street’s Most Popular Trading Strategies Is Now Failing

By Nishant Kumar

Machines that decide when to buy and sell are struggling to keep up with central banks and Donald Trump.

Hedge fund investors learned that the hard way last year when data-crunching computers that invest $220 billion based on historical price trends did worse than most other managers, robot or human. The losses were so bad that investors pulled billions of dollars out of an investment strategy that for years had, paradoxically, been regarded as a great way to protect portfolios from downside risks.