HEX Scam Day 11 Playing HEX for fun and profit

While we continue to watch the HEX market mature, we have a few topics to share with you today.

AA market vs. exchanges strategy

At the end of each ETH transformation window (or AA day), a price per HEX in ETH is established.

It is not shown directly in the HEX dApp wallet (reasons seem obvious) but can be easily deduced. In the first several days, with extra volatility present, it was quite simple to transform using ETH, sell HEX on exchange at a higher price, and recycle ETH back into the contract in a future window. As with similar token distributions, once the initial hype wears off there is a decline and levelling off in price, until some fundamental event in the future occurs that draws more ETH in (such as a new market or promoter taking off). Of course the exchange order book is extremely thin and irrational, so we simply watch to see if an opportunity presents itself.

| Window | Total HEX (MM) | Total ETH | ETH/HEX |

|---|---|---|---|

| 10/351 | 512.34 | 957.994 | 0.000001870 |

| 9/351 | 512.392 | 871.919 | 0.000001702 |

| 8/351 | 512.405 | 1015 | 0.000001981 |

| 7/351 | 512.453 | 1322 | 0.000002580 |

| 6/351 | 512.537 | 1146 | 0.000002236 |

| 5/351 | 512.584 | 1314 | 0.000002563 |

| 4/351 | 512.688 | 1946 | 0.000003796 |

| 3/351 | 512.967 | 2516 | 0.000004905 |

| 2/351 | 513.319 | 6152 | 0.000011985 |

| 1/351 | 1000 | 21015 | 0.000021015 |

It is somewhat worrying to see the price track down so far. If the price drops below 0.00000001 ETH, HEX may even be relegated to DOGE or other lower coin pairs. That could be disasterous to recover from.

Strategic Staking

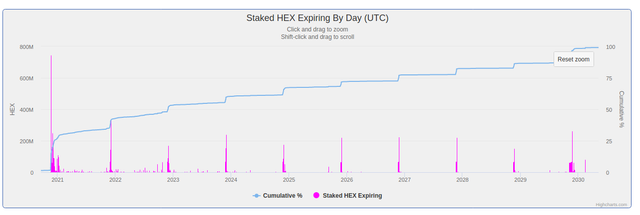

One of the most interesting aspects of HEX is being able to view everyone's stake end dates in real-time. This is touted as one of HEX's main advantages. Regardless, it is an interesting factor for anyone wanting to enter their stakes most profitably. This functionality will improve and probably will appear in the dApp wallet, but for now you need to go to a few data sources to find it. Currently using hexstat.com and hexclaim.com.

The basic concept of CD laddering [1] has made an appearance in HEX chat and also visible in the staking strategy of existing whales. They have not started spreading out throughout the calendar year, and appear to still be concentrated annually in the Nov-Dec timeframe as seen below.

Currently, ending your stake any month other than Nov-Dec should allow for a much less volatile price environment to cash out whatever value exists at that time. How one will close a HEX stake using Ethereum in 2030 or later seems unfathomable with the amount of change we are likely to see between now and then. Considering the already very high risk level, the extremely long stakes (which are incentivized not to end by stiff penalties) seem almost insane.

More centralized ponzi schemes fail

Numerous centralized scams have plagued the crypto community in recent years. The next shoe to fall this week was the announcement of the takedown of Bitclub operators and promoters. [3]

It appears chat logs were obtained which reveal the nature of the various details of how the scheme was being managed and who was involved. In pushing the decentralized, encrypted world of Bitcoin, they seem to have been unable to implement the same principles in their organization.

It is interesting to see in the design of HEX, how carefully it's been crafted and marketed to avoid as much legal exposure as possible. Strangely, it is also marketed as an advantage of HEX; taking away people and promoters from worse scams and bringing them on-board. [4]

Some themes, among others:

- No centralized operator to go after

- Allows promoters to easily generate revenue to any number of ETH addresses, perpetually

- Non custodial smart contract

- No public plan for the two holding addresses

- User-initiated interactions with the contract; the user has to initiate all actions

- Immutable rules and payout to all parties in the contract

@jobyweeks and @jeffberwick, HEX is ready and waiting for the next hexshillionaire, but since there is only one tier of referrals, don't take our word for it, go find it on your own.

Ethereum full node and API

To analyze and access HEX contract data in real time we're spinning up our own geth node. Being quite familiar with running STEEM nodes, taking a few days to sync the chain for a full node is nothing out of the ordinary. More updates will be forthcoming as this comes online.

We continue to find the HEX project/scheme/community and its progress fascinating.

Disclaimer: Anyone sending ETH to this contract is doing so at their own risk. Anyone spending ETH on transaction fees to claim is doing so at their own risk. If you found these posts interesting, please upvote and use the links below.

Free claim for BTC holders, or buy with ETH. Find out more via hexbounty.com. Using this link generates 10% more HEX when claiming.

HEX statistics for Day 10:

https://steemit.com/hex/@hexstats/hex-charts-and-statistics-day-10

Comment spam is frowned upon by the community. Please do not comment spam.