Portfolio rebalancing for fun and profit

Hi folks! Hope you're having a fantastic day! I'm having a pretty exciting morning, watching my crypto portfolio regain some steam (and STEEM), hopefully breaking free of the bear market.

I wanted to share some thoughts on what I've found to be the most interesting and exciting methodology about which I have learned as I've grown into the crypto space. Before I first bought Bitcoin, the extent of my exposure to investing was having a financial adviser manage some basic retirement investments for me. I was largely hands-off, and trusting his competence to place them with care.

In 2013, I first heard about a revolutionary new technology, blockchain, and its flagship application, Bitcoin. From my perspective as a principled libertarian, it was fascinating to me! On a whim, one day, I gathered some emergency cash I had on hand, and deposited it into someone else's bank account to facilitate purchasing my first few BTC. And then I largely just let it sit there for a few years, watching its movement not-too-closely. I recall people telling me I should sell when, at $800 per BTC I could have realized over 10x profit. But I'd put nothing in I couldn't afford to lose, and it was an exciting thing to remain involved in. It wasn't until October or November of 2017 that my attention was really drawn back to my investment, which suddenly looked like it might really go somewhere!

When I saw the prices of and interest in cryptocurrencies start to skyrocket, I felt there was something I could be doing to better actively manage my holdings. Bitcoin had made spectacular gains during the year, but I knew it was not the biggest success story. The first way in which I decided to substantially diversify my holdings was with an index fund offering called Crypto20 (since rebranded to Invictus Capital - https://invictuscapital.com/), which I saw advertised on Twitter. I had heard before, in the context of stock market investing, that index funds tended to outperform actively managed funds. I figured that could be only more true if the index fund was organized by cryptocurrency and financial professionals using machine learning technology, and was competing with active management of my portfolio by me, a barely competent investor, never mind trader.

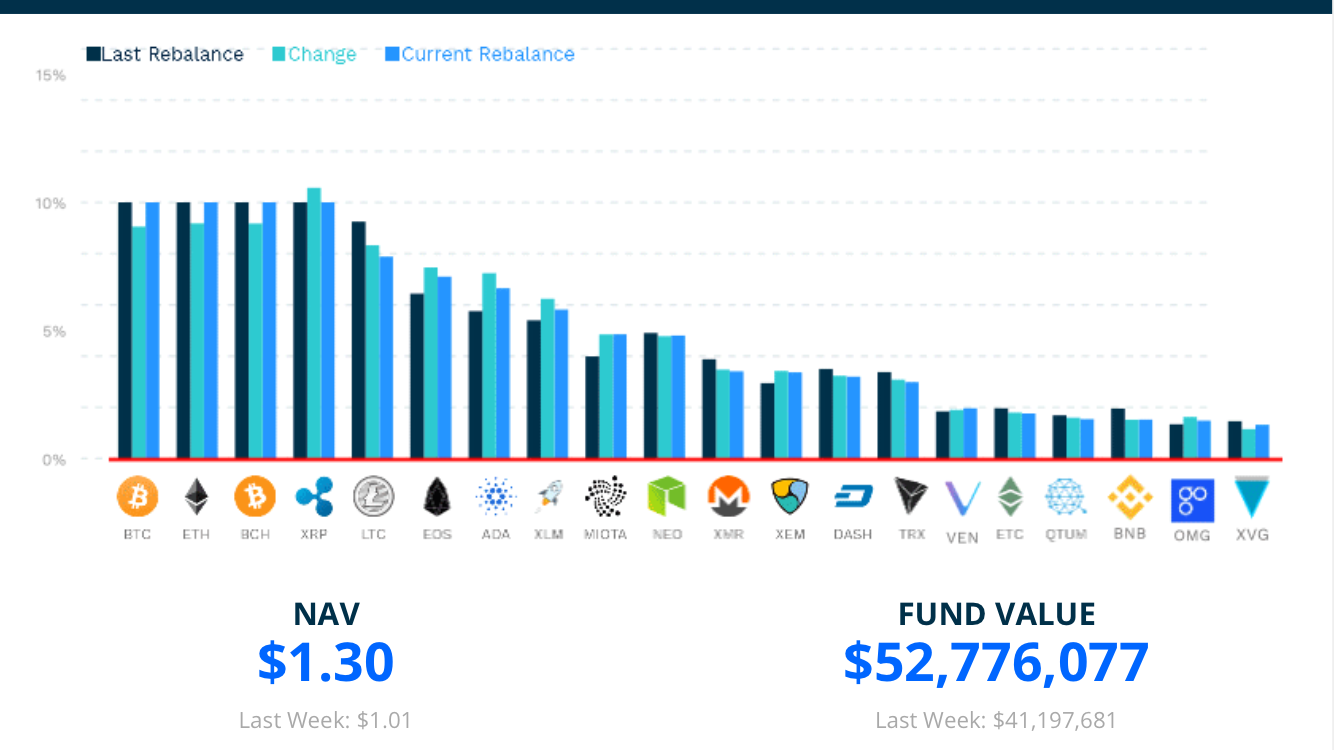

So, I put a substantial portion of my holdings into the C20 token. Crypto20 invested the funds they received in their ICO into the top 20 cryptocurrencies, weighted by their market capitalization. Their smart contract on the Ethereum blockchain allows holders of their tokens to liquidate them for the net asset value backing them, paid out in ETH. This affects a price floor for the token, over which it has traded at a slight premium on exchanges.

Each week, the people behind Crypto20 apply an algorithm that rebalances their holdings, adding or removing tokens as they enter or fall out of the top 20, and ensuring that the value held in each remains in line with the weighted percentage of value appropriate for its market cap. For example, if Bitcoin has gone up in value such that it represents more than 10% of the total value of their holdings, the surplus amount is sold. That money is then put into the coins that have fallen below their designated percentage of value.

(Picture from a recent investor email from Crypto20)

Rebalancing in this way is a logical and intuitive way to tend to sell currencies when they have increased in value (sell high) and buy those that have decreased in their relative value (buy low). Applied over and over, one can expect this to yield better profits than simply buying and holding assets. There is something about the brilliant simplicity of such an approach that really excites me, to the point that I feel like a ridiculous investment nerd, novice though I am.

More recently, I discovered https://www.shrimpy.io - this web based tool interfaces with exchanges (currently Bittrex, Poloniex and Binance) and allows you to create your own auto-rebalancing index of cryptos! I've setup two accounts so that I could use it with both Bittrex and Binance. I selected a number of coins, including some of the strongest (BTC, ETH, XMR, DASH), some promising up-and-comers not represented in Crypto20 (ZRX, ZEN, DGD, STEEM and a few others), and also USDT and TUSD, to hopefully help lock in profits when the crypto has appreciated relative to the US dollar and to buy the dip when it's down.

Since the market seems to have started to turn for the positive, I've seen growth in my own little index fund portfolios, and have watched the rebalancing lock in my gains. I do acknowledge the risks in having too much money on exchanges though, even these largest and most stable ones. My intent is to see my holdings appreciate past a certain predetermined dollar value, then withdraw the excess and use it to purchase silver and gold.

So, what do you think about portfolio rebalancing as a strategy? Any thoughts or tips for best application? I'm trying to figure out, when it comes time to withdraw profit, the best approach for that. If I withdraw the coins that have reached the highest value peak, I'll be automatically buying them back at a high value when the rebalancing occurs next (currently set at daily). Perhaps selling a little of each coin is a better strategy? I'd welcome any input, and I hope this information has been useful to some.

Wishing you all peace and love and profits!