Are We In A Crypto Winter? Back To The Future II

So on 12th Jan (2018) I wrote a post saying there needed to be a ‘Crypto Winter’: a sustained minimum 50% haircut on the market. I actually wanted to say 75% but compromised with the team to not sound too alarmist. Next time I won’t be so restrained 😉

To recap my thinking: it was on the grounds that, there was/is excessively buildup/force exchanging and insufficient esteem being made at the framework layer. Without basic framework all guarantee was only that and I felt we were 2– 3 years from effective DApp based organizations to start to be assembled and supported on top to legitimize these valuations.

I proposed: we expected to return to the activity of building the future otherwise known as 'Back to the Future'.

This post investigates where we are 3 months on and (clearly) must be called..

BACK TO THE FUTURE II

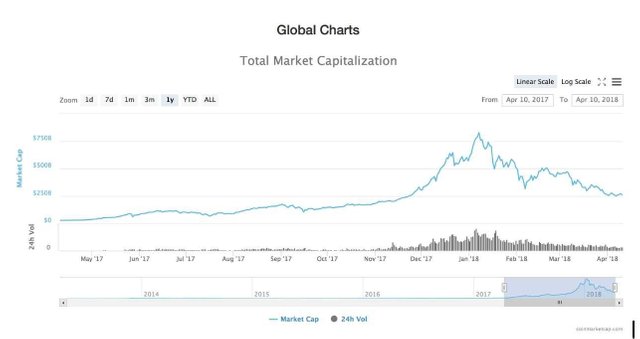

So right off the bat, when I did my post (with knowledge of the past) it shows up we were simply during the time spent a 71% revision from a pinnacle of simply finished $825 billion (Jan seventh) to a low of $234 billion (April first), since recuperating to the $250 billion mark.

While clearly I felt long haul the market expected to remedy I didn't figure it would happen that rapidly and at first idea the plunge was incidentally was basically expedited by the regular Chinese NY impact.

From a board I did with Hedge Fund Weekly/Reuters a couple of days after the fact (eighteenth Jan) I emphasized to the group of onlookers of reserve directors I felt we required a winter to get out the market however learnt a huge number were all the while looking out for the sidelines to enter the advantage, and in view of discussions anticipated that would heap in most recent March (after Chinese NY).

In any case, here we are. In actuality, it appears an impeccable tempest hit the market quite a bit of which was down to various whales having a similar notion and offering at the best:

• Mount Gox whale started dumping Bitcoin

• There was maintained ETH dumping from ICO Treasuries e.g. EOS (something I have reliably pushed as fundamental treasury/hazard administration)

Be that as it may, it was on the grounds that there was a more extensive descending weight from an administrative tidy up of the market (or if nothing else its danger), which again I should pressure is something worth being thankful for

•News of a no. of trades being closed down hit advertise (especially in S Korea which was in charge of huge % of worldwide volume)

•This proceeded in the US and Japan and has seen a more extensive 'tidying up' of trades inc. Binance moving to Malta and different subpoenas to the two trades and greater fruity ICOs

This naturally spooked the market making a sorry excuse for administrative vulnerability and equivocalness. Making numerous genuinely question the very idea of an ICO and 'utility token' would hold. In view of our associations with controllers I have dependably said this was an error. Such a mind-bending concept as an 'utility token' certainly exists (in any event as a probability) in the psyches of the real controllers, including The SEC. They essentially don't have an enough information to take firm positions yet and keep on feeling solid messages are required to move the market the correct way. All activities have been soundly focused at low hanging organic product in conspicuous infringement of existing securities laws or inside and out misrepresentation.

By and large, I think the most recent 3 months have been incredible for the long haul wellbeing of the market for every one of the reasons in my unique post however I am as yet undecided if this would qualify as a 'winter'. Something I accept will be particularly controlled by the following 60 days of exchanging (as of tenth April).

▪SO ARE WE IN A CRYPTO WINTER RIGHT NOW?

Right now I would state no. I think the components definite above have recently extended that occasional pattern and with knowledge of the past feel significantly more clear now than it backed at that point. Besides, it would seem that the hedgies have not left and were simply waiting for their chance for the base. Simply a week ago both Soros and now a Rockefeller subsidize have both flagged they are entering the market. This is the prompt to their associates and when joined with positive signs from G20 and an inescapable (in any event to us) softening of tone from SEC it's reasonable we could see a recuperation.

To add to this, I just got once again from Brussels where I exhibited at the European Parliament and had the delight of talking with MEPs and different government employees initiating the association's way to deal with blockchain and ICOs all the more comprehensively. The message I got was boisterous and clear: various individuals states, for example, Estonia and France and in addition Malta, Gibraltar are hoping to push ahead with national ways to deal with advise (and ideally lead) a more extensive EU wide system. The UK too is wanting its own way even with Brexit. This may incorporate direction however just to enhance measures not slaughter the market.

Keep in mind in the EU we are not troubled by prohibitive financial specialist accreditation and have been world pioneers in crowdfunding for at some point. Similarly, we don't have China's worries of capital flight nor India's grappling with a money based economy (inc. another advanced money).

To put it plainly, controllers are getting focused as they wake up to the opportunity and never again abandoning it to simply periphery situations like Switzerland or Singapore and that is an incredible thing for crypto.

Nonetheless, regardless of all these positive improvements the motivations for a more esteem driven market tragically still aren't here yet. Or on the other hand put another way the disincentives to quit concentrating on energy exchanging haven't completely taken a hold.. So there is minimal motivating force to search for long haul esteem.

The most grounded flag yet for me on this is: I am as yet hearing syndicates saying a 20– 30% rewards on pre-deals notwithstanding for solid ventures is short of what they can 'could' make from an ETH recuperation, and numerous are requesting new tasks to peg to ETH.

The methods standards of the diversion haven't essentially changed. Also, if the hedgies lift the market off the back of progressively positive signs from controllers we could wind up back on the insane ride (and uneven) to a Trillion dollars previously we hit a genuine and supported winter.

That said I think short termist syndicates are bit by bit starting to be supplanted by more professionalized groups that have changed over into assets or venture associations and are hoping to take all the more long haul positions. In any case, for the previous to vanish and the later to thrive we can't live in a market of 10– 30% day by day picks up.

IN SUMMARY,

● With an undeniably focused administrative condition I have never been more bullish on the long haul standpoint for the market. Specifically tokens of honest to goodness utility esteem that fill in too planned crypto-resources for open DLT innovation.

● I would state at last with a 70% hair style the market is properly evaluated for there to be bona fide incentive to be had 'in showcase', yet at the same time trust it is the new Generation 2.0 tasks coming to advertise that offer the most upside.

● My inclination would be the market levels at current value levels to move center to supporting new advancements get the chance to advertise that have genuine long haul esteem and change its fundamental progression far from unadulterated force exchanging.

● In any case I fear now mutual funds can see an incentive in showcase they will draw new capital in which additionally mutilates the market taking us on another insane bull keep running towards the finish of the year.

Meanwhile, it merits worrying at Outlier Ventures we keep on making long haul speculations against our Convergence Thesis, for ventures working out basic web 3.0 framework. These ventures regularly assume control a year of token outline and specialized improvement before they are even conveyed to advertise and our holding frequently vests more than quite a while close by the establishing groups. So we are about as long as you can be on crypto.

Coins mentioned in post:

Congratulations @dipmandal! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP