Alexa.com - Possible Indicator that the Crypto Bubble is at an End?

Alexa Rankings

Alexa.com is a service provided by Amazon that gives statistical estimates of web traffic and ranks websites based on those estimates. They sample traffic by having users opt in with a browser plugin, and use statistical methods to estimate the total traffic. Alexa rankings are based on a rolling average over 3 months, which means that a decline in rank often reflects hitting a peak in traffic some time ago, within those three months. In other words it is usually a lagging indicator for increases or declines in web traffic. A change in the curve typically reflects a change in trend.

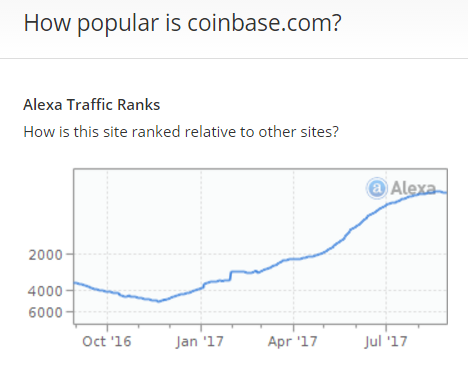

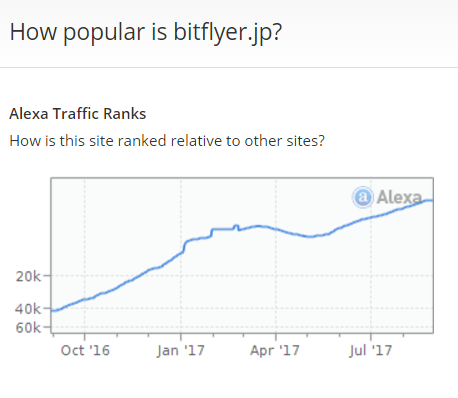

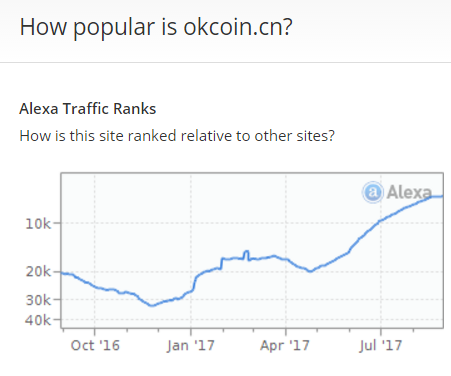

Here are the Alexa ranking charts for some of the top Bitcoin and cryptocurrency exchanges.

Charts appear to show that they have peaked

All these charts have a very similar pattern of growth from 2017. If you zoom in on the top right corner, they mostly show a similar pattern as well:

Most of the exchanges, especially the largest ones like Coinbase, have not seen any decline in traffic since the start of 2017. This decline is the first for the year. But because of Alexa's three month averaging, it likely reflects a decline that began 2-3 months ago. The price of Bitcoin and other cryptocurrencies has continued to rise in those three months, with a new ATH for both Bitcoin and the crypto space being seen only in the last couple of days. The growth of user traffic has not kept up with this price increase.

