Ethereum take off? Yes, it’s time!

When launching a business or a digital product, having the right time to market is crucial for its success. Some would even speak of the right “token to market,” with tokens launched on top of the Ethereum blockchain. A business’s idea could sound great, but if it’s not the right time to do it … no success will come of it.

Today, blockchain technology, and more specifically Ethereum, is still facing a mass adoption issue in the world. To a certain extent, it is linked to common economic, political and social issues shared by diverse countries. That’s the reason why the Dether team has conducted a market study for launching the world’s first mobile Dapp that enables any individual to buy ether with cash and spend it at physical stores. We came to the conclusion that all the lights are green to launch a ground-breaking blockchain app in a favorable economic context.

This blog post is an extract of Dether’s upcoming white paper, underlying who will be our early adopters, early majority and late majority and what strategy we will adopt.

1. A rising interest in cryptocurrency all over the world for political, social and economic reasons

The volatility of cryptocurrency is sometimes described as a disadvantage for its adoption. If this may be true in some situations, it hasn’t stopped many nations from all over the world from beginning and continuing to invest in cryptocurrency, due to economic, social and political factors.

Overall, there’s an increasing interest in cryptocurrency that is very much related to one of the following reasons:

China remains the country where the demand is rising the most in the world. Among other countries where cryptocurrency demand is rising, we can count: Nigeria, Japan, India, South Korea, Singapore, Malaysia, Hong Kong and Taiwan.

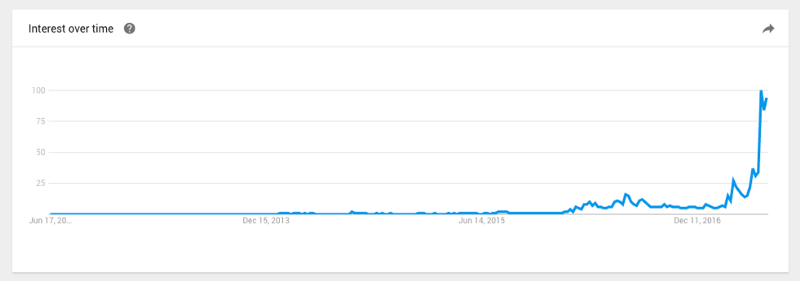

A rising interest in Ethereum blockchain and its cryptocurrency all over the world since 2016

Overall, 2016 was marked by a turning point in overall interest in the Ethereum blockchain. While Ethereum was still unknown to the general public since its first release in July 2015, the trend began to evolve in 2016. There are several reasons for Ethereum’s growing success. This is related to:

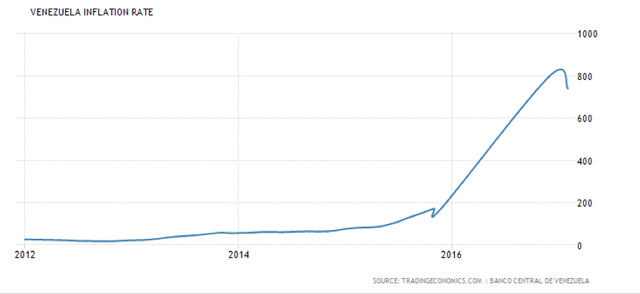

Moreover, Ethereum’s growing success is also linked to the unstable economic situation of countries where the national currency is unstable, and who now turn to Ethereum after having dealt with bitcoin. The saturation of the bitcoin network, which results in longer transactions and higher fees, has led these populations to consider Ethereum as a serious alternative.

Thus, the world’s interest for Ethereum has been exploding since the beginning of 2017. Its steady rise in recent months has led people to consider it more seriously as a form of investment.

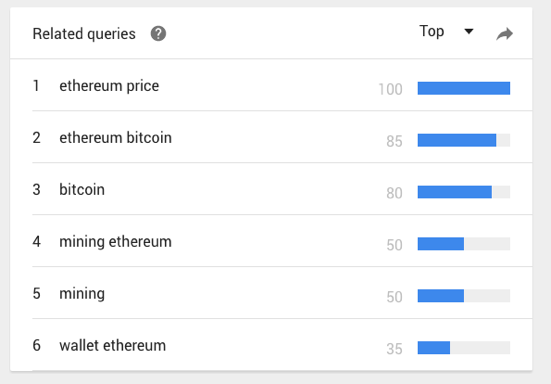

In examining the global research on the Ethereum blockchain in detail, we realize that the first related query concerns its price.

