No money to buy back in during the crash? Here's what I do to make sure I'm ready

disclaimer: none of this is investment advice, just simply what I do in anticipation of a crash and I have no affiliation with the content creators or websites linked in this post.

I came across this issue the last last time the crypto markets had a minor dip. I wanted to buy in because the prices were low, but didn't have money to invest; all the money I had set aside for investing in cryptos was already in different cryptos that had crashed. It was stupid not to use this strategy in the first place, but I learned my obvious lesson: Always have a little bit of your portfolio sitting as fiat so you can reinvest when prices are low. (or better yet, a digital derivative of fiat)

There's no set amount I divest into fiat each cycle; if I think the gains I've been receiving in the past few days is slightly too high, I divest a small amount and scale the % of my portfolio to divest accordingly depending on how quickly my portfolio grew (ie I divest more as fiat the larger the bubble).

Even better than fiat, are cryptos that track the price of fiat called "digital derivatives." You get the speed and low fees of cryptos with the stability of fiat, it's the best of both worlds! I use the bitShares decentralized exchange to do some of my trading for the coins that I can trade on it. It has a really nice USD derivative similar to USD Tether (USDT) called bitUSD. You can learn more about the bitShares decentralized exchange and digital derivatives on their YouTube channel and their web site.

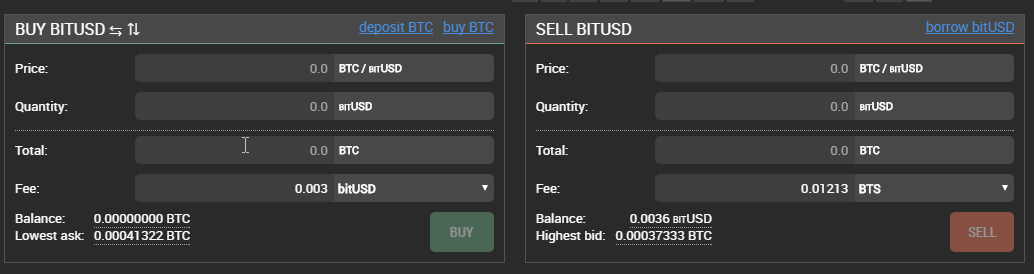

I realized next time my portfolio went up too fast and too quickly, I converted some of my crypto holdings into bitUSD which stays at 1 USD in value when converted to bitShares (BTS.) Then when the markets dipped again, I could instantly convert my bitUSD to BTC or BTS and convert to other altcoins from there. Using the bitShares exchange is a really nice experience since it eliminates some of the trust issues users have with exchanges as it's a decentralized exchange and the fees per trade is a really cheap flat fee:

At the time of this post, the fee is 0.01213 BTS which is current ~0.003 USD per trade.

Check it out if you're looking for a stable store of value when the crypto markets are especially volatile. BitShares also offers other derivatives such as bitCNY, bitEUR, bitGOLD and bitSILVER which track the value of CNY, EUR, gold, and silver respectively and can be very helpful in diversifying and storing value.

Hope this post was helpful, happy trading!

Good info Thanks! I upvoted

Good Post. I was looking for the details which I got from this post . good job , keep it up

@cryptoknight12

Congratulations @dunixify! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!