Is Stablecoin the Next Big Thing for Digital Currency Future?

You might have heard of it, but you might not know it in detail—stablecoins are making a splash since late 2018.

There was a large interest among major companies for stablecoin. Earlier this year, Facebook’s own stablecoin Libra made headlines that politicians, online marketers, finance experts tweeted about it. Libra was seen as an avenue for mainstream cryptocurrency adoption and a major history maker for the digital currency future. And along with that, JP Morgan also launched their own stablecoin called ‘JPM Coin’. JP Morgan has always been seen as an early propagator for major technological innovation and adoption like artificial intelligence. And stablecoin is no exception.

Why Stablecoins and How It’s Working Out So Far

As you know, stablecoins are digital currencies with value tied to real world currencies. It’s different from other cryptocurrencies due to the basis of its value. While other crypto assets have been volatile in nature experiencing an unpredictable shift of market value, stablecoins are tied in value with its corresponding physical asset. This attracts investors and users as well as its function and availability in blockchain.

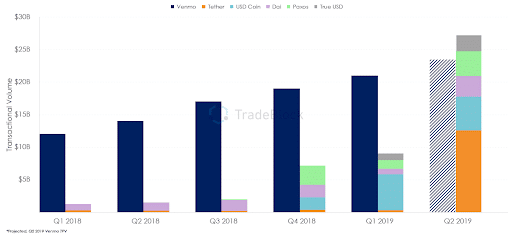

In the stablecoin market, Tether is the leading company with market capitalization. And so far, it is still leading. They also experienced a rise in transactions since 2018. Tradeblock reported that Tether reached the highest spot in number of on-chain transactions across all other stablecoins. In their article, they reported that stablecoins on-chain transactions surpasses payment processor Venmo’s total volume of transactions.

This increase in stablecoin transaction is seen as a positive thing for crypto asset adoption. The rise of interest came from Chris Burniske’s tweet of the article.

Stablecoins Against Payment Processors

The article did receive criticism due to its reportedly absurd comparison. Venmo, a payment processor for crypto assets, is not similar to stablecoins for them to be compared. Stablecoin transactions against Venmo’s total volume of transactions only indicate an increased number of transactions. But any metric or trajectory can’t be defined.

If there is anything to be taken from the article, it probably means that there is a rise of stablecoin use among crypto users.

Stablecoins in the Digital Currency Future

The spotlight with stablecoins is not unnecessary. Stablecoins are getting attention due to many things. The use of blockchain platform for digitalization is probably one of them. The anticipation for mainstream stablecoins from Facebook and JP Morgan is a manifestation of this. And stablecoins are making people, whether crypto enthusiasts or not, talk about cryptocurrency and whatever is related to it.

While the report—and the reactions that came with it—seem to cause a stir for the sake of it, the good thing about the article is it seems that crypto asset users are closely watching for cryptocurrency trends. And considering that tokens and blockchain thrive on a good network and an active community, the rest of the story remains to be hopeful. Until we get practical data for stablecoins, we can’t really say if it’s the next big thing. But stablecoins will surely find its place to the digital currency future.

Posted from the EOI Digital Transformation and Marketing blog : https://transform.eoi.digital/stablecoins-next-big-thing-digital-currency-future/