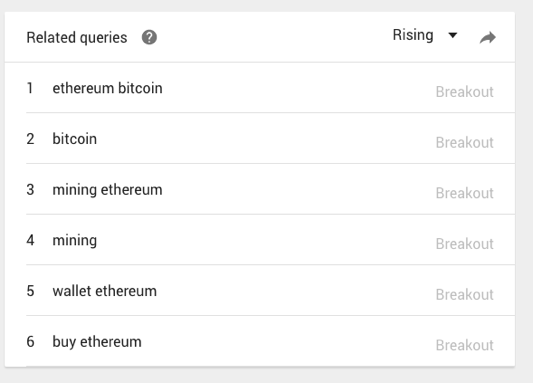

The price of ether is the gateway to the Ethereum blockchain. The fact that the Google search terms “Ethereum bitcoin” is now ranked second proves that there is now a global opportunity cost between acquiring bitcoin or ether. Some have used the term “flippening” to describe this trend.

The search combination “Buy Ethereum” comes in at sixth place, which illustrates the willingness to own ether. It says a great deal about the desire to obtain ether in order to integrate into the Ethereum blockchain. Thus, it is no longer simply a question of knowing what Ethereum is, but a growing willingness throughout the world to buy ether.

When one looks closely at the evolution of the trend of wanting to buy ether since 2014, we find that the combination of words “buy Ethereum” is very much related to the rise in worldwide notoriety of Ethereum that began in 2016 and that has been exploding since the beginning of 2017.

This interest in Ethereum varies from one country to another. Western countries are not the only ones concerned, as one might assume; every continent is now implicated in a renewed interest in Ethereum.

Singapore represents the country where interest in Ethereum is the highest in the world, a fact that highlights the rise of Ethereum in Asia. Switzerland and the Netherlands are second and third respectively. South Africa is in fourth place, and marks the entry of the continent of Africa into the top five regions of the world that are interested in Ethereum. Similarly, Venezuela, who is currently experiencing some economic instability, marks the entry of South America into the top five.

Looking at the top thirty, it’s clear that the Asian and European countries dominate the ranking.

Countries, Ethereum: (05/18/2012 to 05/18/2017)[1]

Singapore 100

Switzerland 87

Netherlands 86

Venezuela 85

Austria 67

South Africa, 64

South Korea 61

Canada 58

Ukraine 54

Australia 46

Russia 44

USA 43

Malaysia 43

Sweden 41

Germany 40

United Kingdom 38

France 29

Poland, 25

Italy 25

Spain, 24

India 20

Vietnam 20

Brazil 16

Mexico, 16

Indonesia 14

Turkey 12

Japan 8

2. The use of cash in the world and financial exclusion

Nowadays, the vast majority of cryptocurrency buyers all over the world make deposits from their bank accounts to online cryptocurrency exchanges, in order to interact with blockchain. The trend is similar whether they are buying bitcoin or ether.

However, a significant number of people around the globe remain excluded from the financial system. According to the World Bank “Two billion poor adults remain excluded from the financial system, with unmet needs and untapped market potential.” For them, it’s either impossible to buy cryptocurrency, or the process is even harder and longer than it is now with bank transfers to online exchanges. This significant number underlines the need for a solution for this significant part of the population.

In parallel, cash remains widely used to pay for basic needs all over the world. The World Bank notes that “1.3 billion adults with an account in developing countries pay their trash, water, and electric bills in cash, and over half a billion adults with an account in developing countries pay school fees in cash.”

Cash is not only the most popular means of payment in countries that have the highest number of unbanked people, but in many Western countries as well. For example, Germany and Austria represent two Western countries where cash is more popular than debit or credit cards, even for costly purchases.

The steady success of cash throughout the world, even in the West, is explained by different reasons, including:

3. Mobile phones are the new gateway to financial, and thus blockchain, inclusion

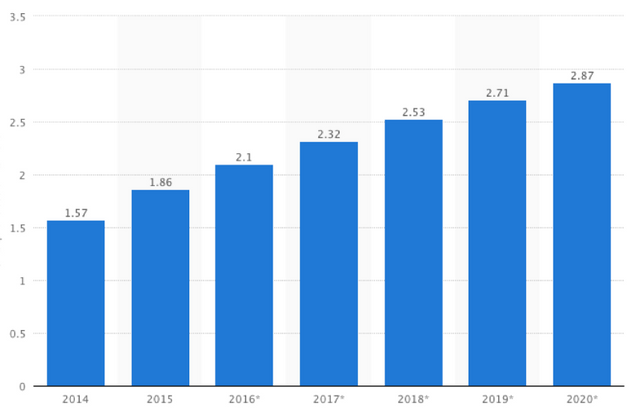

While 2 billion poor adults remain excluded from the financial system, the number of smartphone users is forecast to grow from 2.1 billion in 2016 to around 2.9 billion in 2019. Money accounts and smartphones can drive financial as well as blockchain inclusion.

