8,200 BTC Moved From Mt. Gox Wallet, Possible Sell-Off Affects Bitcoin Price

Advertisement

The Mt. Gox trustee, who was tasked to sell about 200,000 bitcoin after the bankruptcy of the now-defunct cryptocurrency exchange Mt. Gox, is suspected to have dumped another 8,000 bitcoin on the cryptocurrency market.

Domino Effect

As CCN reported yesterday, CNBC’s Fast Money contributor and BKCM founder Brian Kelly stated that the entrance of major financial institutions and banks into the cryptocurrency market could allow the cryptocurrency market to surge in value and cryptocurrencies to be considered as an emerging asset class.

Currently, Kelly stated that cryptocurrencies are bearer instruments and it is difficult for institutional money to flow into the market.

“I’m actually a bit shocked that the market did not pick up on this. Dominic Chu of CNBC said that investors will get physical delivery of bitcoin. That doesn’t sound that interesting except for the fact that it means ICE Exchange has a custody solution. That has been the big hurdle. How do you hold onto these assets. These are generally bearer instruments, just like gold bearer bonds. That’s the big deal. They have come up with a custody solution for institutional holders,” said Kelly.

Following the logic of Kelly, the cryptocurrency market is very volatile and its daily trading volume is relatively low compared to other traditional assets and markets like the NASDAQ and gold. As such, the movement of funds of less than a billion dollars could drastically impact the market and the rates of cryptocurrencies, especially if large amounts of bitcoin are sold on public cryptocurrency exchanges.

Over the past few months, despite of the criticism from the cryptocurrency market, the Mt. Gox trustee has continued to sell massive chunks of bitcoin on cryptocurrency exchanges, even after acknowledging that the sell off of tens of thousands of bitcoins can easily move the market that is already highly volatile.

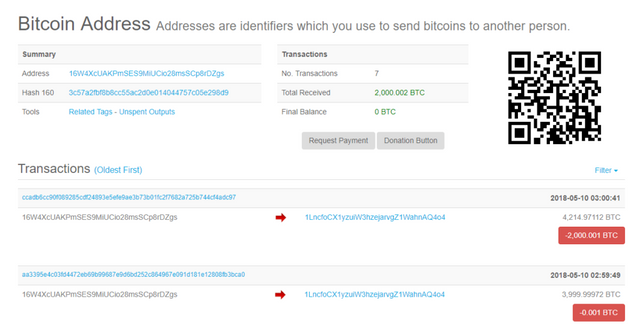

Today, on May 11, various reports have suggested that the recent price dip of bitcoin and other cryptocurrencies was triggered by the sell off of Mt. Gox coins. Four wallets of the Mt. Gox trustee moved around 2,000 bitcoins each, sending over 8,000 bitcoins in total over the past 24 hours. Considering that the Mt. Gox trustee was asked to sell over 200,000 bitcoins and convert it to Japanese yen by local financial authorities, it is evident that any external movement of the Mt. Gox trustee’s funds likely means that they are being sold on cryptocurrency exchanges.

Over-The-Counter (OTC) Market

Similar to how most institutional traders and retail investors purchase and sell large batches of cryptocurrencies, the Mt. Gox trustee could use the over-the-counter (OTC) market and directly deal with large-scale investors that are willing to purchase thousands of bitcoins.

Instead, the Mt. Gox trustee has opted to sell its funds on cryptocurrency exchanges, creating a domino effect across all major exchanges and leading the cryptocurrency market to drop by large margins.

<brFollow @davidlanz for real-time crypto news!

Hello davidlanz!

Congratulations! This post has been randomly Resteemed! For a chance to get more of your content resteemed join the Steem Engine Team