Is the cryptobubble about to burst? A calming post before the week-end.

Lately I've been having my face planted in the screen crawling the market for info. So this is my perspectives:

The Tech is groundbreaking and revolutionary. To a greater extent than the internet itself. The Internet has contributed extremely on it's own, but it is as if roads had been made where there previously used to be forest paths, and in crypto you get the wheel, engine and entire package so that you can use these roads properly. I think thats the level of improvement cryptoz are going to contribute with as the solutions are rolling out into practical use. Disclaimer; the analogy is not yet reviewed and confirmed by @scandinavianlife. Watch in the comments section after his review. :)

So the technology has come to stay, I think we all can agree on that. If not, well, then this post is not for you.

In terms of investment, there are many that compare with the dot-com bubble. Firstly; the dotcom buuble reduced the market by 50%. Pretty fast. Crisis! If you just sold your home and bought some tech stocks right before the bubble burst and waited all the time while everyone else had had great success for several years in advance, then yes. But one could really loose a lot of money if you bought in at the wrong time.... Not really. Because if you were one of the stubbern ones who did not sell, it actually did not take long before you were in 0 and even in + unless you really went all in on the peak.

For those that went in on what would be a healthy level, slowly accumulating a 50% decline in 100-20000% gains is also no crisis, it's hard to see the newly acquired wealth deprecate, but then again, sitting with 20million from 40 million on an investment of 100k is not the world's demise, you can still smile all the way to the bank.

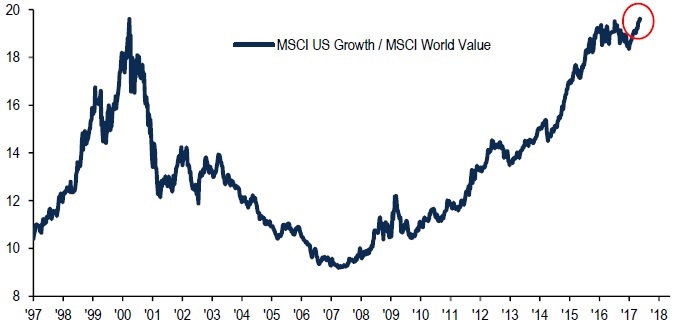

So, where are we today in relation to dotcom bubble? Comparing to total market value (technology companies reached 10% of total market value when bubble burst) we are about 10-20x away with todays mcap. More detalis: https://steemit.com/cryptocurrency/@scandinavianlife/arguing-that-a-possible-correction-could-come-to-crypto-currencies-somewhere-between-9-5-20-times-the-size-of-todays-total.

Regarding bitcoin isolated, I don't roule out that it could burst at a ealier stage

That is, we must multiply by 10x -20x from here on the whole market before we are close to talking about getting to the bubble bursting (if there is a bubble at all, but in a market so full of optimism, the forming of a buuble because of greed is most likely to form). And there are many buts essential buts, which means I think we should at least 2x, maybe 10x (on top of the 10-20x estimation) this before we'll see it bursts some bubble, and even then, I don't think it will take long before the market gets up and we see new heights. So, I clearly mean that we will have a minimum of up to 18x today's market share, maybe even 200x even if that could sound soewhat above positive. Thats total market share. For single projects, we talk from 100% loss to 100000% increase, so it's important not just to sit on a single project here. Don't putt all the eggs in the same basket as they say.

It is also worth mentioning that what happened during the dotcombobile was that everything went up. Shit companies as well as good concepts. Everyone was so positive about computer technology that they invested their money on companies one or never would have believed and would never work in a normal market. Companies with poorly composed teams, bad marketing, unprofessional, bad strategies if any at all etc. It was primarily those that were washed away in the bubble cracking.

What's different this time? Why do I mean we're going to be so much higher than dotcom?

There are several reasons for this. Firstly, at that time, the investment market was very limited if compared to today. The access for ordinary people was very limited. I'm sure if you ask ordinary people, there were very few who sat with IT shares at that time. It was primarily those who invested in equities, or worked in IT. Even if even in small Norway we did her about some of postmen and taxi drivers getting to lambo level.

This time it's different. Now you do not need a stock broker and nor do you need even a stock account, you do not even need a bank account to invest! You only need a mobile phone. That's the way it is for very many of the world's people. In East Asia and Africa and elsewhere. That they pay by cash. Bank cards or accounts they do not have, but they have mobile phones. In other words, the availability of the market is far higher, and that there are extremely many more people who have the opportunity to participate.

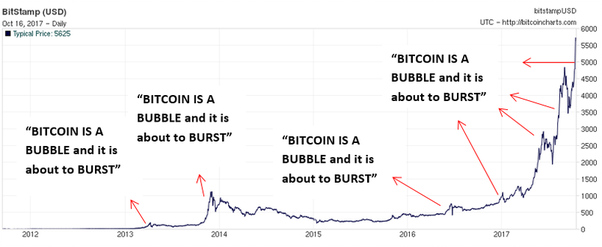

The dotcom bubble. It would be interesting to see what @haejin would make of this one

What opportunities are there? Dotcom and the Internet have gradually affected most industries, but it has taken a long time to develop systems and consumer adaptation. Today, however, most people sit on online banking, shop online, chat online and send mail online (for those newcomers, if you wanted to send a piece of information like this one I'm writing now, it was sent physically by mail, and we used to laugh of pigeons How about a man acctually physically delivering. In other words, most are already on the basic platforms on which crypto operates. It is not that you need to learn something new to the users, so adoption will go fast and you do not want the delays of user acquisition. Even the old grandmas have a smartphone these days.