As an example, “while just 1 percent of adults globally say they use a mobile money account and nothing else, in Sub-Saharan Africa, 12 percent of adults (64 million adults) have mobile money accounts (compared to just 2 percent worldwide); 45 percent of them have only a mobile money account.[2]”

In 2017, 64.5% of the world population used a mobile phone. As seen above, China is the country where the cryptocurrency demand is rising the most in the world. Similarly, around half of the Chinese population is projected to use a smartphone by 2020. “The number of smartphone users in China is forecast to grow from around 563 million in 2016 to almost 675 million in 2019.”[3]

The country where smartphone penetration is the highest is a non-western country: the UAE (80.6%). And among the top 30 countries with the highest smartphone penetration, non-western countries are also present with a significant number of people in their country having smartphones:

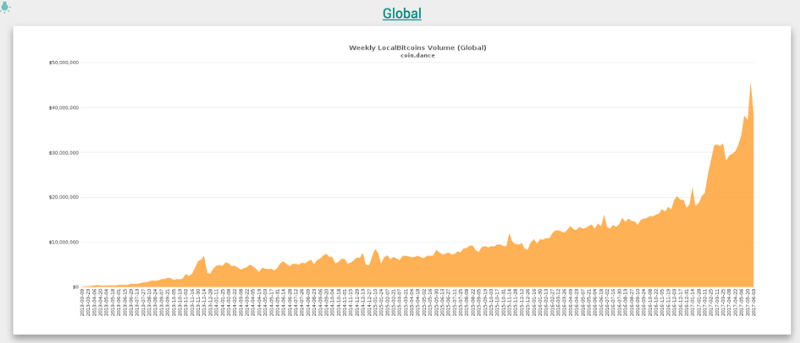

4. An increasing evolution of bitcoin’s demand on Localbitcoins as a point of comparison for anticipating ether exchange zones and volumes

The overall demand for bitcoin purchased on Localbitcoins has grown over the years. The economic, social and political reasons cited above have supported the growth of the bitcoin purchased in cash. If bitcoin has grown and is growing exponentially on Localbitcoins, the growing interest in the Ethereum blockchain suggests that its course could tomorrow follow a similar path, once a sustainable peer-to-peer ether network will be offered to buyers and sellers.

For this purpose, the analysis of the volume of exchanges on Localbitcoins and countries where the demand is the greatest will constitute a point of comparison for ether.

Thus, bitcoin’s demand on Localbitcoins has risen steadily ranging from nearly $10 million a week in November 2015, $20 million per week in December 2016, $32 million per week in March 2017 and finally $45 million dollars per week in May 2017.

Bitcoin demand on Localbitcoins filtered by country

In general, bitcoin’s demand in most countries has grown very rapidly over the past year. Yet, this growth is more rapid in some countries than in others. The devaluation of the currency by the regulatory authorities as in Asia or South America, as well as the withdrawal of certain banknotes deemed too high to slow down inflation, as in India, is strongly correlated with the growing demand for cryptocurrency as a form of investment or safe-haven currency.

Analysis by country according to the volume of bitcoin exchanged during a week in May 2017

In terms of the volume of bitcoins bought on Localbitcoins over the past year, we can see that China is far ahead, with $14.7 million traded in just one week in late May 2017. China is the only country where the level of $10 million traded per week was crossed over the same period, reflecting the country’s importance in the world of blockchain and cryptocurrency (DevCon2 and International Blockchain Week took place in Shanghai in September 2016).

Russia, the United States and the United Kingdom hit $10 million traded in a week in May 2017, representing a total of nearly $30 million for the three zones. Australia, Europe, and Venezuela are above the million-dollars mark a week during the same period. India and Colombia hit the million-dollar mark in a week.

Analysis by country according to the evolution of purchases and sales of bitcoin on Localbitcoins from November 2016 to May 2017 (6 months)

Among the five countries with the fastest growth in demand for bitcoin in six months are:

In the top ten, we then find:

Analysis by country according to the evolution of purchases and sales of bitcoin on Localbitcoins from May 2016 to May 2017 (one year)

Among the five countries with the fastest growing demand in one year are:

In the top ten, we find:

To anticipate the target of Dether’s first potential users, we note that the growing demand for bitcoin on Localbitcoins is pervasive in Asia (driven by China), Africa and South America. This trend is in line with that of the penetration of the number of smartphones in countries like China, Colombia, Venezuela, as well as in Nigeria.

5. The increasing use of cryptocurrency as a means of payment in shops

Shops, businesses and retailers accepting cryptocurrency as a means of payment are becoming part of the blockchain revolution. As seen above, the interest in blockchain and Ethereum is increasing, leading more and more local store owners to accept cryptocurrency as a means of payment for anyone who wishes to purchase their items with it.

Developments in mobile cryptocurrency wallets and a better UX (User Experience) when using cryptocurrency have also been a factor in its success.

Buying a Subway sandwich with crypto in Buenos Aires, Argentina

In Argentina, where inflation has been particularly high, merchants like Subway franchises have decided to accept cryptocurrency as a means of payment.