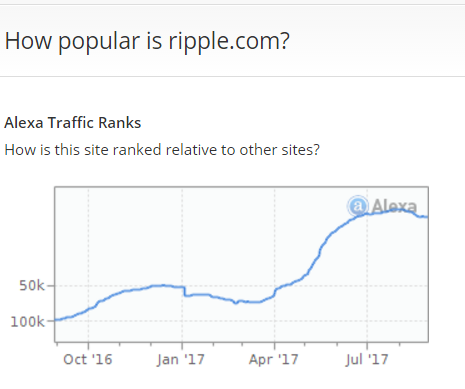

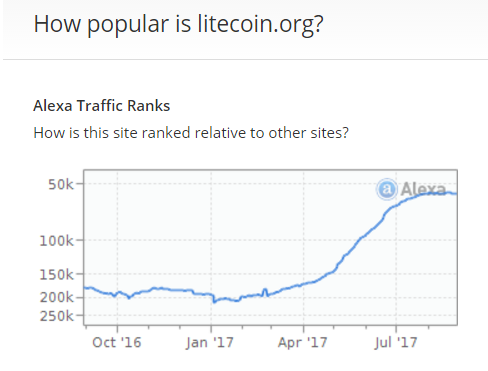

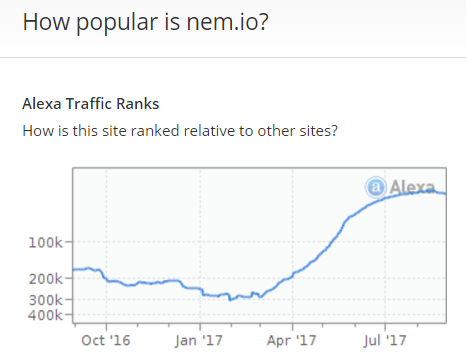

We can see that again in the info pages for the top cryptocurrencies (I will exclude those which came into existence only recently, for obvious reasons).

Exceptions

There are of course some exceptions, with continued growth. It is possible that they have also peaked, but it would mean they likely peaked more recently.

Conclusion

The price of cryptocurrencies have continued to increase in the last three months, with more money in the ecosystem and increased demand for tokens. Growth in traffic to the top cryptocurrency exchanges has not kept up with the price, and appears to have peaked some time in the last 3 months. Traffic on the 'landing pages' of the top cryptocurrencies have also peaked and are seeing a similar decline.

This is just one possible indicator of an overheated market.

Nice potted, but I think that it’s a temporary dip.

Indeed, in fact there already was a dip in crypto prices three months ago, and they have since bounced back. So if alexa's three month averaging is taken into account, we are already beyond the dip only now being reflected...

If there is a recent peak above that then rankings should not be going lower. It would inevitably result in a continuation of an upward curve.

Depends how sustained the peak was before the dip, and how long the dip lasted. Also the mania around the earlier bubble may have created an 'interest' peak higher then than has since been reached even though the interest now is more genuine, and the bitcoin value higher.

very interesting find @demotruk

It seems like it is levelling out on some sites but I think that will drastically increase as the holiday time comes to an end and more investors poor in as fall opens its doors.

I think this bubble was just a fantasy and I don't think we will experience any major crashes compared to before.

Hopefully this traffic will continue since usually with popularity comes higher prices of bitcoin @demotruk

I would agree, the above analysis does not account for seasonal variations.

I don't believe seasonal variations have much impact on this. Aside from the fact that it is a ranking system and most websites are affected by the same seasons (with a population primarily in the Northern hemisphere), the changes in traffic are many orders of magnitude which is way beyond the typical impact of seasonality.

There are many different metrics people are using to look for indicators. I applaud you for looking at something different to most.

I think looking at just one will not give a best indicator. In the end, there are always unforeseen events that historical charts can never account for.

So in the end, time will tell.

Yes I agree, no indicator should be looked at without a broader perspective in mind.

Glad to see steemit.com still increasing in popularity amidst the chaos :)

Looks like you nailed it here!

Interesting to see the Steem related charts not following the trend - they look to be rising still?

Maybe time for use smaller holders to get some SP....

Since this post some of the rankings have curved back upwards again, just slightly. Steemit.com and Steem.io are among the ones were growth in the rankings may be speeding up not slowing down.

In fairness I have been calling the end of the bubble for ages, and even this drop may not actually be the end.

I hope it is. Although it's painful, a bear market is needed to expunge malinvestment in the space. The cryptos that have a solid basis and community will survive.

For sure. The market is way over-cooked. All i'm holding is Steem (Power) - will get involved with the rest when they've all dropped 2/3rds!

Interesting but I don't think it's very reflective of the market. It's interesting nonetheless.

looks like more people using bittrex ;p

Looks like you're correct.

More volume than Poloniex now, and approaching it in web traffic rank.

https://exchangewar.info

hahah that's why i am a PRO #savage :p

Hi @demotruk i am glad of your post indeed is such an informative one because it is showing us the fluctuation that is taking place in the cryptocurrency market ,moreover i am gland to see steemit.com is doing well so far in the midst of other competitors,lastly the graphs and the entire analysis is well detailed thank you man for the post keep up the good work.

I hope you're wrong but I agree with the analysis.

Fantastic analysis. It would be interesting to see the actual correlation between price and search terms