IRS crypto nightmare: WORST CASE SCENARIO

You started 2017 with $50,000.

You bought and sold cyptocurrencies over-and-over, participating in 20 pump-and-dumps.

Sometimes you made money, sometimes you lost money.

You end the year 2017 with $50,000, so no gain, no loss. (Your gains and losses net out to zero.)

During 2017 your purchases of all cryptocurrencies is $1,000,000. ($50,000 x 20 pumps)

During 2017 your sales of all cryptocurrencies is $1,000,000. ($50,000 x 20 dumps)

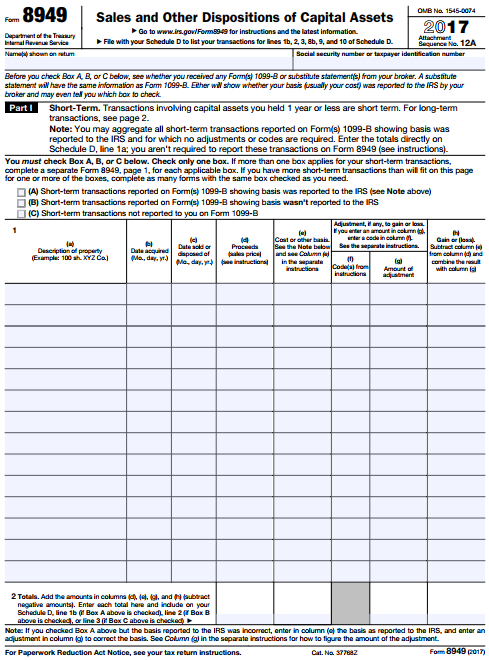

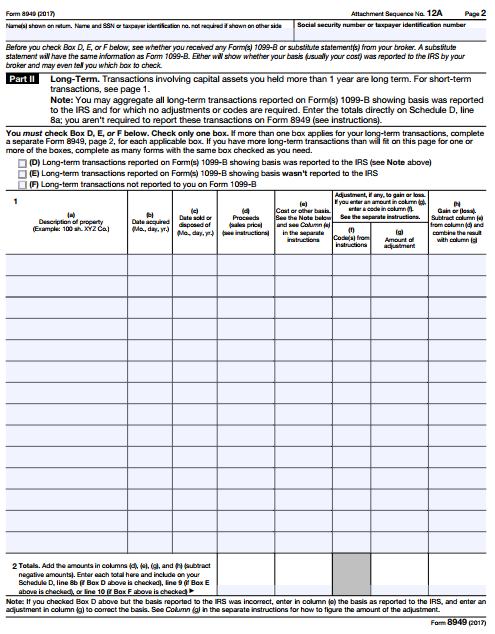

You don't file a Schedule D and form 8949 with your 2017 tax return.

Your crypto exchange reports your $1,000,000 of sales to the IRS after being subpoenaed for all US users records.

The IRS sends you a letter demanding $250,000 in unpaid taxes. (25% tax rate x $1,000,000 in sales.)

This is because they don't know the cost/basis/purchase price of your trades, so they assume you bought in at zero.

Now you need to file an amended 1040 with Schedule D and form 8949 documenting your cost/basis/purchase price and proving that you didn't make any money.

Congratulations @davecrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!