Cryptocurrency and the virtue of patience

There is an old African proverb I learnt about last year:

A Smooth Sea Never Made a Skillful Sailor

I came to learn about this after making a multitude of mistakes in regards to Cryptocurrency investing and trading. Here is my story so far, it's one of many you will hear about.

Wave 1 – 2009 to 2010

I actually heard about Bitcoin in 2009 and recall trying to compare it to coins traded on something like Second Life and other MMPORG games. I quantifed it by comparing the amount of money people were willing to spend in a virtual world, which was in the hundreds of millions of dollars. the concept of digital money not owned by a central authority was hard to comprehend, yet intriguing at the same time. How could it be successful in the real world?

Bitcoin wasn't even tradable at that point and year later there was a rumor of someone convincing a buddy to buy him a pizza in exchange for 10,000 Bitcoins. At the time it sounded ludicrous, but the fact that someone had managed to give real world value had piqued my interest. I didn't know how or who to approach to buy any, but I was willing to put £500 towards it, which would have given me about 500,000 Bitcoins. Suffice to say, that never happened, so I bought some Premium Bonds instead, because they were the safe bet. I won £25 shortly afterwards, yippee!

I didn't bother looking into Bitcoin again until 2013.

Wave 2 – 2013

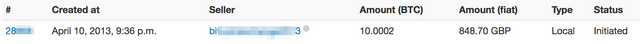

In 2013, I heard Bitcoin had hit $10, whilst I sat and watched it Bitcoin moved past $100 in a FOMO moment I decided I had to get some with all the savings I had at my disposal. So I went on localbitcoins.com and looked for the nearest person. I stayed in contact with them and agreed to purchase some for around £85 ($110ish) each.

We agreed a cash purchase, whilst on the way there with a buddy of mine, my battery ran out on my mobile, and so I tried to message them in McDonalds using free wifi on my laptop. A drunk Irish girl started an argument out of nowhere and started a tirade of racist insults at me. We got into an argument and I never ended up buying them. By the time I had actually managed to purchase some, they had hit $1000. About 10x more then my intended purchase price.

I bought a couple, and then put them in cold storage. Shortly after buying the top, they tumbled 70%, my wife told me to sell them, but I decided to HODL. I just wasn't ready to part with such a big loss.

I also had some Bitcoin on Cryptsy and subsequently that was revealed to be a scam. Expensive mistake in trust.

Wave 3 – 2016

I had been convincing people to get into Crypto for the last few years, most people just ignored me and thought it was a ponzi scheme, or just couldn't get their head around the concept.

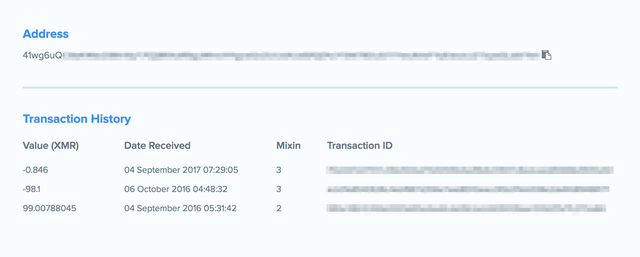

I thought I'd have another go at buying some Crypto and bought some Ethereum, DAO and Monero. Again I put in as much as I could afford at the time and didn't tell my wife.

Shortly after, the DAO hack happened and the hacker made off with $50 million of Ethereum.

I told my wife about what had happened and she scorned me for getting involved in Bitcoin again, so I sold all that I had left, about 265 ETH.

I still believed that cryptocurrencies had a place, and in September bought some Monero, it halved in price a month later, and this time I couldn't bare telling my wife so I just sold it at a loss.

Wave 4 – 2017

As Bitcoin marched back up to $1000 earlier this year, I thought I could break even and decided to sell my Bitcoin, luckily for me the price kept rising, so I decided to buy a little DASH, ETH and DOGE which allshot up in value. Great, I'm doing something right for once! Except the market was in a bull run anyway, and I had done nothing special except enter at the right time.

Wave 4 2017

So at this point I thought to myself I better not be making any more stupid mistakes or decisions. So I paid three different traders to teach me how they do things. One was a FX trader, another was a pure crypto trader, and the last had just patented his own method. I've spent a pretty penny for their knowledge, but in terms of how much I could save in the future, based upon my past performance, it's a drop in the ocean.

I took notes on each and decided to make more informed decisions. I have calculated my mistakes, and they go into the hundreds of thousands (I won't count Bitcoin from 2009 because I never bought any).

It's cost me, but this doesn't deter me, I reflect upon it as valuable lessons.

I've done quite a bit better this year as a result.

The future

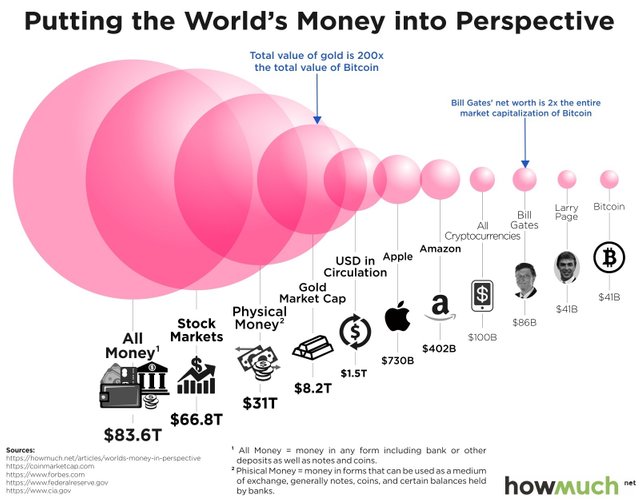

So one big question many people often ask is if we are in a bubble or indeed if we have hit the top.

The true answer is nobody knows, but if we ignore the naysayers from 2009 until today and based off the above, we are just at the beginning.

Study this chart for a moment, since its creation we are about 60% bigger:

In 2009 Bitcoin was even barely worth a pizza. Since it's peak 2013 it's risen about 450%. There is plenty of opportunity ahead.

The key I've taken away from the above is learning virtue of patience, controlling my sense of fear.

If you can do that in this wild market, you can stand to make a life changing amount of wealth.

I wrote a small post recently in order to help people get into the space and plan on doing a series of training courses and videos to help people navigate the rough seas of crypto currency.

Ya. I agree to this post we should have a long patience to our investment. By the way I just want to share this article https://twitter.com/CoryPie11641640/status/1062902733345341440 Now I know what is the 4 top altcoins and worth to holding until 2020. For me, Sphtx. Hbu? Read the article and comment your bet. :)