Grilled chicken using ether in Melbourne, Australia

In Melbourne, Australia, the Eastern European deli at Preston market is challenging the thinking of fiat currency, by embracing virtual currency, accepting ether, bitcoin, and litecoin as payment.

Art exhibition in Paris, France, where artists only accept ether

In April 2017, in Paris, Christophe Pouilly launched the first art exhibition where buyers were able to buy art with ether.

Getting a new camera

Japan has embraced cryptocurrency by recognizing it as a legal method of payment. A few weeks after the decision, major leading retail groups, Bic Camera and Recruit Lifestyle, announced that they would be testing cryptocurrency as means of payment.

A new market is born bringing cryptocurrency closer to real life and daily use. One of Dether’s goals is to include shops, businesses and retailers that accept ether within its decentralized application on the Dether map.

By doing so, Dether will open a gateway to financial inclusion and Ethereum inclusion to any shop across the globe who wishes to be listed on the Dether map as a shop that accepts ether as a means of payment.

Moreover, Dether will also give the opportunity for shops to have a new business activity that they can develop. By being displayed on the Dether map, shops will be able to brand themselves as ATMs (Automated Teller Machine) crypto-fiat. As they deal with cash every day, shops will be able to use it to develop a promising new business activity.

6. Dether’s targets and go-to-market strategy

Taking into account the analysis of bitcoin’s demand for cash via Localbitcoins, the penetration of smartphones around the world, the continued preference for cash in certain countries, and particularly, the growing interest in Ethereum blockchain, the following segmentation is conceivable:

Early adopters: China, Venezuela, Singapore, The United States, Europe, South Africa, South Korea, Argentina, Mexico, India

Early majority: Saudi Arabia, North Africa, Colombia, Nigeria

Late majority: Vietnam, Indonesia

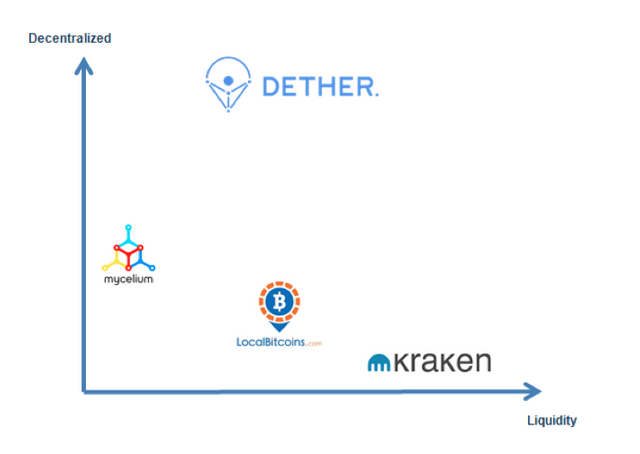

Market positioning and key metrics:

Unlike existing peer-to-peer cryptocurrencies solutions, Dether’s goal is to become a fully decentralized application where:

Key performance indicators:

Dether’s KPIs will be closely followed by the team to monitor and manage performance. Among the metrics to be followed, are:

If you are already have ideas or comments to share, please join us on Slack: http://slack.dether.io

Website: https://dether.io

Email: [email protected]

Sources:

[1] Google Trends

[2] World Bank

[3] Statista 2017

[4] Coindance

If you are already have ideas or comments to share, please join us on Slack: http://slack.dether.io

Website: https://dether.io

Email: [email protected]

Sources:

[1] Google Trends

[2] World Bank

[3] Statista 2017

[4] Coindance

Bought 20x ETH @ $220 and it's now $310 w00t

love this post ... thanks for share

Good 😊

Bienvenido a Steemit! Este Post puede tener muchos upvotes con la ayuda del King: @dineroconopcion, El cual es un Grupo de Soporte mantenido por @wilbertphysique, @yoenelmundo y 5 personas mas que quieren ayudarte a llegar hacer un Top Autor En Steemit sin tener que invertir en Steem Power.Te Gustaria Ser Parte De Este Projecto?

Welcome to Steemit! This Post can have many upvote's with the help of the King's Account: @dineroconopcion, It's a Support Group run by @wilbertphysique, @yoenelmundo, and 5 other people that want to help you be a Top Steemit Author without having to invest into Steem Power. Would You Like To Be Part of this Project?

This post has received a 100% upvote from @melowd. Thank You for sharing @dether. For more information, click here!

OH MY GOD!!!!

DUDE YOUVE DONE A BUNCH OF RESEARCH!!!

ALREADY UPVOTED !!!

Crypt0 was also talking about the possibility of price manipulation so that big investors could get in. There is so much going on with Ethereum it amazes me how the price is held so steadily. Thanks for the post! I'l follow hope you do the same!

Ethereum is projected to hit $22,000 by the year 2020