Bitcoin Dominance!

How You Can Use Your Knowledge of Bitcoin Dominance to Make Serious Gains!

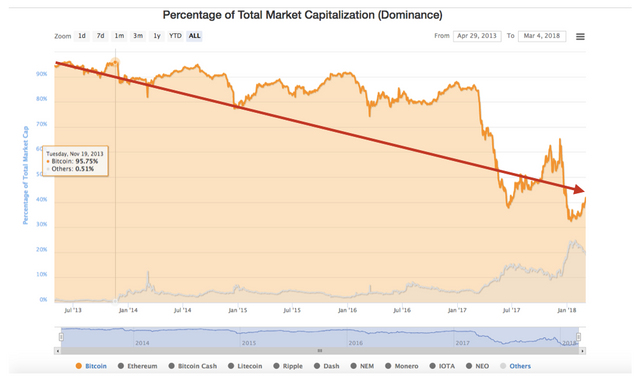

Bitcoin Dominance is basically the percentage of total market cap dominated by bitcoin.

At the time of writing this article the total market cap is $455,282,906,891 and Bitcoins share of the total market cap is $189,690,842,289 equaling 41.7%.

Why Does This Matter and How Can I Make Money?

Well all markets have their ebbs and flows and the cryptocurrency market is no different.

When you invest in crypto, you’re basically trading a fiat currency like US dollars to buy into the cryptocurrency market.

Once you’re in the market you’re basically trading one cryptocurrency for another and as you may or may not know, the major cryptocurrency that almost all other currencies are traded against is Bitcoin.

Why that matters is that Bitcoin is undoubtedly the dominant force it in crypto and due to it’s market share, is seen by most to be the safest and strongest investment in crypto. Therefore, many prominent investors and traders use Bitcoin as their benchmark for wealth accumulation and essentially partake in trading solely for the purpose of increasing their Bitcoin value.

So if you’re one of those traders/investors who seeks to increase their Bitcoin value, then keeping an eye on the Bitcoin dominance chart would be the best way to gauge when you should buy or sell Bitcoin and 'Alts'.

Important to Note

It’s important to note that Bitcoin Dominance fluctuates which basically means that there are better times to buy Bitcoin and better times to sell it if you’re like me and you want to increase you position in promising ‘Alts’

Furthermore it’s also important to note that while Bitcoin dominance fluctuates, so does the overall market in comparison to US dollars so another great way to increase you Bitcoin position is to trade against US dollars when the market is high.

One last important thing to remember is that Bitcoin dominance is reducing over time. For as far back as we can see on coinmarketcap.com which is about to sometime in 2013, you’ll be able to notice a gradual decline in Bitcoins dominance (signified by the image below).

Some would argue that this gradual decline is largely due to the huge number of new cryptocurrencies that have entered the market in recent times and I’d say that definitely has something to do with it, however, the sustained and gradual decline also suggests to me that Blockchain technology is here to stay and that there are many amazing projects out there leveraging the tech to solve problems far more advanced than payment methods or stores of value, like Neo & Ethereum to name just a couple.

In Recent Times

In recent times we’ve seen Bitcoin lose a staggering 20% of it's dominance in a matter of days back in January of this year, I knew it would only be a matter of time before dominance bounced back. The question is, how far?

With over 1500 crytpocurrencies in market, could Bitcoin flex its muscles and hit 50% dominance once again?

In my opinion we should see Bitcoin dominance continue to surge and max peak somewhere between 45-48%.

In the meantime, if you have the nerve it could be a great time to sell a portion of your positions in ‘Alts’ for Bitcoin, to potentially buy back greater sums in the coming months (NOT FINANCIAL ADVICE - DO YOUR OWN RESEARCH).

What do you think?

Please leave a comment below to let me know what you think of this article or the whole Bitcoin dominance situation :)

Thanks!

CCL