Degree of acquisition of entire industries. The Internet and IT added value to existing industries that could operate more efficiently and deliver cheaper services and approached a larger market which naturally resulted in higher value on stocks, etc. Some exception we did have, like Kodak that really had a hard time adapting. But here we talk that ALL this value will be transferred to the crypto operators in quite some large industries. In many cases it will add value such as IT and internet, examples of these are the industries such as the automotive (https://www.tractica.com/artificial-intelligence/six-applications-for-blockchain-in- automotive /) and aviation machine tech and maintainance (https://coinmarketcap.com/currencies/aeron/) Aeron has also gone 10x since November btw. But, banking services will be taken from banks, many of whom they earn the most. Loans, transfers, etc. The first loan platforms are already rolling out. f.eks. factoring which accounts for 25-30% of banks' profits internationally is now available to the man in the street to offer with "Populous". "Salt" is another loan platform with security for both parties. It may be up and running already in Beta if I got it right. So here, many industries' turnover and value will comletely be taken by the crypto market within not too much time. Nobody goes to the bank to get sky-high fees when you can go online, get the same or better at a much better price.

The currency market is included, not just shares. At that time, it was only shares in which they put their money in. This time it includes currency. f.eks. Coinlancer is its own currency. Should you get the benefits of only 3% fee instead of 15-20 as usual, you must convert to CL. All turnover will then be in CL, which would otherwise be NOK or USD. And this applies to the vast mojority of crypto consepts, if not all.

Speculation in gold and precious metals is included. Many who have previously secured themselves against recession times by hording gold and silver are now entering the crypto market.

So; The potential and scope are far greater than a dotcom bubble.

Quick review and summary:

- At worst we are 9x-20x away from a 50% crack if you compare directly with the dotcom bubble.

- The dotcom was not dangerous, it was just a break in the rise to IT and technology companies. Those who did not sell their homes to be in the market (on top) could sit on their shares and gain a profit for too long afterwards. (Relatively compared to f.eks. the real estate buble of 1890's in Oslo, Norway where it took as much as 90 years (!) before prices where up to the same level ajusted againts currecy inflation.

- Crypto has greater potential and extends beyond the industries affected by IT at that time primaraly because of adaptation potential but also the technical solutions on its own. And further in relation to how groundbreaking and revolutionary it is with the potential of wiping out and taking over some industries.

- Crypto is available for many more, both the services, as investment and participation.

NB! The decline and the break we have now is a break for further progress. It's going to be a bumpy ride overall, with authorities raving with their sablers, times when you are wondering if it's going to be something at all, and cases of fraud and hacking. It's all about just using common sense here as in everything else. But this development _ can not be stopped_. At worst, it can be paused for a week or two.

To cryptos and the free people!

Have a nice week-end y'all!

Nice post! However, I do not understand the FUD people have about bubbles in the first place.

It would be even harder to predict the cycle top of digital assets.

How are they going to be valued? And what are they, money, digital commodities or stocks? For me they look like a tribrid of all of them.

I believe cryptos are most comparable to commodities. Take Ethereum, which is used as a digital commodity in most ICOs. What the total oil marked in the world to put it in perspective? My strategy is not to try predict market as a whole, but look at each individual security and diversify well (commodities, stocks, some fiat etc.). Going all in have been the best strategy in this space for years, but that does not look like a smart money strategy imo.

That being said, I believe we are far from the top. Just look at how panicky the market reacts to false FUD/ fake news again and again. The volatility too is still pretty high. I would be scared the day the market do not react to real negative news and the volatility goes down.

Like the perspective. Maybe I've joined in on the bubble focus a little too much myself. Maybe the comparrison is all just a waste, still it is a real phenomena that comes to everything from real estate to, as we all know by now, tulips.

Or maybe this time, the value is real. So a bubble would not form the same way and crash like that. Say f.eks. passive income tokens. They are likely to be valued according to the current expected payout, and tokens like Sub and Populous are not affected by the cryptomarket directly. Just thinking a little bit loud here.

i think crypto will future man <3 but looks what happened in next few years by the way i appreciate your work and thank you for sharing this info.. i wanna see more in future so i am following you

Thanks! I'll try to keep adding to the quality :)

Good article and i approve of the metaphor.... ☝️😅

You got a 1.02% upvote from @buildawhale courtesy of @deismac!

To support our daily curation initiative, please vote on my owner, @themarkymark, as a Steem Witness

@originalworks don't think anyone would suspect I copied this with all it's misspellings, but wan't to see what this bot does.

The @OriginalWorks bot has determined this post by @deismac to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

New Market Updates

Technical Price Analysis

Source

https://steemit.com/@salahuddin2004

You got a 1.82% upvote from @upmewhale courtesy of @deismac!