Fair Market Competition in Cryptocurrency? Almost Non-Existent

Original Post on DNotesEDU.com https://www.dnotesedu.com/2018/09/fair-market-competition-in-cryptocurrency-currently-non-existent/

The rapid development and deployment of Bitcoin to fiat markets attracted droves of profit seekers who wanted to take part in this new digital gold rush. Along with ambition and thirst for quick wealth came the worst of human tendencies, including greed – which prevailed to newfound extremes. These were the perfect conditions required to give rise to natural monopolies within the space.

We can talk about how Bitcoin’s first mover advantage gave it an unfair advantage, but I would argue that Bitcoin itself would have a hard time becoming a monopoly, due to the fact that anyone can create a digital currency with minimal entry barriers, but it takes time to become a trusted brand.

“A natural monopoly is a type of monopoly that exists due to the high fixed or start-up costs of conducting a business in a specific industry. Additionally, natural monopolies can arise in industries that require unique raw materials, technology or similar factors to operate. Since it is economically sensible to have some monopolies like these, governments allow them to exist, but provide regulation, ensuring consumers get a fair deal.” – Investopedia

Large exchanges have dominated the industry’s direction since the early days. They effectively dictate prices and have an unfair hold on how the entire industry progresses. They are typically never open or transparent about their listing requirements, and oftentimes they will even charge excessive listing fees or impose unreasonable trade volume requirements, which prevents startups from entering the free market. Nearing this time of irreversible globalization, government’s around the world should take heed, because now is the time to define society wide trends moving forward. Do we want free market capitalism on a global level, or do we want cronyism and collusion?

ICO’s have inflated prices across the market for services such as (but not limited to) advertising, consulting, and development. The influx of easy capital marked a deterioration in work quality, even though prices for these services went sky high. People were able to sell less and charge more, but do you think that they were complaining? No way! 46% of ICO’s launched in 2018 have no business plan. It turns out many of those ICO founders took the money and ran before unsuspecting investors realized something wasn’t right. It wasn’t long before the con artists realized the path of least resistance was in launching another ICO to collect a bit more money from unsuspecting investors, and then overpaying for services that are essential to the success of cryptocurrency startups. They can even buy community support.

Meanwhile, the entry barriers for ordinary individuals who want to chart a legal business path into cryptocurrency are just too terribly high to compete with the anarchistic free-for-all that has left essential service prices severely inflated. We are currently in a market where you can provide a superior service at a lower cost, but will face entry barriers that are almost impossible to overcome, which greatly increases chances of business failure.

Regulatory Common Ground

“Common arguments in favor of regulation include the desire to limit a company’s potentially abusive or unfair market power, facilitate competition, promote investment or system expansion, or stabilize markets.” – Wikipedia

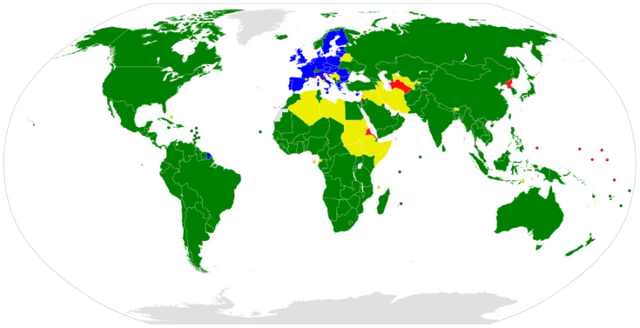

Some of the most active players in cryptocurrency regulation – USA, Russia, and China, all have forms of competition law, along with the majority of other countries:

It would be highly productive for these countries begin delegating a joint task council to investigate areas of common interest, and it would help cryptocurrency participants by promoting a free, fair market.