Wolf of Wall Street, Steve Madden Shoes, and the Crypto Bubble

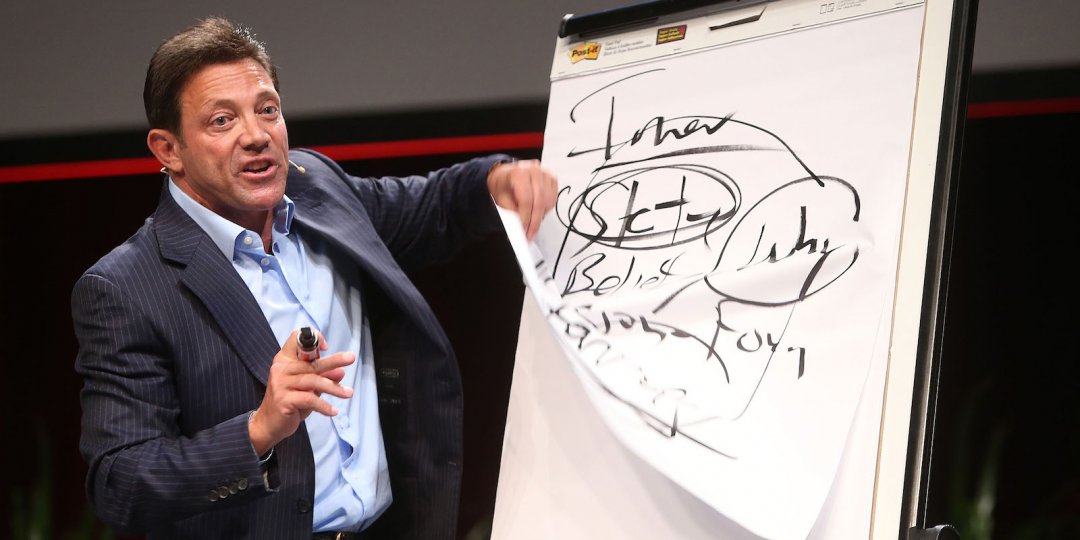

The Wolf of Wall Street is at it again.

"This technology [Cryptocurrencies] is flawed. Flawed in the sense that it opens itself up to be manipulated. [...] Money is being raised, you're creating value and there's nothing behind it. All you're doing in running on scarcity."

Jordan Belfort gained notoriety by running one of the largest penny stock boiler room operation in US history. Through his brokerage firm Straton Oakmont, Mr. Belfort would acquire a massive stake in obscure companies with shoddy financials, take them public, and then use his sales force at Straton to dump his shares on unsuspecting, unsophisticated investors.

His actions eventually caught up with him, resulting in a 22 month prison sentence for the Wolf of Wall Street.

Mr. Belfort knows fraud like the back of his hand. He was responsible for personally manipulating hundreds of penny stocks throughout his career as a white collar criminal. So it is at least conceivable that he recognizes the level of corruption in the ICO market, and is merely sounding the alarm to prevent gullible investors from throwing away their life savings on worthless tokens.

He could be making these admonishments in good faith. I've never met him, and my knowledge of his criminal racket comes exclusively from reading his autobiography, so I'll refrain from making any value judgement regarding his motivation for speaking out publicly against cryptocurrencies.

I only find it strangely ironic that he doesn't see the parallel between the IPO scene in the early 1990s, and the current market for initial coin offerings. Sure, it is a market ripe with fraud and misdirection. Some companies manage to raise hundreds of millions of dollars without a working product or even a sound business plan. Some are straight up ponzi schemes like BitConnect or Laser Online.

The mistake I think he's making is judging the market as a whole by the actions of these fraudulent projects. Some implementations have value, while the ones that don't will meet their inevitable demise. That's the beauty of the free market, and something that should be cherished.

Even among the companies the Wolf of Wall Street took public, I can think of one that turned into a legitimate multi-billion dollar success: Steve Madden Shoes.

The founder, Steve Madden, started the company with only $1,100 out of the trunk of his car. Business grew steadily, but Mr. Madden succumbed to the allure of easy money and aggressive expansion, and became entangled with Mr. Belfort's brokerage firm.

Long story short, Steve Madden ended up serving time in prison, but upon his release, he was able to turn the company around, and turn it into a very successful operation, generating $1.4 billion in sales for 2015.

Like Steve Madden, blockchain projects with active development and real use cases will emerge from the ashes of all the pump and dump schemes and forks, to lead the way towards a more equitable economic system based on the principles of decentralization and self-governance.

And these won't be currencies or projects backed by sovereign governments like the Petro or Ruble Coin, or a framework implementation by a consortium of big banks. Not after the Lehman fiasco. The process will be slow, but I think we'll continue to see a gradual shift towards this new paradigm.

In fact, the slower it happens, the higher our chances of being left alone by the status quo. Which is why I'm willing to sit tight, hold my coins, and bide my time.

This post has received a 2.51% upvote from thanks to: @deselby.

thanks to: @deselby.

For more information, click here!!!!

Send minimum 0.050 SBD/STEEM to bid for votes.

Do you know, you can also earn daily passive income simply by delegating your Steem Power to @minnowhelper by clicking following links: 10SP, 100SP, 500SP, 1000SP or Another amount